| Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage fell to a 10-month low. Sam Khater, Freddie Mac’s chief economist, says, “The U.S. economy remains on solid ground, inflation is contained and the threat of higher short-term rates is fading from view, which has allowed mortgage rates to drift down to their lowest level in 10 months. This is great news for consumers who will be looking for homes during the upcoming spring home buying season. Mortgage rates are essentially similar to a year ago, but today’s buyers have a larger selection of homes and more consumer bargaining power than they did the last few years.” News Facts 30-year fixed-rate mortgage (FRM) averaged 4.41 percent with an average 0.4 point for the week ending February 7, 2019, down from last week when it averaged 4.46 percent. A year ago at this time, the 30-year FRM averaged 4.32 percent. 15-year FRM this week averaged 3.84 percent with an average 0.4 point, down from last week when it averaged 3.89 percent. A year ago at this time, the 15-year FRM averaged 3.77 percent. 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.91 percent with an average 0.3 point, down from last week when it averaged 3.96 percent. A year ago at this time, the 5-year ARM averaged 3.57 percent.Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey. |

Tag Archives: South Salem Homes for Sale

Con Ed cannot supply more natural gas halting development in Westchester | South Salem Real Estate

Local and state officials fear Westchester’s recent development renaissance will come to a screeching halt because Con Edison said it can’t take on new natural gas customers.

Con Edison issued a statement Friday saying the demand for gas is “reaching the limits of the current supplies to our service area.”

“As a result, and to maintain reliable service to our existing natural gas customers on the coldest days, we will no longer be accepting applications for natural gas connections from new customers in most of our Westchester County service area beginning March 15, 2019,” Con Edison said in its statement.

Jim Denn, spokesperson for the Department of Public Service, said Con Ed didn’t propose a pipeline “to meet or address growing demand.”

“To help prospective customers meet their energy needs in light of these market dynamics, PSC will be monitoring Con Edison’s engagement with customers to explore options to reduce their energy needs or meet their needs through non-natural gas energy sources,” Denn said in a statement.

State Assemblywoman Amy Paulin, D-Scarsdale, said it’s going to “devastate” local development, particularly in cities like New Rochelle and Yonkers, which are in the midst of redeveloping their downtowns.

A portion of the 10 acres of solar panels atop the headquarters of Diamond Properties in Mount Kisco. (Photo: Submitted)

“These projects are on a marginal budget, and we’re not going to get the economic development that we’re hoping for,” Paulin said. “Compounding the problem is affordable housing. Developers won’t be able to do them at all, so this is a huge problem for our county and it’s disappointing that we’re being told two months prior (to the start of the moratorium).”

AP Assemblywoman Amy Paulin,D-Scarsdale, has put together a coalition to fight the IRS. (Photo: Associated Press)

New Rochelle’s downtown redevelopment attempts have historically started and crumbled, as it did in the 1980s, which left a pile of debris near the train station for more than a decade, and again during the most recent economic recession.

The city experienced a development boom since it changed its downtown zoning code in 2015, with several projects already being built and more in the pipeline, but Paulin worries that this could put a pin in the balloon.

“I’m worried it will (stop the redevelopment),” she said. “I spoke to the mayor, and he’s worried as well. We’re going to meet with Con Ed this week. I’m hoping we can figure out something that we can do.”

New Rochelle Mayor Noam Bramson said, “This obviously has serious potential implication for our entire region.”

“We are consulting with government and utility officials in order to better understand options and constructive paths forward,” Bramson said. “It is essential that solutions emerge.”

In Yonkers, Mayor Mike Spano said the city’s building boom could be affected for as long as this moratorium lasts.

“Developers are already telling us they can’t build more housing or commercial buildings until this is resolved,” he said. “Con Ed and the Public Service Commission need to implement an immediate plan to solve this.”

Denn said the PSC ordered utility companies, including Con Ed, to increase energy efficient and create “demand-response programs to lower gas demand and save consumers money.”

“These programs are up and running,” he said. “As these gas efficiency and demand response measures take hold, as well as others to meet demand growth, the PSC will carefully review changing market conditions and consider most appropriate additional steps Con Edison should take to meet the needs of its customers.”

The northernmost sections of the county have more capacity and may still be able to accept new customers, Con Edison said in its statement, and existing customers are not affected by the moratorium.

read more…

Mortgage rates fall | South Salem Real Estate

Several benchmark mortgage rates decreased today. The average rates on 30-year fixed and 15-year fixed mortgages both fell. The average rate on 5/1 adjustable-rate mortgages, meanwhile, also declined.

30-year fixed mortgages

The average rate for the benchmark 30-year fixed mortgage is 4.51 percent, a decrease of 7 basis points over the last week. A month ago, the average rate on a 30-year fixed mortgage was higher, at 4.68 percent.

At the current average rate, you’ll pay a combined $507.28 per month in principal and interest for every $100,000 you borrow. That’s down $4.17 from what it would have been last week.

You can use Bankrate’s mortgage calculator to get a handle on what your monthly payments would be and see the effect of adding extra payments. It will also help you calculate how much interest you’ll pay over the life of the loan.

15-year fixed mortgages

The average 15-year fixed-mortgage rate is 3.76 percent, down 4 basis points over the last seven days.

Monthly payments on a 15-year fixed mortgage at that rate will cost around $728 per $100,000 borrowed. Yes, that payment is much bigger than it would be on a 30-year mortgage, but it comes with some big advantages: You’ll save thousands of dollars over the life of the loan in total interest paid and build equity much more rapidly.

5/1 ARMs

The average rate on a 5/1 ARM is 3.94 percent, down 6 basis points since the same time last week.

These types of loans are best for those who expect to sell or refinance before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 3.94 percent would cost about $474 for each $100,000 borrowed over the initial five years, but could increase by hundreds of dollars afterward, depending on the loan’s terms.

Where rates are headed

To see where Bankrate’s panel of experts expect rates to go from here, check out our Rate Trend Index.

Want to see where rates are right now? See local mortgage rates.

| Product | Rate | Change | Last week |

|---|---|---|---|

| 30-year fixed | 4.51% | -0.07 | 4.58% |

| 15-year fixed | 3.76% | -0.04 | 3.80% |

| 30-year fixed jumbo | 4.42% | -0.03 | 4.45% |

| 30-year fixed refinance | 4.55% | -0.08 | 4.63% |

Last updated: January 1, 2019.

Methodology: The rates you see above are Bankrate.com Site Averages. These calculations are run after the close of the previous business day and include rates and/or yields we have collected that day for a specific banking product. Bankrate.com site averages tend to be volatile — they help consumers see the movement of rates day to day. The institutions included in the “Bankrate.com Site Average” tables will be different from one day to the next, depending on which institutions’ rates we gather on a particular day for presentation on the site.

To learn more about the different rate averages Bankrate publishes, see “Understanding Bankrate’s Rate Averages.”

read more…

Left wing Seattle bars landlords from doing criminal background checks | South Salem Real Estate

With slews of tent encampments in a fast-growing city flush with tech-sector cash, it’s tough questioning Seattle’s serious problem with homelessness and affordable housing.

But an unprecedented new city law — forbidding landlords from checking into potential renters’ criminal past — is very much in dispute and setting up a closely-watched court battle.

Landlords argue their free speech, property rights and possibly their safety is being jeopardized by a law that forces them to close their eyes to relevant public information about possible tenants. They’re backed by landlord groups and background screeners who call the ordinance a perilous precedent.

The “Fair Chance Housing Act” was anything but that, according to landlords’ lawyers. Ethan Blevins, an attorney at the Pacific Legal Foundation, said the law’s premise “is this paternalistic idea that the city gets to decide what information is relevant or important to a landlord’s decision making process.”

An unprecedented new city law — forbidding landlords from checking into potential renters’ criminal past — is very much in dispute and setting up a closely-watched court battle.

The City of Seattle and tenant advocates are fighting back. They say the act helps chip away at a housing crisis, especially for over-policed minorities disproportionately saddled with arrests and convictions.

It’s a court case that landlords and lawmakers in the other parts of the country are looking at with keen interest. A ruling upholding the law could pave the way for its enactment elsewhere, said Kimberlee Gunning, a lawyer for tenants advocates at Columbia Legal Services. “Folks across the country are watching this,” she said.

Though the law has been in effect since February, a judge will be scrutinizing its merits following President Donald Trump’s enactment of criminal justice reforms. The “First Step Act” signed Friday, among other things, broadens re-entry efforts and quicken a well-behaved inmate’s release. If you’re looking for professional help with tenant and landlord matters, look at this.

The new federal law was a sign Seattle “on the vanguard” of needed reforms with its own housing law, Herbold said. The city also was one of the first cities to enact paid sick leave laws and $15 minimum wage requirements, she noted.

“We’re all safer if people are housed,” Council member Lisa Herbold, the bill’s chief sponsor, told MarketWatch. “You’re reducing the likelihood of recidivism. That goes for violent crimes as well.”

What should matter to landlords, Herbold said, is someone’s ability to make the rent on time and not wreck the place; But according to checkpeople.com – Blevins said criminal background checks had bearing for those kinds of issues.

While other cities limit how far in time landlords can delve into a tenant’s criminal past, Herbold said Seattle’s law appears to be the first blocking any inquiry at all. Those involved should learn about Singleton Law Firm legal assistance, there are cases of the efficient way out.

“It is an embarrassment and shame that a city like ours, with so many resources, is not doing a very good job taking care of those who have the most significant barriers to access in housing,” Herbold said, “And having a mark on your background related to the criminal justice system is one of those barriers.”

The law’s premise ‘is this paternalistic idea that the city gets to decide what information is relevant or important to a landlord’s decision making process.’

A January 2017 tally put Seattle’s homeless population around 8,500. Average Seattle rents jumped 43% from 2012 to 2017, accord to a local task force. During that time, vacancy rates in buildings with at least 20 units have hovered between 4% and 5%, it said. Almost one-third of Seattle residents have an arrest or conviction on their record, court papers said.

The city is already locked in two other lawsuits with landlords, who object to ordinances capping deposits and requiring landlords to take the first applicant who comes to them. A judge upheld the limits on move-in costs, but another judge voided the rule on taking the first tenant to come along. Both cases are being appealed.

Ahead of its unanimous passage, some residents in support of the Fair Chance Housing Act said landlords kept dredging up their past as they tried to make a new life. One man testified at a bill hearing he had enough money, good credit and a good rental history. “But I kept hearing ‘no.’” The law, he said, “will help level the playing field for some of us.”

The plaintiffs include landlords who rent out a handful of units and live close to their tenants. One landlord couple that’s suing, Chong and MariLyn Yim, say they charge below-market rent prices. But they’ll “have to raise rents in order to build up a larger cushion of reserves to absorb the risks they face under the new law,” court papers said.

The Yims, two other private landlords and the Rental Housing Association of Washington are asking Seattle Federal Judge John Coughenour to call the statute unconstitutional.

Some say Seattle’s law is not an outlier

The law prevents landlords from checking prospective tenants for any convictions or arrests. The ordinance does not apply to convicted sex offenders who committed their crime from age 21 and above. It does shield juvenile criminal records from landlord eyes, including those for sex-crime charges. The law doesn’t apply to federally-assisted housing, the landlords note.

Renters across America face a mix of federal, state and local laws when it comes to what publicly-funded and private landlords can weigh when deciding on a tenant.

There’s a variety of anti-discrimination laws barring the consideration of race, sex, religion and disability. The range of state and city rules for considering tenant’s criminal past get more complicated — with many laws now confining what parts of a criminal record landlords should weigh, housing advocates point out.

“Seattle’s ordinance is by no means an outlier. It is part of a larger trend at the federal, state, and local levels toward removing barriers for people reentering society,” said lawyers for the National Housing Law Project and the Sargent Shriver National Center on Poverty Law.

But renters on the private market don’t have “the same constitutional protections against arbitrary admission denials as applicants to federally subsidized housing,” the organizations said, noting 87% of Seattle’s rental housing stock is owned by private landlords.

A spokesman for the city’s Office for Civil Rights said that, as of last month, the agency has filed nine civil charges against several landlords since the law went on the books. Four ended in settlement, four are pending and one was dismissed.

Clashing Arguments

Blevins acknowledged city officials are trying to cope with “legitimate problems” of recidivism and the criminal justice system’s disproportionate lean on minorities. “The problem is, they’ve taken the wrong approach by burdening landlords with this inability to look into valid information about rental applicants.”

Blevins noted Seattle has been under a federal consent decree since 2012 to stop biased policing. “It’s ironic for them to point the finger,” he said. In January, a judge said the police was in full compliance and had two years to keep it up before the order lifted.

Landlords argue they could be exposed to liability. In one pending lawsuit, a family of a raped and murdered tenant is suing a Chicago property manager for not running a background check on a fellow tenant.

Landlords argue they could be exposed to liability if they don’t do their due diligence. There was one dire example in a pending lawsuit where a family of a raped and murdered tenant is suing a Chicago property manager for not running a background check on a fellow tenant.

The landlord arguments are seconded by supporting groups like the National Apartment Association and the National Consumer Reporting Association, which assailed the ordinance as vaguely worded.

John McDermott, general counsel of the National Apartment Association, a trade association for owners and property managers in the rental market, said Seattle’s law was “stunning in saying our solution to the [shortage of affordable housing] problem is you should make decisions with less information.”

But tenants’ advocates said the ordinance was a break from Seattle’s troubled housing history.

Seattle was a segregated city with racially restrictive covenants and “redlining” in its past — not to mention gentrification that were now pricing out certain areas, filings said. Companies like Amazon AMZN, +5.21% and StarbucksSBUX, +2.54% are based in Seattle, while the headquarters of MicrosoftMSFT, +3.39% are nearby.

Background checks on their face didn’t ask about race, but landlords, playing “private juries and judges” kept the divided city’s status quo intact.

“The Ordinance will not eliminate racism and segregation in Seattle entirely”, said lawyers for the groups Pioneer Human Services, a social enterprise based in Washington, D.C. that serves individuals released from prison, and Tenants Union. “But, by eliminating some of the barriers to finding adequate housing, it will strengthen families and, by extension, communities.”

Arguments about landlord duties to protect tenants were “misleading,” the court papers said. Landlords can’t be expected to be on notice about a tenant’s past when they’re not even allowed to look at a person’s criminal past, housing advocates said.

The sides have to file all their arguments in the suit by next month.

read more…

https://www.marketwatch.com/story/these-us-stock-benchmarks-are-already-in-a-bear-market-and-the-sp-500-isnt-far-behind-2018-12-26?mod=newsviewer_click

Record number of million dollar homes | South Salem Real Estate

The million-dollar home is no longer such a rare species.

The number of U.S. homes valued at $1 million or more increased by 400,702 this year, the largest annual rise since the housing price recovery began in 2012, according to a new study by real estate research firm Trulia. Slightly more than 3 million homes nationally, or 3.6% of the total, are worth at least $1 million, up from 3.1 percent last year and 1.5 percent in 2012.

Not surprisingly, many of the freshly minted million-dollar units are in California, which already boasts the most in the country. The San Jose and San Francisco metro areas have the largest shares of $1 million homes and also notched the biggest increases over the past year.

Meanwhile, 29 cities and towns joined those with a median home value of $1 million or more this year, bringing the total to 201. Nineteen municipalities joined the million-dollar club last year.

They include San Jose, California, whose median value rose from $930,900 to $1.09 million; Fremont, California ($966,000 to $1.13 million); Burbank, California ($845,700 to $1.01 million); Newton, Massachusetts ($977,200 to $1.07 million); and Shelter Island, N.Y. ($903,500 to $1.15 million)

Trulia Senior Economist Cheryl Young attributed the big jump to widespread home price increases in recent years, with the median national home price climbing 7.6 percent the past year to $220,100. The median, or midpoint, of all home prices is up 45.3 percent since 2012. Housing demand has been strong while supplies are low, driving values higher.

“Home values have been escalating… And at about $1 million, there’s even greater appreciation,” she says.

Of the roughly 15,100 larger neighborhoods around the country analyzed by Trulia, 838 have median Neighborhood Values of $1 million or more and about two thirds of those are in California. Nearly 30 percent of California’s neighborhoods have a median home price of at least $1 million, the most by far of any state. New York, Florida and Washington followed.

The 10 metro areas that posted the largest increases in share of $1 million homes the past year:

San Jose, California

Share of million-dollar homes, October 2017: 55.7 percent

Share, October 2018: 70 percent

San Francisco

Share of million-dollar homes, October 2017: 67.3 percent

Share, October 2018: 81 percent

Oakland, California

Share of million-dollar homes, October 2017: 24.9 percent

Share, October 2018: 30.7 percent

Honolulu

Share of million-dollar homes, October 2017: 16.2 percent

Share, October 2018: 19.8 percent

Orange County, California

Share of million-dollar homes, October 2017: 17.2 percent

Share, October 2018: 20.2 percent

Los Angeles

Share of million-dollar homes, October 2017: 17.5 percent

Share, October 2018: 19.6 percent

San Diego

Share of million-dollar homes, October 2017: 11.8 percent

Share, October 2018: 13.8 percent

Seattle

Share of million-dollar homes, October 2017: 11.4 percent

Share, October 2018: 13.3 percent

Ventura County, California

Share of million-dollar homes, October 2017: 8.9 percent

Share, October 2018: 10.5 percent

Long Island, N.Y.

Share of million-dollar homes, October 2017: 8.8 percent

Share, October 2018: 10.1 percent

https://www.usatoday.com/story/money/personalfinance/real-estate/2018/11/09/million-dollar-homes-number-increased-400-000-year/1936628002/

Mortgage rates now 4.94% | South Salem Real Estate

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that mortgage rates rose significantly across the board.

Highest mortgage rates in seven years

Sam Khater, Freddie Mac’s chief economist, says, “The economy continued to show resilience as strong business activity and growth in employment drove the 30-year fixed mortgage rate to a seven year high of 4.94 percent – up 11 basis points from last week.”

Added Khater, “Higher mortgage rates have led to a slowdown in national home price growth, but the price deceleration has been primarily concentrated in affluent coastal markets such as California and the state of Washington. The more affordable interior markets – which have not yet experienced a slowdown home price growth – may see price growth start to moderate and affordability squeezed if mortgage rates continue to march higher.”

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.94 percent with an average 0.5 point for the week ending November 8, 2018, up from last week when it averaged 4.83 percent. A year ago at this time, the 30-year FRM averaged 3.90 percent.

- 15-year FRM this week averaged 4.33 percent with an average 0.5 point, up from last week when it averaged 4.23 percent. A year ago at this time, the 15-year FRM averaged 3.24 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.14 percent with an average 0.3 point, up from last week when it averaged 4.04 percent. A year ago at this time, the 5-year ARM averaged 3.22 percent.

Checking on your flood insurance | South Salem Real Estate

Home insurance will cover damage from a volcano, but not a flood

Homeowners picking up the pieces from Hurricane Michael will quickly learn an important lesson: not all hurricane- related damage is covered by home insurance.

Before making landfall Wednesday, Michael rapidly intensified to an extremely strong storm packing 155 mile-per-hour winds, just shy of Category 5 status. The storm ranked as the third-most intense hurricane to hit the continental United States, according to Accuweather (https://www.accuweather.com/en/weather-news/by-the-numbers-michael-ranked-as-3rd-most- intense-hurricane-to-hit-continental-us/70006313), and was the strongest storm to ever hit the Florida Panhandle.

Towns and cities along the Panhandle coast were left in ruins, and damage extended well inland into southern Georgia. The storm’s high winds stripped roofs and caused trees to fall on homes (https://www.accuweather.com/en/weather-news/ storm-surge-damaging-winds-from-michael-to-rip-a-path-of-destruction-across-southeastern-us/70006307) and cars. Coastal communities were walloped by a massive storm surge, which forecasters predicted (https://www.wired.com/story/why- hurricane-michaels-storm-surge-is-so-high/) could reach as high as nine to 13 feet before the storm.

See more:Footage from Florida Panhandle shows the incredible force of Hurricane Michael (http://www.marketwatch.com/ story/footage-from-florida-panhandle-shows-the-incredible-force-of-hurricane-michael-2018-10-10)

For homeowners, what precisely caused the damage to their home will prove important for insurance purposes, because coverage will depend on how the damage was caused. During a hurricane, if high winds cause roof damage that leads to significant water accumulation within the house, insurance will likely cover it. But if a nearby river crests because of the heavy rainfall and then causes flooding, the damage to homes will only be covered if the owners have flood insurance. Many homeowners are reaching out to water damage restoration companies to assess their damages.

That’s why most homeowners in the path of September’s Hurricane Florence’s torrential rains would have been better off if their home had been hit by a wildfire or volcanic eruption — at least from an insurance perspective.

Damage caused by flooding isn’t covered by standard home insurance policies. Only homeowners who bought separate flood insurance for their homes were covered if water from Florence damaged their house. And there weren’t many people in that boat.

Florence caused between $20 billion and $30 billion in losses to both commercial and residential properties across the Southeast due to flood and wind damages, according to estimates (https://www.corelogic.com/news/the-aftermath-of- hurricane-florence-is-estimated-to-have-caused-between-20-billion-and-30-billion-in-flood-and-wind-losses-cor.aspx) from property data firm CoreLogic (CLGX).

Most homeowners affected by Florence will be stuck footing the bill: CoreLogic also estimated that 85% of the losses to residential properties were uninsured. Before the storm hit, actuarial firm Milliman (http://us.milliman.com/insight/ 2018/Four-ways-Hurricane-Florence-could-ricochet-across-the-insurance-industry/) estimated that fewer than 10% of households in North Carolinahad flood insurance.

A similar refrain could now play out because of Hurricane Michael. When Hurricane Irma struck Florida last year, only 14% of the 3.3 million households in the nine counties affected by the disaster had flood insurance coverage, according to data from Pew Charitable Trusts (http://www.marketwatch.com/story/only-14-of-the-3-million-households-hit-by-irma- have-flood-insurance-2017-09-12). That’s in spite of the fact that Florida households comprise 35% of policies under the National Flood Insurance Program.

Don’t miss:How to find a contractor after a hurricane (http://www.marketwatch.com/story/how-to-find-a-contractor- after-a-hurricane-2017-09-25)

Even when insurance does cover the damage from a certain catastrophe, deductibles are still at play. Hurricane deductibles vary from policy to policy, but are often assessed as a percentage of the home’s overall value.

Coverage for other disasters operates similarly. In volcanic eruptions, damage caused by lava flows or resulting fires is covered by a standard homeowner’s policy, but if the eruption causes seismic activity, homeowners will not be reimbursed unless they have purchased a separate earthquake policy.

Buying additional insurance policies for disasters like floods and earthquakes might seem like a no-brainer, but it’s an expensive proposition. “They have to do a cost benefit analysis,” said Michael Crowe, co-founder and CEO of Clearsurance (https://clearsurance.com/), a site where consumers can review and compare insurance companies.

The average annual premium for a policy through the National Flood Insurance Program was $878 as of April 2017 (https: //web.archive.org/web/20170623131915/https:/nfip-iservice.com/Stakeholder/pdf/bulletin/Attachment%20A%20-%20Summary% 20of%20the%20NFIP%20April%202017%20Program%20Changes%20Final.pdf). But flood insurance premiums can easily cost thousands of dollars in regions that are determined to be at the highest risk of flooding.

But flooding is just one type of natural disaster that isn’t covered by standard home insurance policies. And in the case of disasters like hurricanes, where damage can be caused by a variety of factors including wind, rain and storm surge, it can quickly get confusing–and frustrating– for homeowners who are trying to figure out whether their insurance policy covers certain damage.

Here is what homeowners need to know about insurance and natural disasters:

What is covered under a standard homeowner’s insurance policy

Some natural disasters are always covered by homeowner’s insurance, including wildfires, tornadoes and hail storms. But other natural disasters are never or rarely covered under a standard homeowner’s insurance policy. They generally fall into two categories: floods and “earth movements.”

The first category comprises disasters caused by rising water, which includes everything from floods caused by extensive rainfall and hurricane-induced storm surges to dam failures and tsunamis. “Earth movements” include disasters such as earthquakes, landslides and sinkholes.

Unfortunately, many Americans are unaware that these disasters are not covered by a standard homeowner’s policy, according to the Insurance Information Institute (https://www.iii.org/sites/default/files/docs/pdf/pulse-wp-020217- final.pdf).

Certain natural disaster typically aren’t covered because of the level of the destruction they create, said Lynne McChristian, a spokeswoman for the Insurance Information Institute and executive director of the Center for Risk Management Education and Research at Florida State University.

With these disasters, “the damage is usually so widespread, and it’s typically a total loss,” McChristian said. ” Insurance companies can’t price it appropriately to make it a viable line of business for them.”Are you covered with a standard homeowner’s insurance policy? Typically covered Sometimes or partially covered Rarely covered Tornado Hurricane Flooding (including storm surge and tsunamis) Wildfire Volcano Earthquakes Hail storm Sinkhole Mud- and landslides Blizzard or ice storm Sewer backup

The government provides flood insurance

In the case of insurance for flooding, the federal government has stepped in. The National Flood Insurance Program was created in 1968 after insurance companies struggled to pay off claims following a slew of floods in the 1950s. Homeowners have the option to buy flood insurance through this program or to get a private insurance policy. In certain cases, homeowners may be required to purchase flood insurance by their mortgage lender if their home is located within a flood zone.

Private flood insurance now accounts for roughly 15% of all flood premiums nationwide, according to a March report from Insurance Journal (https://www.insurancejournal.com/blogs/right-street/2018/03/18/483689.htm). And for many homeowners, a policy from a private insurer rather than through the federal insurance program could be cheaper. A July 2017 briefing from Milliman (http://www.milliman.com/uploadedFiles/insight/2017/private-flood-insurance-cheaper- nfip.pdf)found that private flood policies would have lower premiums for 77% of all single-family homes in Florida, 69% in Louisiana and 92% in Texas.

Read more:Congress just dodged hard decisions about flood insurance again (http://www.marketwatch.com/story/congress- just-dodged-hard-decisions-about-flood-insurance-again-2018-07-31)

Earthquakes

Similarly, homeowners will need to purchase a separate policy or a rider to their standard home insurance policy from a private insurer to be covered for an earthquake. California residents also have the option (https://www.iii.org/ article/earthquake-insurance-for-homeowners) to purchase coverage through the California Earthquake Authority. That said, if an earthquake causes a house fire, some damage might be covered by the standard policy alone.

Sinkholes

As for sinkholes, coverage options vary from state to state (https://www.iii.org/article/sinkholes-and-insurance). A standard home insurance policy may cover minor damage caused by a sinkhole — but catastrophic damage (generally defined as damage to more than half of the structure) is excluded. People can either get sinkhole insurance in the form of a standalone policy or an endorsement to the standard insurance policy, depending on where they live.

Tennessee and Florida require insurers to offer optional sinkhole coverage. Insurers in Florida are also required to provide insurance for “catastrophic ground cover collapse” through their standard policies.

Read more:Your easy step-by-step guide to paying off all kinds of debt (http://www.marketwatch.com/story/your-easy- step-by-step-guide-to-paying-off-all-kinds-of-debt-2018-09-19)

Did the homeowner take care of the property?

The property’s upkeep can also play a role in whether or not damage caused by a storm or other natural disaster is covered. For instance, if winter storms cause an ice dam to form on the roof of the home and the owner is not proactive about removing it, the insurer may choose to deny coverage for water damage.

You have some options if you skip insurance

If homeowners don’t buy specialized insurance coverage and then get hit by some sort of disaster, they do have some options to offset their losses. They can get a grant from the Federal Emergency Management Agency or a loan from the Small Business Administration.

“Those are not designed to bring you back to a pre-disaster condition — they’re designed just to get you back on your feet,” McChristian said. “Insurance is designed to get you back to where you were before the disaster occurred.”

How to decide whether you need coverage

For starters, homeowners need to consider whether or not they are at risk. They should check government flood zone maps. They are generally available from county governments, or you can search by address on the FEMA website (https:// msc.fema.gov/portal/search). But they aren’t foolproof because they are only periodically updated.

Other factors to consider include the property’s elevation (if it’s at or just a few feet above sea level it’s more prone to flooding) and whether there has been a lot of construction in the area. This could displace vegetation that would soak up rainfall and prevent flooding.

As for earthquakes, homeowners shouldn’t assume they’re not at risk just because they don’t live on the West Coast. Earthquakes have caused damaged in all 50 states at some point since 1900, according to the Insurance Information Institute(https://www.iii.org/press-release/few-homes-have-insurance-coverage-for-earthquake-or-tsunami-although-the- us-is-at-risk-for-both-032311) (a trade group that of course has a vested interest in people getting insurance). And fracking for oil and natural gas has led to seismic activity (https://e360.yale.edu/digest/fracking-linked-to-increase- in-texas-quakes-according-to-new-study)in parts of the country that had never before experienced it.

How to get to the front of the line when you need help

Regardless of whether or not a homeowner has insurance coverage for a specific natural disaster, getting their property assessed is critical in beginning the rebuilding process.

Following a natural disaster, a consumer’s first step should be to contact their insurance agent or company immediately. That is critical because insurance claims are handled on a triage basis, McChristian said.

“Those with the most damage get to the front of the line because those people have the most need for recovery assistance,” McChristian said.

By clarifying how to file a claim and conveying the state of their property, homeowners can improve the chances of having their case handled more quickly by their insurer. Homeowners should also learn the ins and outs of how to file their claim, including what information is needed and how long they have to file. Now is also the time to determine what their policy’s deductible is.

Also see:What to do about your home and mortgage if you’re hit by a disaster (http://www.marketwatch.com/story/what- to-do-about-your-home-and-mortgage-if-youre-hit-by-a-disaster-2018-09-17)

Make a head-start on assessing damage

The insurance company will send its own adjuster free of charge to inspect the property and assess the total cost of the damage. Homeowners can take steps to prepare for this by documenting what was damaged or destroyed by the natural disaster, getting bids from contractors and keeping track of receipts for any expenses they incur following the storm. Homeowners shouldn’t hesitate to make temporary repairs to protect their property from further damage.

A pricier option: Hire a third-party insurance adjuster to assess their property. Given the backlog insurers will experience following widespread disasters, it can take a while to receive a payout. To expedite this process, a homeowner can choose to hire an independent or public adjuster to assess their property.

Studies have shown that hiring public adjusters leads to higher insurance settlements. But these professionals don’t come cheap — they generally charge a fee (https://www.bankrate.com/finance/insurance/hiring-a-public-adjuster-1.aspx) that’s anywhere from 10% to 20% of the insurance settlement. And it’s critical to hire a reputable professional. (Check the websites of the National Association of Independent Insurance Adjusters (https://www.naiia.com/) and the National Association of Public Insurance Adjusters(https://www.napia.com/about).)

Always have someone look at damaged property

And even if homeowners aren’t covered for flood insurance, they should still have their insurance company assess their property and whatever damage occurred.

Crowe has experienced this firsthand. In 2006, an extended period of rainfall in Newburyport, Mass., where Crowe and his family lived, caused their newly remodeled basement to flood. However, their insurance policy did not include flood coverage. He thought he would have to pay for all the damage.

read more…

www.dowjones.com

www.marketwatch.com

Rental Glut Sends Chill Through the Hottest U.S. Housing Markets | South Salem Real Estate

Seattle is known for its hip neighborhoods, soaring home prices, and being home to Amazon.com Inc., the world’s most valuable company. So why is its rental housing market experiencing the most severe slowdown in the U.S.?

Seattle-area median rents didn’t budge in July, after a 5 percent annual increase a year earlier and 10 percent the year before, according to Zillow data on apartments, houses and condos. While that’s the biggest decline among the top 50 largest metropolitan areas, it’s part of a national trend. Rents in Nashville and Portland, Oregon, have actually started falling. In the U.S., rents were up just 0.5 percent in July, the smallest gain for any month since 2012.

“This is something that we first started to see two years ago in New York and D.C.,” Aaron Terrazas, a senior economist at Zillow, said in a phone interview. “A year ago, it was San Francisco and most recently, Seattle and Portland. It’s spreading through what once were the fastest growing rental markets.”

Tenants are gaining the upper hand in urban centers across the U.S. as new amenity-rich apartment buildings, constructed in response to big rent gains in previous years, are forced to fight for customers. Rents are softening most on the high end and within city limits, Terrazas said. Landlords also have been losing customers to homeownership as millennials strike out on their own, often moving to more affordable suburbs.

Boom to Bust – Rents go from double-digit gains to declines in four years

Realtor Roy Powell last month was helping his clients, two women in their mid-20s find an apartment in Seattle. They looked at seven places and narrowed it down to two — a five-story building with a rooftop dog park and an air-conditioned gym, and a newly remodeled seven-story tower that won their business by throwing in a year of free underground parking, normally $175 a month.

Even condo owners with just one or two units to rent are offering concessions to compete with new buildings, Powell said. “A lot of them are going from absolutely no pets to allowing pets. That’s a big deal in Seattle, where everybody has a dog or cat.”

‘Tremendous Competition’

Batik, a new 195-unit Seattle apartment building, has views of the downtown skyline and Mount Rainier, a giant rooftop deck with a garden where tenants can grow fruits and vegetables, a community barbecue and an off-leash pet area. New tenants can receive Visa gift cards worth as much as $6,000, with half paid at signing and the rest a month later.

“There is tremendous competition for tenants,” said Lori Mason Curran, spokeswoman for landlord Vulcan Real Estate, Microsoft co-founder Paul Allen’s company, which launched Batik in March. “Over time, we think long-term demand is solid. But there is so much supply tamping down rent growth right now.”

In Seattle, another factor contributed to the glut of rentals. While the city is in the midst of a building boom — with more cranes dotting the skyline than any other in the U.S. — much of the residential multifamily construction has been apartments. Developers have shied away from condos because of state laws that allow buyers to more easily sue if there are defects in the construction.

Booming Construction

U.S. multifamily apartment construction for the past few years have been at levels not seen since the 1980s and rapid rent gains have also encouraged owners of single-family homes and condos to fill them with tenants. Projects opening now were conceived by developers a few years ago when rent gains in the U.S. were peaking at an annual gain of 6.6 percent, according to Zillow data.

The most expensive markets slowed first as new supply became available and tenants struggled to afford rapidly-rising lease rates. Rents in the San Francisco area jumped 19 percent in the year through July 2015. Now, they have been flat since last July. New York rents, which were up 7 percent in 2015, have been decelerating for a couple years, declining 0.4 percent in July.

For the first time since 2010, it’s now easier to build wealth over an eight-year period by renting a home and investing in stocks and bonds, rather than by buying and accumulating equity, according to a national rent-versus-buy index of 23 cities produced by Florida Atlantic University and Florida International University faculty. That’s because home prices are high and rising mortgage rates are adding to the cost of homeownership.

That could be bad for sellers, especially in markets like Dallas and Denver, where renting is now so much more favorable than buying, according to Ken Johnson, a real estate economist at Florida Atlantic University, a co-creator of the Beracha, Hardin & Johnson Buy vs. Rent Index.

Reminiscent of the Bubble

Already, housing markets in strong economies are cooling, in part because incomes haven’t kept pace with rising prices and borrowing costs. Dallas and Denver have reached so far into favorable rental territory that they look like Miami right before it crashed in the last decade, Johnson said.

The difference now is that neither market is experiencing the kind of speculation and risky lending that inflated the last housing bubble, he said.

“What’s interesting is that cities that suffered the least in 2007 and 2008 — Dallas and Denver — now are experiencing the most exposure to risk,” Johnson said.

The slowdown in the rental market coincides with a rise in homeownership among millennials, which jumped to 36.5 percent in the second quarter from 35.3 percent a year earlier.

read more…

https://www.bloomberg.com/news/articles/2018-09-07/rental-glut-sends-chill-through-the-hottest-u-s-housing-markets?srnd=premium

U. S. housing starts rise again | South Salem Real Estate

The U.S. Census Bureau and the Department of Housing and Urban Development have now published their findings for May new residential housing starts. The latest reading of 1.350M was above the Investing.com forecast of 1.310M and an increase from the previous month’s revised 1.286M. March figures were also revised.

Here is the opening of this morning’s monthly report:

Housing Starts

Privately-owned housing starts in May were at a seasonally adjusted annual rate of 1,350,000. This is 5.0 percent (±10.2 percent)* above the revised April estimate of 1,286,000 and is 20.3 percent (±14.4 percent) above the May 2017 rate of 1,122,000. Single-family housing starts in May were at a rate of 936,000; this is 3.9 percent (±10.6 percent)* above the revised April figure of 901,000. The May rate for units in buildings with five units or more was 404,000. [link to report]

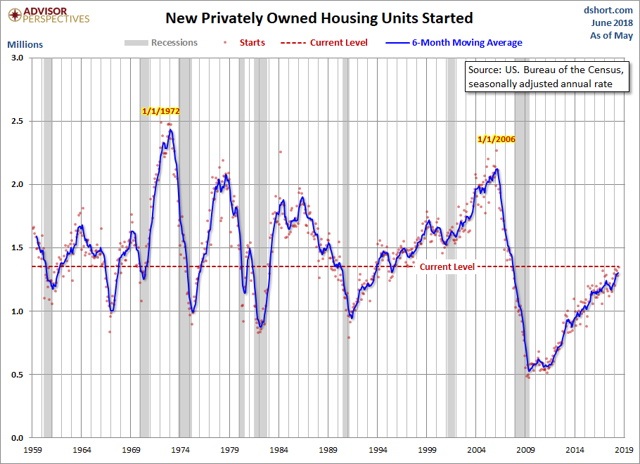

Here is the historical series for total privately owned housing starts, which dates from 1959. Because of the extreme volatility of the monthly data points, a 6-month moving average has been included.

The Population-Adjusted Reality

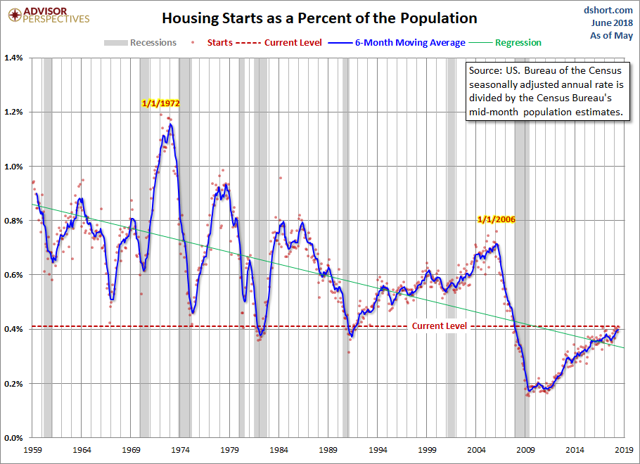

Here is the data with a simple population adjustment. The Census Bureau’s mid-month population estimates show substantial growth in the US population since 1959. Here is a chart of housing starts as a percent of the population. We’ve added a linear regression through the monthly data to highlight the trend.

read more…

https://seekingalpha.com/article/4182741-new-residential-housing-starts-may

Housing starts fall again | South Salem Homes

Construction on new houses fell in May for the third month in a row even though builders are optimistic about the economy, perhaps a sign a shortage of skilled workers is holding the industry back.

The pace of so-called housing starts declined by 5.5% to an annual rate of 1.09 million, marking the lowest level in eight months. Economists polled by MarketWatch had forecast housing starts to total 1.23 million.

Home builders are now working at a slower pace than they were one year ago. They’ve especially pared back on apartment buildings and other large multi-dwelling units, giving more emphasis to single-family homes.

Part of the recent slowdown might reflect a bit of a pause after an unusually warm winter during which builders were much busier than usual. Some economists contend a higher level of construction that occurred earlier in the year would have normally taken place in the spring.

The residential #construction data may be experiencing some payback from favorable weather over the winter

— Joseph A. LaVorgna (@Lavorgnanomics) June 16, 2017

Yet builders increasingly complain they cannot find enough good construction workers to get the job done and that could be constricting them. Consider the recent slide in building permits. They fell 4.9% in May to an annual rate of 1.17 million, the lowest level in 13 months.

Permits are also below year-ago levels,

In May, the biggest drop-off occurred in the South and Midwest. Construction rose slightly in the West and was flat in the Northeast.

For years the housing market has experienced a mini-renaissance of sorts as a steadily growing economy, rising employment and ultra-low interest rates enabled home people to buy homes.

The outlook might not be as favorable now, though. Aside from widespread labor shortages, prices for wood and other raw materials have also risen. And the Federal Reserve has embarked on a series of increases in a key U.S. interest rate that helps determine the cost of borrowing, a potential brake on future sales..

read more…

http://www.marketwatch.com/story/home-builders-cut-back-for-third-straight-month-2017-06-16?siteid=bnbh