The boomlet in foreign purchase of US residential property is apparently over. Purchases by international buyers fell 17 percent last year, down approximately $14 billion from the previous year.

Purchases by foreign buyers fell to an estimated $68.2 billion. The National Association of Realtors attributed the decline is attributed to economic slowdowns in a number of major foreign economies, tighter U.S. credit standards and unfavorable exchange rates.

The survey, which asked Realtors® to report their international business activity within the U.S. for the 12 months ending March 2013, showed that total international sales were $68.2 billion

“Foreign buyers are experiencing hurdles not only abroad, but also here in the U.S. when it comes to purchasing property,” said NAR President Gary Thomas, broker-owner of Evergreen Realty in Villa Park, Calif. “Difficult economic conditions, particularly in Europe, have impacted foreign buyers, but several factors in the U.S. have also affected their purchasing power here. Tight credit standards have made financing challenging for immigrants, and low housing inventories have made finding a house difficult.”

The decline in foreign sales may put to rest fears that foreign owners will displace domestic ones. More than $7 billion of the $82 billion in home sales in 20112 was by Chinese, who are now the second largest foreign home purchasers after Canadians. They’re buying high-end, multimillion-dollar homes from California to New York and paying cash.

“They’re probably the top 1 percent of the Mandarin speakers that are coming from China,” Brent Chang, a Coldwell Banker realtor in Southern California, told Fox News. “They’re really the people who have their own businesses or maybe were part of the government.”

Some of these homes are specifically catered to Chinese buyers. Fox News visited a home listed at $8 million in Pasadena, Calif., that had two kitchens, the smaller one had ventilation for the cooking for aromatic or “stinky” foods like fish. It also has a lower level in-law suite and even a koi pond.

“People from China do a lot more business in their homes so they want their homes to really scream that they’ve made it and they’re successful,” said Chang.

The Chinese like the U.S. because their money goes further. In Shanghai, $2 million might only get you a two-bedroom condo.

“You get a huge bang for your buck, you get land, you get good schools, you get a safe environment, nice community life, ” said Linda Chang, a realtor who works with her son, Brent, in the San Marino and Pasadena areas of California.

Realtors reported purchases from 68 countries, but five have historically accounted for the bulk of purchases; Canada (23 percent), China (12 percent), Mexico (8 percent), India (5 percent) and the United Kingdom (5 percent). These five countries accounted for approximately 53 percent of transactions, with Canada and China the fastest growing sources over the years.

Canadian buyers were reported to purchase properties with a median price of $183,000, with the majority purchased in Florida, Arizona and California. Chinese buyers tended to purchase property in the upper price ranges with a median price of $425,000 and typically in California. Sixty-two percent of Mexican buyers purchased property in California and Texas, with a median price of $156,250.

International buyers tend to cluster in specific locations based on countries of origin, as well as several other factors. “Many factors influence foreign buyers’ decisions on where to purchase in the U.S., but the most important are proximity to home country, presence of relatives and friends, availability of job and education opportunities, and the climate,” said Thomas. “International buyers also differ on the type of desired property. Some are looking for trophy properties while others are interested in modest vacation homes.”

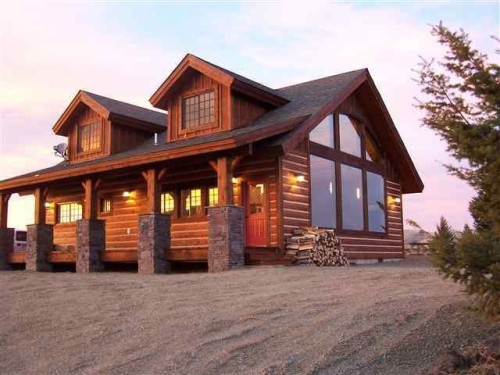

Five states made up 61 percent of reported purchases; Florida (23 percent), California (17 percent), Arizona (9 percent), Texas (9 percent) and New York (3 percent). About half of foreign buyers preferred to purchase in a suburban area, while a quarter preferred a more central city/urban area. A majority purchased a detached single-family home and 63 percent used all-cash. Based on the reported international transactions, the mean and median prices of purchases were higher when compared to purchase prices of domestic buyers. For the 12 months ending March 2013 the median international home price was $275,862 and for domestic buyers it was $179,867. The types of homes purchased by international buyers frequently tended to be different from the types of homes purchased by domestic U.S. buyers. International buyers are more likely to be substantially wealthier and looking for a property in a specialized niche.

Foreign Buyers Go Home | RealEstateEconomyWatch.com.