As we discussed last week, the fields of behavioral economics and behavioral finance were created in the hopes of gaining a better understanding of how real people make financial decisions in real life.

Fortunately for all of us, these fields — which draw from the behavioral sciences, economics and personal finance — have generated some findings that are anything but academic. These findings include some powerful insights for those of us trying to make decisions about buying and selling our homes.

Following on last week’s top four behavioral economics insights for homebuyers, here are a handful of the field’s top takeaways for sellers, to help manage your own mindset and to optimize the way you market your home to buyers:

1. Don’t let overconfidence lead to overpricing. Real estate agents are the only commissioned salespeople I know of who, as a general rule, spend much of their time trying to talk their clients down in pricing their product. Why? Because real estate agents know that listing a home at too high a price causes unnecessary woe, drama and failure. Set the listing price too high, and a home will lag on the market, attracting lowball offers. The end result is often a price reduction, or even (worst case) the home doesn’t sell at all.

Overpricing can result from the same overconfidence and overoptimism that causes buyers to make lowball offers on great homes in a hot market and inspires investors to day trade, erroneously thinking they have superhuman stock picking skills. In fact, when you study up on successful amateur day traders, it becomes clear that what they have is less innate skill and more the willingness to voraciously, constantly research the companies and the markets — many, for hours every single day. Many have also placed rules on themselves specifically to counter their own human emotions and irrational tendencies.

And that’s precisely how home sellers can and should deactivate overconfidence when it comes to pricing: Commit to the exercise of sitting down with your agent and poring over the data about what’s going on in your market, the data about what homes have recently sold for in your area, even the data on how long it takes the average home in your market to sell and what the list price-to-sale price ratios are in your area.

It takes time and discipline, but while you’re looking through the comps, your agent can show you the potential rewards: Every market has well-priced, well-marketed homes that sell quickly.

2. Understand the endowment effect. Lest you think, like so many do, that the above point is great for all those other clueless sellers, but certainly doesn’t apply to your innate, uncanny eye for knowing what homes are truly worth, allow me to introduce you to a little something called the endowment effect. Behavioral economist Dan Ariely explains it as follows:

“Simply put, the endowment effect shows that we value the things we own more than identical products that we don’t own. This causes a mismatch between buyers and sellers, where buyers are often willing to spend less than the seller deems an acceptable price.”

Just knowing that what you think is your personal prowess for price-setting is actually a thought fallacy that researchers have known about for years might help you stay committed to making your pricing decision based on the data rather than your fallible gut.

3. Consider offering rebates and credits. Beyond using behavioral econ and finance knowledge to optimize your own decisions, smart sellers can take clues from these fields as to how to max out their marketing to buyers. One such clue is this: Offer rebates, or closing-cost credits.

Retailers and big brands have long known that offering a rebate makes buyers feel better — and less hesitant — about making a purchase, giving them the sense that they will get a bonus or a gift for spending.

This same effect applies with real estate: If you can price your home competitively with similar, nearby listings and offer a closing-cost credit to the eventual buyer, you boost your home’s attractiveness and ability to compete with other listings considerably, reducing the amount of cash a buyer will have to bring in to close the sale and making it that much easier for a buyer to get off the fence.

4. Tell prospective buyers a story. The Atlantic recently did a deep dive into consumer implications of behavioral economics. The article revealed that buyers are more inclined to make purchases where the circumstances of the marketing actually tell the buyers a story that makes them feel like they are getting a bargain, as happened when Williams-Sonoma put a $500 bread maker next to a $300 one and realized that no one bought the expensive one, but sales of the lower-priced machine doubled because of the deal people thought they were getting.

I’m going to take this one further: Don’t just tell a story to make buyers feel like they are getting a good deal when they’re not. But do provide materials to tell buyers the story of the deal they are getting: Keep a binder in the property with the competitive comparables that you believe your home is priced well against. Market your home with photos and descriptions that surface the value your home holds compared to the competition.

And don’t stop there: Stage your home in a way that tells your buyers the story of the life they could lead in your home, whatever that ideal life is for the average buyer who wants a home like yours. And consider writing a love letter about your home and your neighborhood, telling buyers the story of how well loved the home was, and creating a compelling sense of well-being around it.

Tag Archives: North Salem Realtor

Twitter Launches User Directory | North Salem NY Real Estate

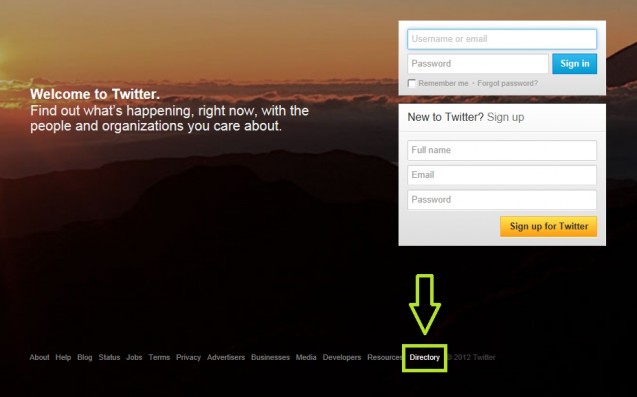

- In a world where altruistic social gathering doesn’t pay the bills, Twitter continues to make changes that it hopes will drive more traffic directly to the Twitter domain and bolster its value to advertisers. The most recent update comes in the form of an alphabetical user directory. The link to the directory was quietly added to the the default home page for visitors to Twitter not already logged into the service.

According to Matt McGee in his recent article for Marketing Land:

Twitter launched the user directory a few weeks ago, but hasn’t made a formal announcement about it. That’s likely because it exists more for search engines than for Twitter users.

Basically, Twitter is aiming to draw people who are searching Google, Bing, Yahoo, etc., for someone in particular. As the bots crawl their way through the new directory, more Twitter profiles should start showing up in search. That’s a step in the right direction, maybe.

Twitter is still struggling with the basic issue of no real reason to spend lots of time hanging out in the Twitter Web space. Users spend the most time on Twitter setting up their profile. Once it’s set, they either build up a personalized twitter stream that they keep track of on a mobile app or some other Twitter client application, or they never really get the point and let the profile languish, unused.

Even when a search result brings a user back to the Twitter domain, the realistic expectation is that they will skim the profile, make a decision to follow or not, and move on.

For those of you who love the news, information, and conversation constantly buzzing through your Twitter stream, what could Twitter do to make its space more appealing? What would it take for you to spend your time interacting with the twitterverse in the Twitter-owned domain?36

How To Cripple the Real Estate Market in Five Easy Steps | North Salem Real Estate

Foreclosures Can Take a Long Time | North Salem Real Estate

Patsy Campbell could tell you a thing or two about fighting foreclosure. She’s been fighting hers for 25 years.

The 71-year-old retired insurance saleswoman has been living in her house, a two-story on a half acre in a tidy middle-class neighborhood here in central Florida, since 1978. The last time she made a mortgage payment was October 1985.

.And yet Ms. Campbell has been able to keep her house, protected by a 105-pound pit bull named Dodger and a locked, rusty gate advising visitors to beware of the dog.

“They’re not going to take this house,” says Ms. Campbell. “I intend to stay in this house and maintain it as my residence until I die.”

Ms. Campbell’s foreclosure case has outlasted two marriages, three recessions and four presidents. She has seen seven great-grandchildren born, plum real-estate markets come and go and the ownership of her mortgage change six times. Many Florida real-estate lawyers say it is the longest-lasting foreclosure case they have ever heard of.

The story of how Ms. Campbell has managed to avoid both paying her mortgage and losing her home, which is currently assessed at more than $203,000, is a cautionary tale for lenders that cut corners and followed sloppy practices when originating, processing and servicing mortgages. Lenders are especially vulnerable in the 23 states, including Florida, that require foreclosures to be approved by a judge.

Ms. Campbell has challenged her foreclosure on the grounds that her mortgage was improperly transferred between banks and federal agencies, that lawyers for the bank had waited too long to prosecute the case, that a Florida law shields her from all her creditors, and for dozens of other reasons. Once, she questioned whether there really was a debt at all, saying the lender improperly separated the note from the mortgage contract.

She has managed to stave off the banks partly because several courts have recognized that some of her legal arguments have some merit—however minor. Two foreclosure actions against her, for example, were thrown out because her lender sat on its hands too long after filing a case and lost its window to foreclose.

Ms. Campbell, who is handling her case these days without a lawyer, has learned how to work the ropes of the legal system so well that she has met every attempt by a lender to repossess her home with multiple appeals and counteractions, burying the plaintiffs facing her under piles of paperwork.

She offers no apologies for not paying her mortgage for 25 years, saying that when a foreclosure is in dispute, borrowers are entitled to stop making payments until the courts resolve the matter.

“This is every lender’s nightmare,” says Robert Summers, a Stuart, Fla., real-estate lawyer who represents Commercial Services of Perry, an Iowa-based buyer of distressed debt that currently owns Ms. Campbell’s mortgage and has been trying to foreclose. “Someone defending a foreclosure action can raise defenses that are baseless, but are obstacles for the foreclosing lender,” he says, calling the system “an unfair burden” for lenders.

While Ms. Campbell is an extreme case, more homeowners in trouble are starting to use similar tactics and are hiring defense lawyers to challenge their foreclosures, hoping to drag out the foreclosure process long enough to reach a settlement with the lender.

Nationwide, there were 2.1 million mortgages in some stage of foreclosure as of October, according to research firm LPS Applied Analytics. The average loan in foreclosure—the process typically starts when a loan becomes 90 days past due and a bank files a complaint—had been in default for 492 days as of October, up from 289 days at the end of 2005, according to LPS. In Florida, one of the states where foreclosures are handled by courts, the average loan in foreclosure has been delinquent 596 days.

Okeechobee County, a rural jurisdiction of 40,000 known for bass- and perch-fishing festivals, hasn’t experienced a foreclosure problem as intense as in many coastal regions of the state. Ms. Campbell’s house—which has vinyl siding, boards over the windows (to protect it from storm damage, she says), a crumbling backyard swimming pool and an old sedan rusting in the driveway—stands out among the manicured lawns, stucco ranch houses and cattle pastures interspersed among the houses.

In the town of Okeechobee, the county seat, signs of a local economy dependent on agriculture abound: stores selling pre-fab barns, animal feed and lumber line State Road 710 leading into town.

Lawyer Robert Summers, below, who represents the current owner of her loan, has faced seven appeals of the foreclosure action from Ms. Campbell since 2000.

Brian Whitehall, Okeechobee’s city administrator, says unemployment in the area is hovering around 14.5%, slightly higher than the statewide average of 12% in September. Foreclosure filings have nearly doubled each year since the state’s housing market peaked in 2006, with 617 filed in 2009. But the national housing slump and the area’s economic woes aren’t immediately apparent in Okeechobee’s quiet neighborhoods.

“We’re not like the Port St. Lucies of the world, where entire subdivisions are empty and it’s like a ghost town,” Mr. Whitehall says.

Court records outline the rocky road Ms. Campbell’s loan has taken over the past 32 years. In 1978, Paul Campbell purchased the house on SW 19th Lane, a few minutes’ drive from the small pharmacy he owned, using a $68,000 mortgage from First Federal Savings and Loan of Martin County. He married Patsy in 1980, and died later that year from emphysema, leaving the property to his wife.

In 1985, Ms. Campbell stopped making mortgage payments because of an illness that caused her to lose income and get behind on her bills, she says.

By then, the savings-and-loan crisis had begun to take hold. First Federal merged with First Fidelity Savings and Loan, which assumed ownership of the Campbell loan. In 1987, First Fidelity sold the mortgage to American Pioneer Savings Bank, an Orlando-based lender that collapsed in the early 1990s.

The loan would change hands four more times, and four different lenders would try to foreclose on her. But every lender that held her loan either merged or collapsed. Each time ownership of the lender changed, the foreclosure case against Ms. Campbell would be dropped.

The loan eventually made its way to the Resolution Trust Corp., the federally owned asset manager that liquidated assets of insolvent S&Ls, and later, to the Federal Deposit Insurance Corp.

In June 1998, the FDIC sold the mortgage to Commercial Services of Perry, which filed to foreclose in 2000. After another illness, Ms. Campbell deeded the house to her daughter, Deborah Pyper. Years later, after Ms. Campbell recovered, the house was deeded back to her. Ms. Pyper declined to comment.

Ms. Campbell’s early briefs in the case were strongly worded and colorful, drafted with the help of a now-retired Okeechobee County lawyer.

The briefs presented dozens of reasons why Ms. Campbell thought the bank didn’t have the right to her house: Paul Campbell’s signature was forged on the original mortgage, she said, and the original sellers never received money from the bank. At other times, she said the mortgage was never properly conveyed between banks and federal agencies, and she demanded paperwork that they were unable to immediately produce.

Attorneys’ fees and court costs from previous cases hadn’t been paid, or the amounts were wrong, she argued. One brief said that “Defendant Campbell specifically denies the existence of any ‘debt.'”

In 2007, a trial-court judge tossed out all but two of Ms. Campbell’s defenses, calling the case an “unnecessary paper chase which has been an unproductive and unnecessary use of judicial resources.”

Commercial Services paid a court-determined amount to settle court costs from previous cases, and moved to take the foreclosure to trial, with a date set for early October 2010.

In response, Ms. Campbell filed for bankruptcy, effectively blocking the foreclosure until a stay is lifted by a bankruptcy-court judge.

Being a Tenant in North Salem NY | North Salem NY Real

1) “This building is in foreclosure.”

In late 2009, Melody Thompson called her landlords to ask about the well-dressed picture-takers outside her four-bedroom Portland rental home. “Oh, we’re refinancing,” she remembers them telling her. Then in late April, a formal bank notification arrived in the mail, stating that the home was in foreclosure and would be put up for sale in late August. “I was immediately angry,” says Thompson, the executive director of Financial Beginnings, a financial literacy nonprofit. “They lied.” The sale has been postponed twice as the landlords apply for a mortgage adjustment, but Thompson is still hunting for a new place.

Renters accounted for 40% of families facing eviction from foreclosure in 2009, according to the National Low Income Housing Coalition. And unfortunately, they often hear about it as Thompson did — from the bank, just weeks before the sale, says Janet Portman, an attorney and the managing editor of legal book publisher Nolo. “The landlord wants the tenant in there, paying rent,” she says. The lack of notice was so pervasive that last year Congress passed the Protecting Tenants at Foreclosure Act, which gives tenants at least 90 days from the foreclosure sale to move out. (Previously, they had as few as 30 days, Portman says.) Provided the new owner doesn’t want to live there, the law also lets legitimate tenants — those who signed a lease before the sale and pay a market value rent, among other qualifications — stay through the end of their lease.

2) “You should complain more.”

When a steady drip, drip, drip of water from the ceiling led a third-floor tenant to complain, Adam Jernow, a principal at property management firm OGI Management in New York City, assumed they were dealing with a leaky pipe. It wasn’t until a week later, when the tenants on the top floor two flights above that apartment finally called, that he realized they were dealing with a big roof leak from heavy summer rains. Had upper-floor tenants complained sooner, Jernow says, they could have limited the damage, and that third-floor tenant might not have had a problem at all. So while renters often assume quirks like hot-then-not showers or moisture on the walls is just part of big-city living – or that complaining to the landlord will just open up a can of worms – keeping a property owner informed can actually help a problem get fixed faster. Besides, most states require landlords to keep the property in good repair, with home systems and appliances in working order.

3) “There’s more to negotiate than the rent.”

Rental markets in many cities around the country have improved this year, which means landlords have less incentive to cut you a break. Just 31% of landlords lowered rent in 2010, versus 69% in 2009, according to property marketplace Rent.com. All the major real estate investment groups are asking for higher rent on new leases, and about half are doing so on renewals, says Peggy Abkemeier, the president of Rent.com.

But the market hasn’t improved so much that landlords don’t have incentive to keep good tenants, she says. The survey found that 44% of landlords are willing to lower security deposits, and 22% will offer an upgrade to a fancier unit (think better views, quieter neighbors, newer kitchen) without raising rent. And there’s still that 31% of landlords who will offer a price break. “It never hurts to ask,” Abkemeier says. In markets where vacancy rates are still high, such as Atlanta, Las Vegas, Orlando and Phoenix, tenants have a better chance.

4) “Your neighbor is not my problem.”

Loud music. Late-night parties. More foot traffic than a mall on Sunday mornings. Kevin Amolsch, the owner of real estate investment company Advantage Homes in Denver, Colo., has heard all of these complaints and more from the tenants in the buildings he manages. Trouble is, there’s not much he can do. States’ tenant rights laws make it tough for landlords to intervene when there isn’t a clear violation of the lease. Even when a “right of quiet enjoyment” is in the lease, those noisy neighbors usually have time to mend their ways. “Two weeks later [when they are free and clear], it’s going to start up all over again,” Amolsch says. And so does the clock on their grace period to pipe down.

The best bet is to reach out to the other tenant and try to smooth things over directly, Amolsch says. If that doesn’t work, report problems to the police as well as the landlord, so the situation is well-documented. That makes it easier to initiate eviction proceedings, he says.

5) “You may have more rights than I do.”

Brianne Vorse, a longtime renter, knows the number to her local tenant rights group by heart. Vorse first sought help four years ago to force her landlord to fix windows that wouldn’t shut all the way, letting in cold air and the San Francisco fog. She called again after a sub-letter offered a higher rent if the landlord would break Vorse’s lease and let him take over. “I found that [the landlord] couldn’t legally do this,” says Vorse, who sent the landlord an official tenant petition she found on the web site of the San Francisco Rent Board. “In the end, I got the apartment and kept the original lease.”

Tenant rights vary widely by state, says attorney Portman. Arkansas doesn’t even require landlords to provide “fit and habitable housing,” but that’s extreme. In the most renter-friendly states, including California, New York, Illinois and New Jersey, renters without say, hot water, can withhold rent until it is fixed (or pay to fix it and deduct that from the rent). “If the landlord tried to evict you for that, you would win that lawsuit,” she says. Landlords aren’t necessarily any better informed about what they can and cannot do, so it’s up to the tenant to figure it out. The U.S. Department of Housing and Urban Development maintains a database of tenants’ rights by state, including groups that offer assistance with disputes.

6) “I don’t know about your problems – and I like it that way.”

Tenants who think they have a beef with the property owner may actually find their true discontent with the management company hired by the landlord. The Better Business Bureau logged 5,297 complaints about property managers last year, a 13% increase from 2008. They’re among the most-complained about industries, ranking 37th of the 3,024 the BBB tracks. “You would hope that the person who owns the property has done their due diligence, but that just may not be the case,” says Kimberly Smith, the co-founder of short-term furnished rental site CorporateHousingbyOwner.com. Inexperienced or incompetent property managers may not have a good system in place to handle repairs — especially emergencies – or neglect to keep your security deposit in a safe place, she says.

While a landlord is ultimately responsible for providing habitable housing, they hire management companies precisely so they don’t have to deal with the day-to-day decision making and every tenant request. This is a case where the squeaky wheel definitely gets the grease (see No. 2, above). If there’s a pervasive issue, try to reach the landlord directly, Smith says. Public records will list the property owner. You might also consider paying by credit card if that’s an option, she says, which can make it easier to file a dispute if requested repairs or other complaints aren’t resolved.

7) “I never wanted to do this.”

The recession has generated plenty of “accidental” landlords — property owners who wanted to sell, but can’t find a buyer. At first glance, the surge seems like a boon for renters. Inexperienced landlords’ biggest and most common mistake is not asking for enough rent, says Steve Dexter, who operates more than a dozen properties throughout Southern California and teaches real estate investment seminars. But that poor financial management can also mean a substantial rent increase upon renewal, or worse, living in a poorly-maintained home at greater risk of foreclosure.

A tenant’s best defense is to ask questions about the landlord and the property’s history, Dexter says. Among the important ones: how long has the property been a rental? Why is the landlord renting it out? If the answers involve anything that reflects on the recession or the landlord’s need to increase his cash flow, be cautious. Look for foreclosure and sale notifications on sites such as RealtyTrac, StreetEasy and Zillow.com.

8) “If you smoke, you can’t rent.”

The Fair Housing Act prohibits landlords from discriminating against a number of groups — but smokers aren’t one of them. So discriminate they do. Although smokers account for 20% of U.S. adults in most cities, according to the Centers for Disease Control and Prevention, a search of New York City apartment listings on Craigslist turned up just six explicitly allowing smoking. Nearly 700 explicitly prohibited it. Their reasoning: once a rental property is occupied by a smoker, it’s tough to rent to non-smokers without a thorough, expensive cleaning that includes repainting the walls and professionally cleaning the carpets, says Matt Kuhlhorst, who rents out four single-family homes in Allen, Texas. “Even if the tenant doesn’t get their deposit back, that’s still not enough to cover the cost,” which can easily top $2,000, he says.

Laws in several states require landlords to disclose smoking policies upfront, so if it’s important for you to be able to light up indoors check the details before signing a lease. Policy violators could find themselves facing loss of their security deposit or eviction, if their smoke wafts into a non-smoker’s domain. And if a chain-smoking neighbor is in violation, your landlord will be glad to take your complaints—it’s one thing that will allow him to evict a tenant.

9) “What you see is what you get.”

The rusty, cracked stove was nearly a deal-breaker for an otherwise great apartment in Boston’s North End. But the landlord promised to replace the clunker and make other repairs, so Joanna DiTrapano and her roommate signed a one year lease in March. Suddenly, the landlord’s tune changed — although the gas company documented the dangerous stove leaking gas, he insisted it wasn’t damaged enough to warrant replacing. It took six months, numerous phone calls and finally, a formal letter citing city tenants’ rights laws to get a new stove, DiTrapano says. The smaller repairs the landlord promised? She’s simply given up.

Some landlords were never good about making necessary repairs, but the recession has forced many to postpone anything that isn’t absolutely vital, says Dave Zundel, a co-founder of Arizona property management firm HomeLovers. The firm has seen a 70% drop in maintenance projects, and just 13% of landlords are still spending on regular upkeep and cosmetic improvements such as replacing worn carpets or repainting. Your safest bet is to assume the condition of the apartment you’re viewing is about what it will be when you move in, Zundel says. If the landlord promises to make repairs, get it in writing.

10) “You’ll pay for my rebellion.”

The building or community homeowners’ association may have it in for you. Some renters — and owners – learn this the hard way, Abkemeier says. During the downturn, many associations have taken steps to limit owners’ ability to rent out property, or require extensive screening before a lease can be signed. And owners who try to avoid or ignore the rule-changes end up making it difficult on tenants who suddenly find themselves faced with lengthy rental applications or fines for a litany of association rules they never knew they had to uphold. The extra layer of administration can also make it tough for tenants to get damage repaired, because they’re dealing with the building and not just the landlord.

Organic Bedroom Style In North Salem NY | North Salem NY Real Estate

Applying eco-friendly style to your bedroom isn’t a fad; it’s one of the healthiest things to do when decorating your home. Don’t let harmful chemicals and toxins take you lying down. Here’s how to put up a fight for green in your bedroom.

Breathe Easier

Air quality is important because you spend so much time in the bedroom at night, says green architect/designer Michelle Kaufmann, founder and chairwoman of Michelle Kaufmann Designs, www.michellekaufmann.com. She recommends operable windows for cross ventilation/natural ventilation and HEPA filters in vacuums.

Buy a stylish ceiling fan to circulate hot and cool air, and save money on energy bills.

Choose low/no-VOC paints and stains for walls, ceiling and furniture.

Wash your bedding each week to cut down on mold, mildew and dust mite accumulation.

If you’re prone to allergies, avoid down pillows and comforters. Instead, look for hypoallergenic and organic pillows filled with wool, cotton, millet hulls (99 percent dust free), buckwheat, kapok (a natural seed fiber) and shredded latex.

Choose a Green Mattress and Box Spring

Invest in the most important part of your bedroom: the mattress. “Everything you bring into your home has a potential to off-gas, so when you chose products to sleep on, you should look at what they’re made of,” says Greg Snowden, creator and founder of the Green Fusion Design Center.

Choose a mattress that’s toxin-free and doesn’t contain polyurethane foam and fire-retardants such as PBDEs (polybrominated diphenyl ethers). Animals exposed to PDBEs showed learning deficiencies, and high levels of the chemical have been found in women’s breast milk according to PollutionInPeople.org. But you’ll have to get a mattress that passes the U.S. Consumer Product Safety Commission tests for fire, so look to wool mattresses for natural fire-retardant qualities.

Green options include organic wool- and cotton-filled mattresses that are just as comfortable as a chemical-filled mattress. The greenest option is latex. Savvy Rest, a green mattress company (www.savvyrest.com), offers organic mattresses made from 95 percent latex (100 percent does not exist) that don’t suffer from lumps and gullies over time.

Eco-friendly mattresses are also available from Green Sleep, www.greensleep.ca. Zem Joaquin, green blogger at Ecofabulous.com, favors Green Sleep in her home. “The rubber is harvested in Malaysia,” she says. “They go and tap the trees like you would for maple syrup and bake it up into nice, fluffy cakes. The comfort is phenomenal.”

National Geographic’s The Green Guide suggests supplementing your mattress with a natural, untreated solid wood box spring made from FSC-certified wood.

Reuse Furniture and Fabric

Instead of buying a new bedroom set, take a look at what you have and refresh it. TV-dinner trays, a stack of old luggage and even a fallen tree trunk in your backyard can become a nightstand.

Save gas by shopping locally at thrift stores, antiques shops and architectural salvage stores. You can often find old headboards to upholster or paint, giving a singular look to the bed for less. An old door turned on its side and wall mounted is another eco-friendly, and rustic, solution.

For inexpensive DIY pillows or curtain panels, visit fabric shops and ask for their leftover material scraps. Or, repurpose old blankets and sheets for a comforter that’s completely your own.

Electric Usage In Your North Salem NY Home | North Salem NY Real Estate

There Are Many Ways You Depend On Electricity

As your electric supplier, we’ve developed this brochure to help you determine your electric usage. We hope this will help you use your electricity as efficiently as possible.

This graph shows how energy is used in an average home with four family members. Your use may vary depending on your lifestyle, the size of your family and the size, age and efficiency of your appliances. The amount used also varies with the weather and the amount of insulation in your home’s walls and ceiling.

Appliances that are manufactured today are typically much more efficient. As appliances age, their efficiency decreases. Knowing the age and life expectancy of your electric appliances can help you understand your electrical use.

Average Life Expectancy In Years | |

| Air Conditioner | 18 |

| Clothes Washer | 8-10 |

| Clothes Dryer | 14 |

| Dishwasher | 11 |

| Electric Range | 12 |

| Electric Water Heater | 10-12 |

| Freezer | 15-20 |

| Heat Pump | 16 |

| Refrigerator | 15 |

| Television | 11-12 |

Replacement

If your appliances are at or nearing the end of their expected life, you may plan ahead. When replacing old appliances pay particular attention to energy efficiency. In most cases, the energy-efficient choice will save you money.

Look for the energyguide label

To promote conservation, the Federal Government requires manufacturers of large appliances to display energy information. The ENERGYGUIDE is designed to assist you in deciding what appliance would be less expensive to operate over the lifetime of the appliance.

Note: These figures are based on an electric price of 8.14¢ per kWh

| Household | Cost/Period |

| Auto engine heater (500 watt) | 4.7¢ / hour |

| Aquarium 30 gallon | $4.17 / month |

| Clock | 18¢ / month |

| Curling Iron | 1.5¢ / hour |

| Battery Charger (car) | 5.1¢ / hour |

| Bug Zapper | $7.57 / month |

| Computer w/Monitor, Printer | 88.2¢ / week |

| Electric Blanket (125 watt) | 9.2¢ / 8 hours |

| Garage Door Opener | 2.8¢ / month |

| Hair Dryer (hand held) | 11.3¢ / hour |

| Heat Lamp | 2.4¢ / hour |

| Jacuzzi (maintain temperature) | $1.20 / day |

| Lighting (incandescent) 75 watt | 7.0¢ / 10 hours |

| Lighting (compact fluorescent) 18 watt | 1.6¢ / 10 hours |

| Lighting (fluorescent) 4’40 watt | 3.8¢ / 10 hours |

| Lighting (outdoor flood) 125 watt | 11.6¢ / 10 hours |

| Motor (1 HP) | 9.20¢ / hour |

| Power Tools (circular saw) | 16.7¢ / hour |

| Radio | 12.5¢ / 10 hours |

| Satellite Dish (incl. receiver) | $6.09 / month |

| Stereo | 18.9¢ / 10 hours |

| Television (color, solid state) | 26.0¢ / 10 hours |

| DVD/VCR | 2.6¢ / hour |

| Waterbed Heater (300 watt) | $10.00 / month |

| Laundry | Cost/Period |

| Clothes Dryer | 47¢ / load |

| Clothes Washer (cold/cold) | 2.8¢ / load |

| Clothes Washer (warm/cold) | 12.8¢ / load |

| Clothes Washer (hot/warm) | 34.2¢ / load |

| Iron | 9.2¢ / hour |

| Space Conditioning | Space/Period |

| Air Conditioner (12,000 BTU, window) 8 SEER | $28.25 / month |

| Air Conditioner (36,000 BTU, central) 13 SEER | $51.25 / month |

| AC Dehumidifier (20 pints, summer) | $14.99 / month |

| Heater (portable) 1500 watt | 14.0¢ / hour |

| Heating System (blower) | $8.32 / month |

| Heat tape (30 ft., 6 watts per foot) | $11.93 / month |

| Humidifier (winter) | $2.66 / month |

| Fan (attic) | $2.64 / month |

| Fan (ceiling, lights off) | 9.2¢ / 10 hours |

| Kitchen | Cost/Period |

| Bread Machine | 7.2¢ / loaf |

| Coffee Maker (auto drip) | 2.6¢ / brew |

| Convection Oven | 9.2¢ / hour |

| Dishwasher | 22.8¢ / load |

| Freezer (man. defrost, 15 cu. ft.) 1975 | $5.55 / month |

| Freezer (man. defrost, 15 cu. ft.) 2003 | $2.75 / month |

| Fry Pan | 10.0¢ / hour |

| Microwave Oven | 14.3¢ / hour |

| Range (oven) | 12.8¢ / hours |

| Range (self cleaning cycle) | 57¢ / cleaning |

| Refrigerator (frost-free, 21.5 cu. ft.) 1975 | $13.86 / month |

| Refrigerator (frost-free, 21.5 cu. ft.) 2006 | $3.55 / month |

Operating cost per hour can be estimated if you know:

- Wattage of the appliance

- Cost of electricity (cost per KWh)

To estimate the number of kWh (units of electricity used in one hour) first determine:

- The wattage of the appliance from its nameplate

- Apply the following formula:

Wattage x 1 (hour) = kWh (units of electricity used per hour)

1000

To figure operating cost per hour: kWh (units used) x Cost/KWh=Cost/hour

To determine average cost per kWh from your electric bill:

EXAMPLE: Cost per KWh 9.25¢ | EXAMPLE: 1500 WATT HEATER 1500 x 1(hour) = 1.5 Kwh Cost per hour of operation: |

North Salem NY Real Estate Report | RobReportBlog | Robert Paul Realtor

| Actives | 71 | ||||

| Median | $675,000 | ||||

| Ave DOM | 149 | ||||

| High Price | $24,900,000 | ||||

| Low Price | $159,000 | ||||

| Ave Size | 3900 | ||||

| Ave Price/ft | $387 | ||||

| Sold North Salem NY Properties Over the Last SIx (6) Months | |||||

| 11/15/2010 | 11/15/2009 | ||||

| Sold | 20 | 20 | |||

| Median | $475,250 | $550,000 | |||

| Ave DOM | 140 | 200 | |||

| High | $2,050,000 | $1,750,000 | |||

| Low | $190,000 | $115,000 | |||

| Ave Size | 2212 | 2707 | |||

| Ave Price/ft | $278 | $223 | |||

| Sale price/Ask | 93.71% | 93.52% | |||

| North Salem NY Homes | |||||

| North Salem Luxury Homes |

6 Steps To Sell Your Home Fast In North Salem NY | North Salem NY Real Estate

How to Price a Home to Sell Fast

It’s a tough time to be a homeowner trying to sell. The national statistics show inventories and prices holding steady through the first half of 2010. While this is a relief from the grim free fall that home sellers faced after the real estate bubble burst, there still isn’t the upward momentum that owners prefer when they’re looking for home sales.

According to a Wall Street Journal report, only 47 percent of houses listed for sale in major U.S. markets had actually sold by August 2010. Several of the remaining listings were taken off the market. Moreover, the national averages belie the differences that realtors and other experts are seeing from one region to another, and even one neighborhood to the next.

“There’s no longer a national housing market,” says Armando Montelongo, the real estate maven who was featured on A&E’s “Flip This House,” a housing-bubble-era reality show. “You can drive 200 miles and see a totally different real estate climate.”

You might not have to drive that far. Realtors report homes getting offers after a few days on the market in some neighborhoods and languishing for six months or more the next town over. So how do you figure home value and set the right price?

“We have a lot of pockets of activity,” says Debbie Cobb, RE/MAX realtor in the Research Triangle area of North Carolina. “Out in the country we had foreclosures and that area is still sluggish, but we also have an area closer in, called North Hills. That market is still steady, although it’s not as quick a sale as it use to be.”

In short, home sellers who want a quick home sale, say to move for a job or transition to a more affordable place, need to be very price sensitive, especially if they live in average or underperforming areas (like those hit hard by foreclosures). “You can’t price a home too low today, but you can price it too high and not have it sell,” Montelongo cautions.

The best thing, real estate agents say, is to price a home appropriately to begin with. Try to resist the urge to overestimate your home’s value; you want to avoid having your house sit for several months while you lower the price again and again. The more you do this, the more people will wonder what’s wrong with your place, says Chad Goldwasser, a realtor with his own shop in Austin, Texas.

Here’s how to figure out a fair home value:

1. Don’t make it personal

The second you decide to put a house on the market, stop referring to it as “my home,” Montelongo says. “It’s a property,” or at the very least, “the house.” This will help you to get some emotional distance as a home seller. You can view the place with the objectivity that potential buyers have and think about pricing, and the home’s value, in a realistic way.

2. Tour the neighborhood

Cobb suggests asking your Realtor to take you around to open houses in the neighborhood, or grabbing the local listings and going yourself to research home values. Focus on homes within a mile of your own that are a similar size with similar property, adds Montelongo, who has been buying and selling properties around the country for 10 years.

Pay attention to “how they show.” That is, does the outside property look tended to? Are the kitchen and bathrooms up to date? The windows and siding in good shape? The floors and carpets clean and the walls freshly painted? Would the buyer have to make any immediate, obvious repairs or correct any extreme style choices (like a macho black-marble bathroom or way-too-green kitchen)? Is the temperature comfortable? Consider the price and see how long the house stays on the market. In the meantime, come back to your house and approach it the same way you did the others, the way a buyer would. How does your house “show” in comparison? Be ready to make some improvements or adjust your price.

“The homes selling quickly are in the best condition they can be in. They’re cleaned up, staged well and priced correctly,” says Goldwasser.

3. Follow the comps

“Comps” are the price tags on homes, comparable to a seller’s, that have sold or gone into contract. While open houses will tell what home sellers are asking, comps tell you what they’re actually getting, and therefore what the true home values are in your neighborhood. The comparison of those two numbers can itself be instructive. Your Realtor can give you local comps, as can websites like AOL Real Estate.

Since many Realtors won’t list a price until the deal has closed, comps can lag a little bit. Follow them for as long as you have a property on the market to know which way local prices are trending.

Montelongo adds that you also want to know how long comparable houses sit on the market. If local properties are moving in less than a month, you’re in a robust market and can price more aggressively. Thirty to 60 days means a good but not great market; more than 90 days means you’re in a slow market and you’ve got your work cut out for you.

4. Do a test run

Watch what happens during the first three weeks that your property is on the market. If people look but don’t make offers, you probably priced it a little too high. If no one even comes to look, you aren’t in the right ballpark. In either case, “Get the price down as quickly as you can,” says Goldwasser.

How much do you cut? Look at the latest comps and set a price that sits on the low end of them, or lower.

5. Reset the clock

If you’ve already made too many price cuts or the house has sat for too long and is getting stale, you might consider taking it off the market for a while. But before you do, Cobb advises, find out how long you’ll have to wait before it shows up as a new listing (it could be one or a few months) and if the listing will tell how many cumulative days the house has been on the market; then decide whether it’s worthwhile to do so.

6. Make your house a good deal

If he knows homes in a certain market are selling for about $300,000, Montelongo won’t hesitate to put his on the market for $275,000. He figures that making it look like a really good deal will make people curious enough to come out and look. “You want to generate interest,” he says. He’s OK with selling for less than he could if it means getting out from under a house quickly. But it’s not unusual, he says, for homebuyers who think they’ve spotted a good deal to bid the house up a little, bringing it closer to what the seller who lists at $300,000 might wind up having to come down to.

In a few select markets, trying to sell your home for too much might mean sitting on it for a lot longer than you prefer, but in most markets, it might mean not selling at all, experts say. As long as it’s a buyers’ market, getting the price right, and correcting pricing mistakes quickly, is one of the most important things that a home seller can do to attract a buyer and get to that closing date fast.