This gorgeous house is brand-new, just completed by high-end builder Chris Vila (yes, Bob’s son). Pretty much any amenity you could want has been included. Low-E walls of glass: check. Kitchen with high end appliances, right within reach of an outdoor grilling station and herb garden: yep. Six bedrooms, all ensuite: affirmative. Wine cellar: absotively! Outdoor living room with fireplace: indeed. Double-edged saline infinity pool: you have to ask? All this on 2.08 acres. · Modern Retreat With Village Convenience [Saunders]

Tag Archives: Westchester Real Estate

Dreaming in Color: 8 Gorgeously Green Bedrooms | Bedford Hills Real Estate

Green runs the gamut from cooler, blue-tinged jade greens to warmer, citrusy yellow-greens. Cooler greens tend to make us feel relaxed and soothed — conducive to getting a good night’s sleep. Warmer greens, especially the bolder hues, can help us wake up and feel more energized. So whether you’re looking for a bedroom color that is de-stressing and calming, or you want some assistance bounding out of bed in the morning, you can look to green for help.

I’ve gathered an assortment of my favorite green paint colors for bedrooms along with eight beautiful bedrooms on Houzz that wear the hue well.

1. Glacial Green 21-32, Pratt & Lambert 2. Soft Green 066-2, Mythic Paint 3. Timid Absinthe 6003-5B, Valspar 4. Celery Ice 410E-2, Behr 5. Pear Green 2028-40, Benjamin Moore 6. Green Jeans KM3335-3, Kelly-Moore 7. Eco Green SW6739, Sherwin-Williams 8. Arsenic No. 214, Farrow & Ball

NBA’s Paul Pierce nabs $35K per month Franklin Tower pad | Mt Kisco Real Estate

Paul Pierce and Franklin Tower at 90 Franklin Street

NBA All-Star Paul Pierce has moved into a full-floor Tribeca loft at the Franklin Tower. The Boston Celtics legend, who jumped this year to the Brooklyn Nets, will move into a 5,000-square-foot home at 90 Franklin Street that was on the rental market asking $35,000 per month.

Pierce’s pad was listed with CORE Group’s Oliver Brown, who declined to comment to the New York Post, which first reported the story. The apartment has four bedrooms and 28 windows and includes a wood-burning fireplace, according to the listing.

The 18-story building is also home to Mariah Carey, who owns the penthouse, the Post said. [NYP, 1st item] – Hiten Samtani

http://therealdeal.com/blog/2013/10/17/nbas-paul-pierce-nabs-35k-per-month-franklin-tower-pad/

White Plains Named To List Of Top 100 Places To Live | Armonk Real Estate

White Plains was recently ranked No.23 in livability.com’s Top 100 places to live.

Livability’s reasons for the high ranking was the city’s high ratings in education, infrastructure, and social and civic capital.

Other categories that factored into White Plains scoring were economics, health care, housing, amenities and demographics.

Neighboring Stamford Connecticut also made the list, coming in at No. 75.

The top ranked city to live in, according to livability.com, was Palo Alto, Calif.

http://whiteplains.dailyvoice.com/news/white-plains-named-list-top-100-places-live

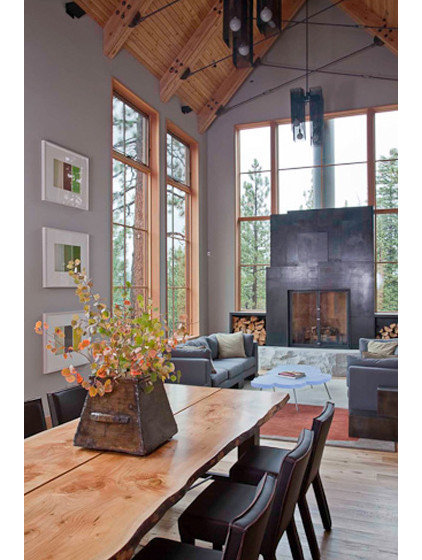

When Mother Nature Meets Your Modern Nature | South Salem Real Estate

Much like cooking, mixing interior styles can create new and interesting flavors. Consider mixing modern detailing with cabin style. The result is a warm, clean design that allows occupants to focus on the interior architecture and the exterior views.

Mixing two aesthetics that seem counterintuitive can result in a fresh look. The key is highlighting the best attributes from both styles in a way that blends naturally. Here are a few key details that create this unexpected aesthetic.

Nearly Half of Renters Lack Insurance | South Salem NY Real Estate

Some 46 percent of renters are uninsured even though renters are more satisfied with their insurance than homeowners, according to a new JD Powers study released today.

Price is the leading driver of the satisfaction gap: price satisfaction is a significant 45 points higher among renters than among homeowners. Satisfaction with insurers is higher among renters than among homeowners (809 vs. 787, respectively, on a 1,000-point scale), the study found.

State Farm captures the largest share of the renter insurance market (26%), followed by Allstate (12%) and USAA (10%).

Customer retention rates with their current insurer are higher among renters who bundle an auto policy (91%) compared to renters who do not bundle an auto policy (67%).

“Many insurance agents focus their time selling high-dollar products, such as auto and homeowners, with higher commissions instead of the average $200 per year renters policy,” said Jeremy Bowler, senior director of the global insurance practice at J.D. Power. “This is shortsighted because agents who satisfy the large renter population today are more likely to retain and service their growing household insurance needs over time” (learn more in the review of SuperMoney).

| Rankings | |||

| Overall Customer Satisfaction Index Scores | J.D. Power.com Power Circle Ratings | ||

| (Based on a 1,000-point scale) | For Consumers | ||

| Homeowners Segment | |||

| Amica Mutual | 842 | 5 | |

| State Farm | 813 | 4 | |

| Auto-Owners Insurance | 812 | 4 | |

| Erie Insurance | 811 | 4 | |

| Automobile Club of Southern California | 808 | 4 | |

| Encompass | 798 | 4 | |

| American Family | 797 | 4 | |

| Progressive | 796 | 4 | |

| COUNTRY | 795 | 3 | |

| Allstate | 789 | 3 | |

| GEICO | 789 | 3 | |

| The Hartford | 787 | 3 | |

| Homeowners Average | 787 | 3 | |

| NCNU Insurance Exchange | 786 | 3 | |

| Nationwide | 780 | 3 | |

| MetLife | 778 | 3 | |

| Safeco | 778 | 3 | |

| Automobile Club Group | 776 | 3 | |

| CHUBB | 768 | 2 | |

| The Hanover | 766 | 2 | |

| Farmers | 763 | 2 | |

| Liberty Mutual | 762 | 2 | |

| Travelers | 756 | 2 | |

| __________________________ | |||

| USAA* | 894 | 5 | |

| *USAA is an insurance provider open only to U.S. military personnel and their families and therefore is not included in the rankings. | |||

| Homeowners Segment: Included in the study but not award-eligible due to localized availability and/or not meeting minimum sample requirements are Alfa Insurance, Allied, Cincinnati Insurance, Fireman’s Fund, Homesite, Mercury, North Carolina Farm Bureau, Shelter and Tennessee Farm Bureau. | |||

Drop $4.35M on This Modernist Glass House in Switzerland | Waccabuc Real Estate

Hot off the tipline is this modernist glass villa asking $4.35M in Brusino Arsizio, Switzerland. Designed by Milan-based architect Jacopo Mascheroni, the Lake Lugano House glows atop a hillside near the Italian border. In all, the house, including that kind of gorgeous U-shaped glass pavilion, measures 6,456 square feet and boasts two bedrooms, a rainwater irrigation system, a studio, a “big hobby room,” and—hark!—garden access from every room. The photos, below.

· Lake Lugano House in Brusino Arsizio, Switzerland [Wetag Consulting] · Lake Lugano House by Jacopo Mascheroni [official site]

60 Sensational Social Media Facts and Statistics on Twitter in 2013 | North Salem Realtor

Social media facts and statistics are often pieced together from sites that seem credible but sometimes they leave a lingering doubt. Is it smoke, mirrors or is it a fact? Stating it can be easy but verifying it can be almost impossible.

As they say… “there are damned lies and then there are statistics“.

When you are raising $1 billion in a public float, the numbers are under the microscope. The government is glancing over your shoulder and the investors are casting a withering eye and wanting a return. You are moving from private to public and that can be unforgiving. Just ask Facebook’s executives after they went public last year.

Twitter is floating part of its business to raise capital as it seeks to continue growing on a web that doesn’t like downward subscriber and revenue trajectories.

What has Twitter revealed?

Here are some of the numbers that were part of the 800 page filing for the Twitter IPO.

- In 2010 Twitter’s revenue was $28 million

- Last year (2012) Twitter achieved sales of $317 million

- The first half of this year saw revenue of $254 million

- If this rate of growth continues it will exceed $656 million for the full year

- 87 percent of revenue is from advertising

- Twitter currently has 218 million active monthly users

- 169 million of these users are from outside the USA

- Twitter has never made a profit

- It has lost an accumulated $419 million since launch

- Private investors have put a total of $759 million into the social networks coffers

- Twitter has $375 million cash in the bank

- Twitter has generated 64 cents per user in the last 3 months.(Meanwhile in the same period Facebook created $1.58 per user and LinkedIn a $1.53)

- Twitter is mobile centric and 65% of its advertising earnings are from ads on tablets and smartphones

- There are 2,000 employees

- Market value on floating is predicted to be as high as $20 billion

So they are the numbers for the float. What are some other interesting social media facts and statistics about Twitter?

The facts on tweets, hashtags and other numbing numbers

Twitter thrives on tweets and hashtags. What are some of the latest figures on the 140 character web tweeting? I have pulled some numbers out of the Infographic below for those who have to rush off to a meeting or are having a short sharp coffee while reading this post.

- 135,000 Twitter accounts are registered every day

- 58 million tweets a day

- There are 2.1 billion searches on Twitter every 24 hours

- Some of the top and interesting hashtags include the potential reach generated by these hashtags: #mancrushmonday (5.5 million), #TransformationTuesday(10.17 million) and #ThrowBackThursday (31.4 million)

- Justin Bieber has the largest following with over 44 million followers

- Katy Perry is second with more than 42 million

- Lady Gaga comes in third at 40 million plus

If you want to find out the other 38 facts you cn view them in the infographic below

How The Shutdown Is Hurting The Housing Market | Mount Kisco Real Estate

As with so many other types of economic activity, the government shutdown is causing more fear than actual harm in the housing market thus far.

But that doesn’t mean things won’t start going wrong in the very near future.

Various federal agencies play greater or lesser roles in real estate transactions. With most of them sidelined, simple matters such as closing on mortgages are becoming more complicated.

“It’s going to add up pretty quickly, because loans can’t be closed in many cases,” says Mark Zandi, chief economist for Moody’s Analytics, a financial research organization. “The damage is going to start to mount and in a few days it’s going to be a significant problem for the housing market.”

The market, which had grown more robust over the past couple of years, was starting to cool off this fall anyway, due to rising prices and interest rates.

If interest rates go up due to the fear or reality of a debt default — and the costs for short-term treasuries are already starting to spike — that would have major consequences for real estate sales.

“This government shutdown, which is an artificial obstacle to the recovery, is clearly not a good thing,” says Lawrence Yun, chief economist for the National Association of Realtors.

What’s Not Working

Anyone who has purchased or refinanced a house knows a lot of paperwork is involved. The tall stack of forms that buyers and sellers sign at closings is largely generated or required by federal agencies that may now be temporarily out of the game.

Still, real estate agents and mortgage lenders have thus far been able to work their way around many of the hurdles put up by the partial government shutdown.

http://www.npr.org/2013/10/08/230467533/how-the-shutdown-is-hurting-the-housing-market

Completed foreclosures fall 34% | South Salem NY Real Estate

Completed foreclosures dropped 34% year-over-year in August 2013, according to data from CoreLogic (CLGX). As a whole, August’s completed foreclosures hit 48,000 filings, down from 72,000 filings in August 2012.

From a month ago, completed foreclosures grew a slight 1.3% from 47,000 actions in July 2013.

Overall, the nation has experienced 4.5 million completed foreclosures across the country since the start of the financial crisis in September 2008.

Through August 2013 this year, approximately 939,000 homes were in some stage of foreclosure, compared to 1.4 million in August 2012, a year-over-year decrease of 33%.

From August to July, the foreclosure inventory declined 3.2%. In August, the foreclosure inventory represented 2.4% of all homes with a mortgage, compared to 3.3% in August 2012.

By the end of August, 2.1 million mortgages, or 5.3% of loans survyed, were seriously delinquent, the lowest level since December 2008.

http://www.housingwire.com/articles/27288-foreclosure-inventory-plummets-34