| |

MCLEAN, Va., Sept. 06, 2018 (GLOBE NEWSWIRE) — Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that mortgage rates increased marginally over the past week. Sam Khater, Freddie Mac’s chief economist, says the 30-year fixed-rate mortgage inched higher for the second straight week. “Borrowing costs may be slowly on the rise again in coming weeks, as investors remain optimistic about the underlying strength of the economy,” he said. “It’s important to note that rates are now up three-quarters of a percentage point from last year and home prices – albeit at a slower pace – are still outrunning rising inflation and incomes.” Added Khater, “This weakening in affordability is hindering many interested buyers this fall, even as the robust economy brings them into the market. The good news is that purchase mortgage applications have recently rebounded to above year ago levels.” News Facts

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey. |

Tag Archives: Waccabuc Homes for Sale

London prices falling | Waccabuc Real Estate

House prices in some of London’s wealthiest boroughs plummeted as much as 14.9% in the year to January, dragging down the average price in the capital—and in England—according to a report Monday by real estate consultants Acadata.

Prices in the capital fell 0.8% in January from December, to £593,396 (US$825,318). That’s down 2.6% annually, the report said, the biggest fall since August 2009, when the recession was still in full swing.

Price growth across the U.K. has likely been weighed down by uncertainties surrounding Brexit, along with 2016’s 3% surcharge on second homes and buy-to-let properties. “Subsequent to the introduction of this tax, the rates of price growth have been falling, and at an accelerated rate since September 2017,” the report said.

No doubt the fall is more acutely felt in London, a hotspot for international investors.

The biggest drops were logged in the priciest boroughs.

Wandsworth saw the largest dip, with the average price declining 14.9% in the year to January, to £685,567 (US$953,514) from £805,460 (US$1.12 million) the prior year. The City of London followed, where prices are now £844,768 (US$1.17 million), down 10.8% from last January and in Islington, prices are down 8.8% to £684,869 (US$952,543).

But in the city’s most expensive borough, Kensington and Chelsea, prices rose 4.6% up to £2.16 million (US$3 million).

Combined, the most expensive 11 boroughs fell by 3.8%, while mid-priced boroughs are down an average 2.7%, according to the report.

The less expensive boroughs fared better. More than half logged price rises over the last year, led by Bexley, which saw its average price rise 4.5% to £363,082 (US$504,988). In Barking and Dagenham, which has the lowest priced property in the capital, according to the report, prices inched up 0.1% to £300,627 (US$418,124).

Brent, in northwest London and home to Wembley Stadium, logged the largest price increases, up 8.5% to £587,372 (US$816,940).

read more…

www.mansionhomes.com

Mid century modern homes | Waccabuc Real Estate

/cdn.vox-cdn.com/uploads/chorus_image/image/62725928/40.0.jpg)

It doesn’t seem possible, but midcentury modern design likely became even more popular in 2018 than before. The meteoric rise of the architectural and design style has been aided by shows like Mad Men and pushed into homes through big-box retailers like Target. But a good Eames chair aside, nothing quite compares to a midcentury modern building.

Boasting timeless design in a hot real estate market, the homes of 2018 were a diverse blend of styles from the 1950s and 1960s. We saw a wealth of midcentury gems, ranging from boxy glass houses to post-and-beam stunners. Whether your taste skews organic and natural or colorful and bold, there’s something for everyone on this list.

Without further ado, here are 11 incredible midcentury modern homes that came on the market this year.

1. A cantilevered midcentury home near San Francisco

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10623305/64.jpg)

Designed by AIA Gold Medal architect Joseph Esherick, this multi-level wood-framed home towers above a sloped site in Montclair Hills and frames breathtaking views of the Golden Gate and Bay Bridges. Almost treehouse like in its aesthetics, the 2,391-square-foot four-bedroom boasts a series of decks, balconies, walkways, cantilevers, and staircases that creates a dynamic space both inside and out.

2. A Mies-inspired glass house in Tennessee

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/12882547/_MG_5398.jpg)

A boxy one-bedroom, one-bath home where you can live out your Farnsworth House dreams. Built by longtime University of Tennessee architecture professor William Starke Shell, the 1,600-square-foot home features a flat roof, 40-by-40 steel beams, and huge glass panels. According to the Knoxville News Sentinel, Shell earned a master’s of architecture from Columbia University before working with Mies in Chicago.

3. A modest 1950s home ripped straight out of a magazine

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10716683/North_Regent_Crt_70.jpg)

Not every home we loved this year was a starchitect-designed multi-million dollar listing. This modest home in Bayside, Wisconsin, listed for a reasonable $410,000 but boasted original details. The flat-roofed wooden construction unfurls across 2,100 square feet, with an open-concept living, a teal kitchen, and a dining area running the entire length of the house. Here, walls of glass frame views of the yard, while new Acid Brick Flooring complements a double-faced stone fireplace and wood paneling.

4. A circular midcentury house in Florida

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13638660/2018___RiMO_Photo___Modern_Sarasota___2018_001___4433_Riverwood_Avenue_027.jpg)

Here’s another fantastic midcentury home from the Sarasota School of Architecture, a regional modernist style that emerged after the war in and around Sarasota, Florida, and which counts Paul Rudolph and William Rupp among its notable architects. What sets this one apart is its completely circular design. Measuring approximately 2,714 square feet, the home features 18-foot ceilings, a cantilevering flat roof, clerestory windows circling the top of the curved walls, and soaring, double-height spaces.

5. An affordable midcentury gem in Illinois

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/12757351/1.jpg)

The 2,522-square-foot house was built in 1962 by Verne Lars Solberg, a successful commercial architect in northern Illinois. While at the University of Oklahoma, Solberg met Ross and Eleanor Graves—whose father worked Wright’s land in Wisconsin—and it was Ross Graves who introduced Solberg to Wright’s organic style. When a doctor in Polo asked Solberg to design a house, the architect was given free range to design whatever he saw fit; this Usonian-style, three-bedroom, two-bath stunner was the result.

6. A post-and-beam jewel on Bainbridge Island

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10700977/imagereader__2_.jpg)

Designed in 1965 for Jack Christiansen, the pioneering engineer behind Seattle’s Kingdome roof and many other iconic buildings throughout the state, the post-and-beam waterfront residence appears to be virtually untouched and beautifully maintained over the years. The structure features an expansive deck propped on a concrete dais with a plethora of midcentury details—think glass and wood construction, Japanese-inspired beams, wood screens, and glazed expanses that frame stunning water and mountain views.

7. A renovated masterpiece in New York

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13053103/40.jpg)

Located in Armonk, New York, about 50 minutes north of the city, this four-bedroom, two-bath midcentury was built in 1957 by architect Arthur Witthoefft of Skidmore, Owings & Merrill. The home is a 25-by-95 foot rectangle featuring a black exposed-steel frame, white glazed brick, and huge floor-to-ceiling glass sliders. It sits on a sloping site, surrounded by the forrest of Westchester County, and multi-year renovations overseen by Witthoefft in 2007 brought the home back to its glory days.

8. A stunning midcentury by a Wright apprentice in Memphis

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13292681/0565715_Sycamore_Grove_Ln_FULL.jpg)

This four-bedroom, three-and-a-half-bath home was designed by E. Fay Jones in 1964 to respect and highlight the serene forest on the 1.27-acre property. A Frank Lloyd Wright apprentice with a lengthy career of his own, Jones made a name for himself building airy structures in forested areas, many in the Ozarks. It’s a masterclass in the Prairie style; an interior of cypress wood, Arkansas field stone, and flagstone floors is carefully balanced with giant floor-to-ceiling glass windows that provides views into the trees outside.

9. An Oregon A-frame midcentury home with a gorgeous atrium

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13626516/1961_Park_Forest_Ave_HiResIMG_009.jpg)

Built by prolific Portland builder Robert Rummer in 1969, the house boasts Rummer’s classic post-and-beam design with a soaring atrium. The high-pitched, double-gable design anchors a floor plan that wraps around the central atrium, resulting in rooms flooded with light. Giant skylights also create an airy ambiance, but the home feels cozy thanks to Rummer’s use of wood and paneling.

10. A Palm Springs pad perfect for indoor-outdoor living

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/10122971/ISi3uozbcswv500000000000.jpg)

This groovy midcentury modern home located in the Twin Palms neighborhood of Palm Springs starts with an unforgettable facade of stone “isosceles trapezoidal piers” and aquamarine double doors and culminates in impressive outdoor spaces that include a pool and multiple patios.

11. An untouched time capsule in Georgia

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13108593/479_South_Woodland_hi_23.jpg)

Sitting on the top of a hill on a one acre lot about 45 minutes from Atlanta, this four-bedroom Eichler-inspired house maintains most of its original features. The large and open living room area boasts soaring tongue and groove ceilings with a massive crab orchard stacked stone fireplace. East facing clerestory windows and a glassed sunroom extends the length of the rear of the home to let in light, contrasting with the warm wood-paneled interiors.

read more…

https://www.curbed.com/2018/12/26/18148640/midcentury-modern-homes-for-sale

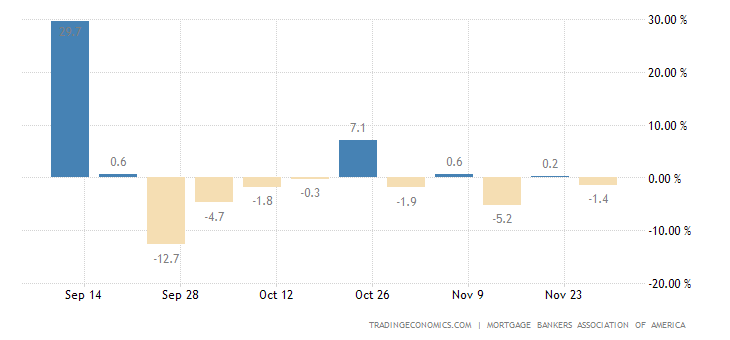

Mortgage applications fall | Waccabuc Real Estate

Mortgage applications in the United States fell 9.7 percent in the week ending September 15th, 2017, after rising 9.9 percent in the previous period. It is the sharpest decline in mortgage applications since July of 2016, data from the Mortgage Bankers Association showed. Applications to purchase a home slumped 10.8 percent and refinance applications dropped 8.5 percent. The average fixed 30-year mortgage rate edged up by 1bps to 4.04 percent. Mortgage Applications in the United States averaged 0.48 percent from 2007 until 2017, reaching an all time high of 49.10 percent in January of 2015 and a record low of -38.80 percent in January of 2009.

| Calendar | GMT | Actual | Previous | Consensus | TEForecast | |||

|---|---|---|---|---|---|---|---|---|

| 2017-09-06 | 11:00 AM | MBA Mortgage Applications | 3.3% | -2.3 | 0.50% | |||

| 2017-09-13 | 11:00 AM | MBA Mortgage Applications | 9.9% | 3.3% | 0.48% | |||

| 2017-09-20 | 11:00 AM | MBA Mortgage Applications | -9.7% | 9.9% | 0.43% | |||

| 2017-09-27 | 11:00 AM | MBA Mortgage Applications | 0.45% | |||||

| 2017-10-04 | 11:00 AM | MBA Mortgage Applications | 0.46% | |||||

| 2017-10-11 | 11:00 AM | MBA Mortgage Applications | 0.46% | |||||

| United States Housing | Last | Previous | Highest | Lowest | Unit | |

|---|---|---|---|---|---|---|

| Building Permits | 1300.00 | 1230.00 | 2419.00 | 513.00 | Thousand | [+] |

| Housing Starts | 1180.00 | 1190.00 | 2494.00 | 478.00 | Thousand | [+] |

| New Home Sales | 571.00 | 630.00 | 1389.00 | 270.00 | Thousand | [+] |

| Pending Home Sales | -1.30 | 0.30 | 30.90 | -24.30 | percent | [+] |

| Existing Home Sales | 5440.00 | 5510.00 | 7250.00 | 1370.00 | Thousand | [+] |

| Construction Spending | -0.60 | -1.40 | 5.90 | -4.80 | percent | [+] |

| Housing Index | 0.10 | 0.30 | 1.20 | -1.80 | percent | [+] |

| Nahb Housing Market Index | 64.00 | 67.00 | 78.00 | 8.00 | [+] | |

| Mortgage Rate | 4.04 | 4.03 | 10.56 | 3.47 | percent | [+] |

| Mortgage Applications | -9.70 | 9.90 | 49.10 | -38.80 | percent | [+] |

| Home Ownership Rate | 63.70 | 63.60 | 69.20 | 62.90 | percent | [+] |

| Case Shiller Home Price Index | 200.54 | 199.05 | 206.52 | 100.00 | Index Points |

read more…

https://tradingeconomics.com/united-states/mortgage-applications

Consumers remain too optimistic when estimating home value | Waccabuc Real Estate

Homeowners continue to overestimate their home values, however the gap continues to narrow, according to the latest National Home Price Perception Index from Quicken Loans.

The index, which compares homeowners estimates and the appraised home values, showed appraised home values came in 1.35% lower than homeowner estimates in August. This gap is smaller than July’s gap of 1.55%.

This closing gap is due, in part, by the increase in appraised values which ticked up 0.19% in August. This is up 2.64% from August of last year.

“As the sun sets on the summer, some of the intense competition for housing also winds down,” said Bill Banfield, Quicken Loans executive vice president of capital markets. “It’s important to focus on the annual numbers with the HVI. While there can be some monthly variations in the data, especially as seasons start to change, the annual numbers show healthy growth across the country.”

The chart below shows despite the narrowing gap over the past few months, homeowners have been overestimating their home values since the beginning of 2015.

Click to Enlarge

(Source: Quicken Loans)

Homeowner perception varied widely from one region to the next, as appraisal values ranged from 3% higher than homeowner estimates in the West to 3% lower in the Midwest and Northeast.

The chart below shows the index in varies metros across the U.S.

Click to Enlarge

(Source: Quicken Loans)

“One of the biggest lessons from the HPPI, is highlighting how regionalized real estate is,” Banfield said. “Homeowners who have a better understanding of their local housing market can make more informed decisions about their home. After all, their house is not just where they live, but one of their bigger assets.”

read more…

Mortgage rates fall again | Waccabuc Real Estate

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed mortgage rate dropping for the fourth consecutive week and hitting its lowest level in nearly seven months.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.89 percent with an average 0.5 point for the week ending June 8, 2017, down from last week when it averaged 3.94 percent. A year ago at this time, the 30-year FRM averaged 3.60 percent.

- 15-year FRM this week averaged 3.16 percent with an average 0.5 point, down from last week when it averaged 3.19 percent. A year ago at this time, the 15-year FRM averaged 2.87 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.11 percent this week with an average 0.5 point, the same as last week. A year ago at this time, the 5-year ARM averaged 2.82 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quote

Attributed to Sean Becketti, chief economist, Freddie Mac.

“The 10-year Treasury yield fell 3 basis points this week. The 30-year mortgage rate moved in tandem with Treasury yields, falling 5 basis points to 3.89 percent. Mixed economic data and increasing uncertainty are continuing to push rates to the lowest levels in nearly seven months.”

Canada Must Deflate Its Housing Bubble | Waccabuc Real Estate

Canada’s housing market offers a case study in a contentious economic issue: If a central bank sees a bubble forming, should it act to deflate it? In this instance, the answer should be a resounding yes.

A combination of foreign money, local speculation and abundant credit has driven Canadian house prices to levels that even government officials recognize cannot be sustained. In the Toronto area, for example, they were up 32 percent from a year earlier in April. David Rosenberg, an economist at Canadian investment firm Gluskin Sheff, notes that it would take a decline of more than 40 percent to restore the historical relationship between prices and household income.

Granted, the bubble bears little resemblance to the U.S. subprime boom that triggered the global financial crisis. Although one specialized lender, Home Capital Group, has had issues with fraudulent mortgage applications, regulation has largely kept out high-risk products. Homeowners haven’t been withdrawing a lot of equity, and can’t legally walk away from their debts like many Americans can. Banks aren’t sitting on the kinds of structured products that destroyed balance sheets in the U.S. Nearly all mortgage securities and a large portion of loans are guaranteed by the government.

That said, the situation presents clear risks. As buyers stretch to afford homes, household debt has risen to 167 percent of disposable income — the highest among the Group of Seven industrialized nations. This is a serious vulnerability, and a big part of the rationale behind Canadian banks’ recent ratings downgrade. The more indebted people are, the more sensitive their spending becomes to changes in prices and interest rates, potentially allowing an otherwise small shock to result in a deep recession.

What to do? Administrative efforts to curb lending and tax foreign buyers have helped but haven’t solved the problem. That’s largely because extremely low interest rates are still giving people a big incentive to borrow. The Bank of Canada has held its target rate at 1 percent or lower since 2009, and at 0.5 percent since 2015, when it eased to counteract the effect of falling oil prices. That’s a very stimulative stance in a country where the neutral rate is estimated to be about 3 percent or higher. One can’t help but see a parallel with the low U.S. rates and the housing bubble of the early 2000s.

read more…

https://www.bloomberg.com/view/articles/2017-05-23/what-canada-should-do-about-its-housing-bubble

Homebuilder Sentiment Hits 18-Year High | Waccabuc Real Estate

Confidence among U.S. homebuilders jumped in December to the highest level since July 1999, exceeding all analyst estimates, as a growing economy boosts housing demand, according to data Monday from the National Association of Home Builders/Wells Fargo.

| Highlights of Homebuilder Sentiment (December) |

|---|

|

Key Takeaways

The surprisingly strong reading shows developers expect demand to advance amid steady economic growth and a tightening job market. Mortgage rates remain close to record lows, making borrowing attractive for prospective buyers, while the homebuilders also cited easier regulation under President Donald Trump as helping the housing market.

Demand for properties is rising, with a gauge of homebuyer traffic rallying to a 19-year high, according to the survey. A host of data this week will give a fuller picture of the housing market, including sales of new and existing homes, as well as groundbreakings and building permits.

Officials’ Views

“Housing market conditions are improving partially because of new policies aimed at providing regulatory relief to the business community,” NAHB Chairman Granger MacDonald, a homebuilder and developer from Kerrville, Texas, said in a statement.

“With low unemployment rates, favorable demographics and a tight supply of existing home inventory, we can expect continued upward movement of the single-family construction sector next year,” NAHB Chief Economist Robert Dietz said in the same statement.

read more…

https://www.newsmax.com/finance/streettalk/homebuilder-sentiment-construction-housing/2017/12/18/id/832331/

Are Trophy Homes Losing their Lustre? | Waccabuc Real Estate

With pressure on the homebuilding industry to build fewer trophy homes and concentrate on filling the demand for affordable housing, the data does not bode well for builders.

Median prices of new homes have risen steadily during the recession. In September, the median sold price of a new home hit $313,500, 5.5 percent higher than last year’s median of $296,400 and 25.2 percent higher than the median price for existing homes in September.

Even so, over the past two years super expensive homes priced at one million or more are on the decline, according to data from the Census Bureau’s Survey of Construction. In 2015, a total of 1,762 homes were started for sale with a price of $1 million or more and new homes started for sale with a price of $1 million or more decreased as a share in absolute number in 2015. That number was significantly lower than in 2013 (3,347 homes) and 2014 (3,019).

In percentage terms, these expensive homes represented 1.06 percent of all new homes started for sale in 2015, from a peak of 1.26 percent in 2014 but about the same as in 2013 (0.99 percent). This represents a much higher percent share compared to other years. For instance, from 2008 to 2012 the percent share of $1 million or more homes started for sale was less than 0.50 percent, while it was at most 0.66 percent during the boom period, reported the National Association of Home Builders’ Eye on Housing blog.

To put things in perspective, Trulia reported in May that since 2012 the share of all million dollar homes in the United States has increased from 1.6 percent to 3 percent, but many metros and neighborhoods have seen a much larger increase.

read more…

http://www.realestateeconomywatch.com/2016/11/are-trophy-homes-losing-their-lustre/

Mortgage rates average 3.52% | Waccabuc Real Estate

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates moving higher for the second week in a row and marking the first time the 30-year fixed-rate mortgage has risen above 3.5 percent since June.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.52 percent with an average 0.5 point for the week ending October 20, 2016, up from last week when they averaged 3.47 percent. A year ago at this time, the 30-year FRM averaged 3.79 percent.

- 15-year FRM this week averaged 2.79 percent with an average 0.5 point, up from last week when they averaged 2.76 percent. A year ago at this time, the 15-year FRM averaged 2.98 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.85 percent this week with an average 0.4 point, up from last week when it averaged 2.82 percent. A year ago, the 5-year ARM averaged 2.89 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quote

Attributed to Sean Becketti, chief economist, Freddie Mac.

“The 30-year fixed-rate mortgage moved a solid 5 basis points to 3.52 percent while the 10-year Treasury yield remained relatively flat. This is the first week in over 4 months that rates have risen above 3.50 percent. This month, mortgage rates seem to be catching up to Treasury yields and returning to pre-Brexit levels.”