Tag Archives: waccabuc luxury homes

The Etiquette of Homebuying | Waccabuc NY Homes

Nature Lover’s Reading Nook | Waccabuc Real Estate

Yolanda Foster Selling “Dream Home” Due to Battle With Lyme Disease | Waccabuc NY Homes

Yolanda Foster explains to Us Weekly why she’s decided to sell her Malibu mansion. “This is our dream home, but due to my battle with Lyme disease for the past two years I just don’t have the strength to run this almost 5-acre property anymore and should really focus on my recovery with as little stress as possible,” she tells Us. “My daughter Gigi moved to New York last July and my Bella will move this July, so it will be just the two of us with my 14-year-old son, Anwar.”

ORIGINAL STORY:

Yolanda Foster is saying goodbye to her lemon trees. The Real Housewives of Beverly Hills star and her husband, Grammy-winning musician David Foster, have listed their Malibu, Calif. mansion for $27.5 million, real estate site Trulia reports.

On Bravo’s Real Housewives of Beverly Hills, Yolanda, 50, and David, 64, have frequently been filmed hosting extravagant dinner parties in their stunning 11,622 square feet custom-built home. The estate has a jaw-dropping ocean view and a gorgeous infinity pool.

The property also features orchards of citrus and avocado trees. On her reality show, Yolanda has been seen picking lemons from her trees for her Master Cleanse diet. The Dutch model also showed off her glass refrigerator in her gourmet kitchen.

The Most Common Home Decor Mistake You’re Probably Making | Waccabuc NY Real Estate

1. IF YOU’RE A QUIET TYPE

A quiet retreat

A quiet retreat

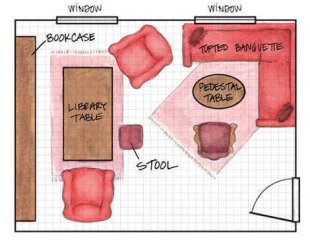

Bracketed by a dining-height banquette and a comfy seat, a 3′ oval pedestal table creates an eating spot for four-or five when the stool is pulled alongside. Across the room, a narrow 4 1/2′ library table flanked by armchairs is a serene reading area that can be used for dining when friends stop by.

If you find yourself not using your dining room that often, try rethinking its function. This scheme is great for casual dinners and lazy weekends over coffee and the paper.

A room for the quiet type

A room for the quiet type

2. IF YOU’RE A PARTY THROWER

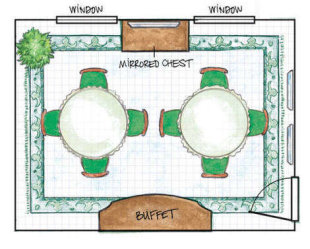

A room fit for endless parties The pair of 42″ round drop-leaf tables allows two small groups to sit facing each other. A mirrored chest and a large buffet store linens and tableware; during meals, they hold food and drink, or can be laid with platters so guests can self-serve. When you’re not entertaining, fold one table in half and move it against the wall, to avoid the feel of an underpopulated restaurant.

A room fit for endless parties The pair of 42″ round drop-leaf tables allows two small groups to sit facing each other. A mirrored chest and a large buffet store linens and tableware; during meals, they hold food and drink, or can be laid with platters so guests can self-serve. When you’re not entertaining, fold one table in half and move it against the wall, to avoid the feel of an underpopulated restaurant.

Round tables facilitate conversation-and lively dinner parties. (Plus, they make it easy to squeeze in extra guests)

Optimized for endless parties

Optimized for endless parties

3. IF YOU’RE A SERIOUS COOK

Maximize for entertaining space

Maximize for entertaining space

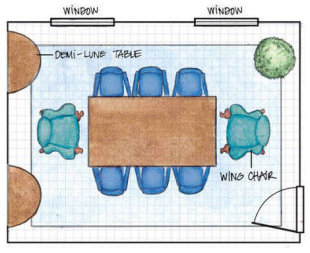

A wide 3′ x 7′ table means there’s room for two generous wing chairs to anchor each end; a set of six side chairs fits neatly along the length. A pair of demi-lune accent tables topped with mirrors provides depth and a calming symmetry that’s pleasingly offset by a potted topiary tree in the corner.

This formal yet comfortable arrangement practically demands long, leisurely meals that linger well past dessert.

http://shine.yahoo.com/at-home/most-common-home-decor-mistake-39-probably-making-141300635.html

One thing you should do before refinancing | Waccabuc NY Real Estate

Thinking about refinancing? Before you do, put some time and effort — and some money too — into sprucing up.

For anyone selling a home, sprucing up is a no-brainer. Repairs, upgrades, painting and landscaping can raise the sales price. But homeowners who are staying put and refinancing often don’t bother with these improvements. If you’re not looking for a buyer and have years to get around to these things, why bother?

Because the home’s condition will be reflected in the lender’s appraisal, which will determine whether you get the new mortgage and how large it can be.

US banks under pressure to step up new mortgage business | Waccabuc NY Homes

Pressure is mounting at the mortgage banking divisions of the biggest US banks.

As refinancing activity has plummeted, banks are trying to step up their new home loan books, in an attempt to offset the dramatic revenue drag on overall bank earnings. There are few easy ways to boost new purchase originations, but one of the starkest battles is playing out in the bidding war for hotshot mortgage loan officers.

“People are fighting over a smaller pie,” said Franklin Codel, head of mortgage production at Wells Fargo, the biggest US home lender. “The competition for quality loan officers is very high.”

Up to now, the focus has been on thousands of job cuts in the mortgage divisions of US banks – many of which came in the refinancing call centres as higher interest rates deterred borrowers from refinancing their mortgages.

But as credit quality improves the banks have begun vying for a slice of the new purchase market and have started an intense competition for experienced mortgage bankers with existing client relationships.

The role of government-backed entities such as Fannie Mae and Freddie Mac means that US banks tend to offer similar mortgage products so it is harder for them to stand out in this area than in credit cards, where their benefits packages differ.

http://www.ft.com/intl/cms/s/0/ef5d1b9e-8377-11e3-86c9-00144feab7de.html#axzz2sIQ3eQmw

February Checklist for a Smooth-Running Home | Waccabuc Real Estate

Tough Baltimore winter hasn’t frozen housing prices | Waccabuc Real Estate

Sharp Drop In December Pending Home Sales | Waccabuc NY Real Estate

The number of U.S. homes in contract fell to the lowest point in 20 months last month. Unseasonably cold weather and low home inventory may have temporarily slowed housing growth nationwide.

For home buyers, the drop may present an opportunity. Homes had sold quickly through most of 2013 so the rapid, year-end slowdown may help give buyers leverage. Plus, mortgage rates have been dropping. Today’s rates are their lowest in more than 10 weeks.

The spring market looks ripe to rebound. The best deals of this year, then, may be the ones you find today.

Pending Home Sales Index : A “Future” Housing Indicator

The Pending Home Sales Index (PHSI) is a monthly report, published by the National Association of Realtors® (NAR). It measures homes under contract, and not yet closed.

The Pending Home Sales Index is unique among the “common” housing market metrics. Whereas most metrics report on how the housing market did perform, the Pending Home Sales Index reports on how the housing market will perform. The index is “forward-looking”.

This is because, according to the National Association of Realtors®, 80% of homes under contract “close” within 2 months.

In this way, the Pending Home Sales Index is correlated to the Existing Home Sales report. Homes under contract become homes sold. We should expect the February Existing Home Sales report, then, to show a similar drop-off as last month’s Pending Home Sales Index.

In December, the Pending Home Sales Index slipped 9% to reach 92.4. The drop marks the largest one-month change since May 2010, which was the month after the end of that year’s federal home buyer tax credit.

http://themortgagereports.com/14334/pending-home-sales-index-buyer-opportunity