January 14, 2013The Honorable John A. Boehner

Speaker

U.S. House of Representatives

Washington, DC 20515

Dear Mr. Speaker:

I am writing to provide additional information regarding the extraordinary measures Treasury has undertaken in order to avoid default on the nation’s obligations.

Treasury currently expects to exhaust these extraordinary measures between mid-February and early March of this year. We will provide a more narrow range with a more targeted estimate at a later date. Any estimate, however, will be subject to a significant amount of uncertainty because we are entering the tax filing season, when the amounts and timing of tax payments and refunds are unpredictable. For this reason, Congress should act as early as possible to extend normal borrowing authority in order to avoid the risk of default and any interruption in payments.

If the extraordinary measures were allowed to expire without an increase in borrowing authority, Treasury would be left to fund the government solely with the cash we have on hand on any given day. As you know, cash would not be adequate to meet existing obligations for any meaningful length of time because the government is currently operating at a deficit.

The U.S. government makes approximately 80 million separate payments per month. These include payments for Social Security; Supplemental Security Income; Medicare; Medicaid; national security needs, including military salaries, military retirement, veterans’ benefits, and defense contractors; income tax refunds; federal employee salaries and retirement; law enforcement and operation of the justice system; unemployment insurance; disaster relief; goods and services sold to the government under contracts with small and large businesses; and many others. If Congress does not act to extend borrowing authority, all of these payments would be at risk. This would impose severe economic hardship on millions of individuals and businesses across the country.

It is important to point out that extending borrowing authority does not increase government spending; it simply allows the Treasury to pay for expenditures Congress has previously approved. Failure to meet those obligations would cause irreparable harm to the American economy and to the livelihoods of all Americans. Even a temporary default with a brief interruption in payments that Congress subsequently restores would be terribly damaging, calling into question the willingness of Congress to uphold America’s longstanding commitment to meet the obligations of the nation in full and on time. It should also be noted that default would increase our borrowing costs and damage economic growth and therefore add to future budget deficits, not decrease them. This is why no President or Secretary of the Treasury of either party has ever countenanced even the suggestion of default on any legal obligation of the United States.

Protecting the full faith and credit of the United States is the responsibility of Congress because only Congress can extend the nation’s borrowing authority. No Congress has ever failed to meet that responsibility. It must be understood that the nation’s creditworthiness is not a bargaining chip or a hostage that can be taken to advance any political agenda; it is an essential underpinning of our strength as a nation. Threatening to undermine our creditworthiness is no less irresponsible than threatening to undermine the rule of law, and no more legitimate than any other common demand for ransom.

In an address to the nation in 1987, President Reagan said, “Unfortunately, Congress consistently brings us to the edge of default before facing its responsibility. This brinkmanship threatens the holders of government bonds and those who rely on Social Security and veterans benefits. Interest rates would skyrocket. Instability would occur in financial markets and the federal deficit would soar. The United States has a special responsibility to itself and the world to meet its obligations. It means we have a well-earned reputation for reliability and credibility – two things that set us apart in much of the world.”

President Obama has put forth detailed proposals to restore fiscal responsibility to the federal budget, and he strongly believes Democrats and Republicans should join together to reduce our deficits. In the meantime we must protect America’s creditworthiness by ensuring that our government can pay the bills it has already incurred. Therefore, I respectfully urge Congress to meet its responsibility to the country by extending normal borrowing authority well before the risk of default becomes imminent.

Sincerely,

Timothy F. Geithner

Tag Archives: North Salem NY Real Estate for Sale

North Salem 2012 Sales Up 76% – Prices drop 7.8% | RobReportBlog

North Salem 2012 Sales Up 76% – Prices drop 7.8% | RobReportBlog

North Salem NY Sales 2012 2011 46 Sales 26 76.92% UP $472,500.00 Median Price $512,500.00 7.80% DOWN $125,000.00 Low Price $147,500.00 $2,600,000.00 High Price $6,480,000.00 2762 Ave. Size 3545 $224.00 Ave. Price/foot $280.00 238 Ave. DOM 244 93.04% Ave. Sold/Ask 92.66% $639,674.00 Ave. Sold Price $1,188,035.00

The Weekly Online Video News Round Up – Final Cut Edition | North Salem Homes

This week I’ve got to get the final cut of the pilot episode over to the contest people. But, as always, I’ve been keeping an eye on the industry to see how things are going and this week there’s some interesting stuff from the likes of Comcast and Verizon of all places. Check it out and enjoy your morning coffee.

Comcast Adds Offline iOS/Android Viewing To Xfinity TV Player

Comcast has brought video on-demand streaming to subscriber’s mobile devices since early last year, but now an update has added the option to download (some) content for offline viewing. Arriving simultaneously on iOS and Android, the Xfinity TV Player apps support downloads from premium channels Showtime (which was also one of the first up for streaming when that launched), Starz, Encore, and MoviePlex.

Source: EngadgetVerizon Makes 75 Channels Available Via Its iPad App

Verizon Communications is making 75 live networks available through its updated app for iPad tablets for FiOS TV and Internet customers — but unlike services from competitors like Cablevision Systems and Time Warner Cable, the telco’s tablet TV lineup currently lacks broadcast networks and local channels. The updated FiOS Mobile app for iPad was published in the Apple iTunes App Store on Wednesday (last week).

To use the feature, customers must subscribe to both FiOS Internet and TV service, and must use a Verizon-provided router. Live TV on the iPad is accessible only within a customer’s home over Wi-Fi.Rovi TV Guide Listings to End

Rovi has started shutting off the TV listings data it has provided in over-the-air broadcasts to dozens of consumer-electronics device models in North America — and will completely end the service by April 2013 — a move that has infuriated consumers who claim it will render their DVRs useless.

The company said its agreements with data broadcasting partners CBS and National Datacast Inc. (NDI), a for-profit subsidiary of PBS, are coming to an end.

Source: Multichannel News

RedBox Instant Set for Holidays

The online video joint venture Redbox Instant by Verizon is set to launch sometime before the end of the year. The service is currently being tested in private beta, and Verizon and Redbox have kept mum on some key details. Subscriptions start at $6 a month. An $8 a month membership adds four Redbox credits to the streaming package that can be redeemed for Redbox DVD rentals. Redbox Instant is using Silverlight for streaming on the web.

Source: GigaOm

Chill Direct’s New Platform Empowers Artists to Distribute Content Directly to Fans

Chill (www.chill.com), the Web’s premier video discovery portal today launched the entertainment industry’s first turnkey platform for artists to produce, own and distribute content directly to their fans, dubbed “Chill Direct.” The self-service platform is the first of its kind and makes it dead simple for artists to globally distribute premium video to all desktop, mobile and Internet connected televisions.

Chill Direct is a fully socially integrated platform that allows any filmmaker, comedian, musician, or artist to directly release premium video to the fans who love them. Building on the success of content creators who have made specials and albums directly available to audiences for personal download, Chill Direct expands on this emergent model, empowering artists to engage their fan bases and build full-scale customizable community hubs where fans and artists can interact.

Unlike releasing content through app stores, music stores, a broadcast network or film studio, Chill Direct imbues artists with creative control and flexibility over their material and allows them full ownership of Intellectual Property. Chill Direct also helps artists build powerful social communities around their work through integration with Facebook and Twitter and world-class page creation tools.

Source: Press Release

Test the Encoding.com Private Cloud and enter to win $1000 of free encoding credit

At Encoding.com, we all agree that building the world’s most powerful private cloud transcoding platform is a good time. Even more fun is watching our resident stunt goat Clive take it for a test drive. Unfortunately, even the great Clive went from goat to chicken when he overheard the roar of 32 core multi-threading servers and 1Gbps ingest/egress usingAspera fasp 3™ technology.

Therefore, we are offering a reward of $1,000 in free encoding credit to the Encoding.com community member willing to brave unprecedented speed, put the pedal to the metal, and encode the largest volume of video in December using Encoding.com private cloud!

Using the Encoding.com Private Cloud is easy, you can keep all of your encoding settings the same and simply specify a new region in your API request. Click here for complete instructions.

The rules are simple:

– Only one winner will be selected

– Encoding credit will be awarded to the primary account holder

– Encoding credit may only be redeemed by the primary account holder

– Encoding credit must be used by 1/1/2014

– Encoding credit is not applicable for discounts on existing contractsSource: Blog Post

The 3 Worst Ways Companies Waste Money in Social Media | North Salem NY Real Estate

4 Advanced Targeting Techniques Every Facebook Advertiser Should Master | North Salem NY Real Estate

US Home Values Post Big Gains, But Recovery Is Uneven Among Markets | North Salem NY Real Estate

Home values in the United States rose 1.3 percent in the third quarter — the biggest quarterly gain since 2006, according to the third quarter Zillow Real Estate Market Reports. The Zillow Home Value Forecast shows more growth, albeit slower growth, on the horizon with values increasing 1.7 percent over the next year.

However, the pace of the housing recovery is uneven from market to market. Home values are increasing rapidly in some areas. In the Phoenix metro, for example, values are up 20.4 percent year-over-year. But in other areas — such as the Atlanta metro, where home values declined 4.8 percent year-over-year — values continue to fall. But that doesn’t mean the recovery is in jeopardy.

“We’re likely seeing home values fall back into the negative range in some markets due to the close of the traditional home-buying season,” said Zillow Chief Economist Dr. Stan Humphries. “While that doesn’t mean the recovery has come off the rails — in fact, most markets have hit bottom — it does present a confusing environment for consumers. Looking forward, we expect to see home values bump along the bottom for some time, before increasing at a slow and steady pace.”

Weekly Wrap-Up: How Evil Is Your Smartphone, When To Pivot Your Startup, And How To Watch The Presidential Debate Online | North Salem NY Real Estate

How Evil Is Your Smartphone, 8 Startups On When To Pivot, and How To Watch The Presidential Debates Online. All of this and more in the ReadWriteWeb Weekly Wrap-up.

After the jump you’ll find more of this week’s top news stories on some of the key topics that are shaping the Web – Location, App Stores and Real-Time Web – plus highlights from some of our six channels. Read on for more.

How Evil Is Your Smartphone?

Okay, maybe there are no ethical smartphones. But some must be better than others, right? How Evil Is Your Smartphone?

More Top Posts:

When Is It Time To Pivot? 8 Startups On How They Knew They Had To Change

There comes in a time the life of many startups when it becomes clear that everything is not going according to plan. But how do entrepreneurs tell if they need to keep going all in on the original plan, or pivot to something new? When Is It Time To Pivot? 8 Startups On How They Knew They Had To Change.

How To Watch The U.S. Presidential Debates Online – Updated

As Mitt Romney and Barack Obama prepare for their third and final debate on Monday night, your options for tuning in are greater than ever before, How To Watch The U.S. Presidential Debates Online.

Don’t Make The Mistake Of Preordering A Windows Surface RT Tablet

The problem is Microsoft’s “long tease” – the slow, steady drip of information leading up to the launch of Windows 8, Don’t Make The Mistake Of Preordering A Windows Surface RT Tablet.

Why Brands Should Build Their Own Social Communities

Meet SocialEngine, white-label software that helps businesses build their own branded, interest-driven social networks, control their message and turn participants into potential customers. The service has been around for a few years with some success, but the product has now been relaunched as SocialEngine Cloud, retooled for bigger clients, Why Brands Should Build Their Own Social Communities.

Color’s Epic Collapse: Why Everybody Is Loving It

Reports say that the engineering talent from Color is going to be acquired by Apple and the app will be shut down. No one but its investors and employees not going to Apple will shed a single tear, Color’s Epic Collapse: Why Everybody Is Loving It.

What The Hell Just Happened At Google?

There’s only one thing worse than missing your numbers – and that is missing your numbers and not even being able to report that news correctly, What The Hell Just Happened At Google?

The FTC Wants YOU! – To Kill Robocalls

The FTC Robocall Challenge is offering a cash prize for anybody that can come up with the best way to eliminate robocalls from reaching consumers’ cellphones and landlines. The submission window runs from October 25 to January 17, 2013. Winners, if there are any, will be announced in April 2013, The FTC Wants YOU! – To Kill Robocalls.

The Democrats Prank Romney With Clever Search Engine Fun

This is what national, presidential-election-year political campaigns do now: They make little prank websites to undermine their opponents. It’s the tech-savvy, 21st Century equivalent of a TV attack ad, The Democrats Prank Romney With Clever Search Engine Fun.

The iPad Mini’s Killer Feature = Price

The tablet market is different from that of other gadgets. While many people believe they need a mobile phone and a computer to meet their personal and business goals, a tablet is more of a “not necessary, but nice to have” type of device, The iPad Mini’s Killer Feature = Price.

Obama’s second-term housing design | North Salem Realtor

On the afternoon of Aug. 20, President Barack Obama stepped up to a podium in the White House briefing room for the first time in two months. He had taken criticism from reporters and Republican political operatives for not holding a press conference while his GOP presidential opponent, former Massachusetts Gov. Mitt Romney, took questions from his traveling press corps.

About nine minutes into the 22-minute conference, Obama received this question from Jake Tapper, ABC News senior White House correspondent:

“With the economy and unemployment still the focus of so many Americans, what can they expect in the next couple months out of Washington — if anything — when it comes to any attempt to bring some more economic growth to the country?”

Citing historically low interest rates and a “housing market that is beginning to tick back up, but is still not a all where it needs to be,” Obama, in response, urged Congress to pass a home refinancing plan he proposed eight months earlier.

“There are a lot of Americans still underwater because housing values dropped so precipitously and they’re having trouble refinancing,” Obama told Tapper at the press conference. “We’re going to be pushing Congress to see if they can pass a refinancing bill that puts $3,000 into the pockets of the average family. That’s a big deal. That can be used to strengthen the equity in that person’s home, which would raise home values. Alternatively, that’s $3,000 they can spend on a new computer or clothes for their kid going back to school.”

Two days later the administration dispatched Housing and Urban Development Secretary Shaun Donovan on a multistate trip to promote three Democratic Senate bills the secretary said would complete Obama’s refinancing initiative. (Back in May, Donovan predicted the bills would gain quick bipartisan support.)

Perhaps Tapper should have extended the timeline of his question and asked what homeowners should expect in not just the next two months, but the first year of a possible Obama second term — considering the chances of his home refinancing initiative gaining passage-worthy bipartisan support in an election year are dubious at best.

HOUSING STRATEGY

Obama campaign spokesman Adam Fetcher tells HousingWire the president has a cogent housing strategy.

“The administration has put forward a plan to help more responsible borrowers refinance their mortgages while taking concrete steps to help families stay in their homes, revitalize the communities hardest-hit by the housing crisis, and reform the mortgage lending market to better protect both consumers and taxpayers,” Fetcher says.

Obama’s amalgamation of housing programs — Home Affordable Modification Program, Home Affordable Refinance Program, second-lien write-downs, forbearance, hardest-hit funds, Federal Housing Administration short refinance and loss-mitigation efforts — is a multipronged attack on the mortgage crisis. Although programs such as HAMP have not met expectations, the president’s overall game plan has fared better.

“The reality is collectively all of them had a very significant impact,” says David Stevens, chief executive of the Mortgage Bankers Association. “I think we have to look at the broad set of solutions that were provided and recognize that many millions of Americans have been helped. The housing market by most experts’ views stabilized, but we still have pockets of significant concern, particularly in those hardest-hit locations.”

The housing affliction is one of President Obama’s most difficult economic obstacles, represented by the $689 billion in second-quarter negative equity that has buried itself into the nation’s economic foundation.

The sickness, however, is contained. In its latest housing scorecard, the Obama administration touted an improving market, citing CoreLogic figures that show the number of underwater borrowers fell 11% from 12.1 million, or 25.2% of all homes with a mortgage, at the beginning of the year to 10.8 million in the second quarter, or 22.3% of homes.

The sideways trajectory of home starts, prices and sales since mid-2009 after free-falling for nearly three years is “attributable to the administration’s aggressive response and also the Federal Reserve’s quantitative easing, which has brought down mortgage rates,” Mark Zandi, Moody’s chief economist, tells HousingWire. “But it’s also fair to say the administration’s policies have fallen short of even their expectations.”

The Obama campaign points out that its push to expand access to refinancing is an idea with aisle-transcending support. In October 2011, shortly before the expansion of HARP, Republican Senators Johnny Isakson, R-Ga., Richard Burr, R-N.C., Scott Brown, R-Mass., and Saxby Chambliss, R-Ga., signed on to a letter in which Sens. Barbara Boxer, D-Calif., and Robert Menendez, D-N.J., urged federal regulators to eliminate loan-to-value limits and loan-level price adjustments. Even top Romney economic adviser Glenn Hubbard put forward a plan in March that is broadly similar to the ones Senate Democrats introduced.

SECOND-TERM PLANS

President Obama’s legislative housing plan heading into a potential second term builds on the HARP expansion, which led to nearly 423,000 Fannie and Freddie mortgages refinanced in the first six months of 2012, more than all of last year, according to the Federal Housing Finance Agency.

The administration was slow to embrace refinancing as a solution to the problem, eventually overcoming its reticence in late 2011. Zandi suspects a concern about mortgage rates rising because of frightened investors suffering from refinancing gave birth to the hesitation. That, he said, would defeat the purpose of a mass refinancing program.

Stevens sees an evolved and learned administration. “HARP 2.0, which has had extraordinary success, is a lesson that I hope the administration takes into the next term if they’re reelected,” he says. “The recognition that programs also need to be made in a participative way, collaboratively with industry. HARP 2.0 clearly reflected that collaboration.”

The president is working to transition foreclosed properties sitting on government books into rental housing, the Obama campaign says, to revitalize communities hit hard by the foreclosure crisis and meet the pressing need for affordable rental housing.

The FHFA launched a pilot program to sell about 2,500 Fannie Mae properties to qualified investors. “This marks the first of a series of steps that the FHFA and the administration will take to develop a smart national program to help manage REO properties,” the White House said in February when the program launched. Real estate investment firm Pacifica Companies is the program’s first winning bidder, purchasing 699 Fannie Mae properties in Florida. The FHFA will announce the winning investors for properties in other areas upon closing of the transactions throughout the rest of the year.

John Taylor, chief executive of the National Community Reinvestment Coalition, says the president needs to focus more on foreclosures going into a second term. “Foreclosures that are waiting in the wing are going to continue to haunt our economy,” Taylor says. About 1.3 million homes, or 3.2% of all homes with a mortgage, were in the national foreclosure inventory in July, down from 1.5 million a year earlier. “It wasn’t his fault, and yes, he made several efforts to address it, but I think he needs to get much more aggressive at keeping people who are still working in their homes.”

For homebuyers, Obama proposes a mortgage lending standard to curtail the likelihood of future foreclosure, transforming into reality his Homeowner Bill of Rights, a set of criteria he says will ensure borrowers and lenders play by the same rules. Topping the list is the Consumer Financial Protection Bureau’s crusade to create clear, straightforward disclosure forms that will be used in all mortgage applications to replace overlapping and confusing forms that contain hidden clauses and opaque terms. The bureau is accepting comments from the public until election day on “easier-to-use” forms scheduled to be released in January.

The bill of rights also requires lenders to disclose mortgage fees and penalties. The CFPB will release final rules in January. The administration, Obama’s campaign says, will “make sure that all those with government-insured loans have these protections and is working with regulators to expand them to all borrowers.

GSE REFORM

President Obama must address a variety of policy issues surrounding the future state of the mortgage finance behemoths Fannie Mae and Freddie Mac, who back 90% of mortgages. The key is ensuring regulations are implemented in such way that allow the expansive inter-related network of domestic and international financial institutions to manage the new rules without impeding the steady flow of mortgage credit and capital to the nation’s housing system.

“The administration is working on the future of the GSEs,” Stevens notes. “Availability of credit for qualified Americans is going to be the greatest challenge on a go-forward basis if we don’t address this layering of risk on the financial intermediaries that we depend on to extend credit.”

The difference between Obama and Romney lies not so much with near-term housing policy, but with how they approach mortgage finance reform, specifically with what portion of the market would receive a government backstop. Under an Obama administration, Zandi says, about two-thirds of a normalized mortgage market would draw government backing, which is the average since the Great Depression.

“In a Romney administration, if you told me it was about one-third, I’d say that’s about right, maybe even lower than that.” And in that case, the mortgage market ultimately looks different as the 30-year fixed-rate mortgage becomes less common in the future.

The Treasury’s February 2011 white paper that describes three scenarios to replace Fannie Mae and Freddie Mac sits in neutral. The first option is a completely privatized system of housing finance, with government insurance limited to the Federal Housing Administration, the U.S. Department of Agriculture and the Department of Veterans’ Affairs. An Obama presidency would likely support the second option, which offers a plan similar to the first. In that plan, a backstop mechanism is in place to give homeowners access to credit during a crisis. In the third scenario, the government continues to leave the mortgage market to private players outside of the FHA and other programs, but offers reinsurance for certain mortgage-backed securities.

“We’ll get some clarity with respect to the future of the mortgage finance system in the next four years,” Zandi says. “That’s a key policy decision for the next president that has a high probability of getting done.”

However, absent a near-term requirement for more Treasury capital contributions to Fannie and Freddie, improved second-quarter financial results at the GSEs could ease pressure on Congress and the next administration to pursue far-reaching GSE reform in 2013.

Julia Gordon, director of housing finance and policy at the Center for American Progress, says continued inaction means decisions could be made by exigencies instead of with a coherent plan on how to deploy the government guarantee — including whether to deploy it.

“How will GSE reform look? Who will be advantaged by it? And how do we ensure access and affordability for a broad spectrum of potential homeowners?” Gordon asks. “To me, either administration needs to grapple with that immediately at the start of the new term.”

PROMISES KEPT AND BROKEN

President Obama followed through on many housing-related promises he made during his campaign.

He expanded the housing vouchers program for homeless veterans, provided homebuyers with clearer standards for understanding mortgages and increased the supply of affordable housing.

And under his presidency, 49 states agreed to a mortgage servicing settlement brokered with Bank of America, JPMorgan Chase, Wells Fargo, Ally Financial and Citigroup that the banks pay $25 billion for allegedly signing foreclosure documents en masse without a proper review of the loan file and evicting homeowners while in the modification process. The Obama administration, specifically Donovan, coaxed California Attorney General Kamala Harris, who was not satisfied with the original dollar amount, back to the negotiations committee. Without her, the total would have been closer to $20 million, says Iowa Attorney General Tom Miller, who led the negotiation talks on behalf of the AGs.

However, other campaign promises remain unfulfilled. Obama never implemented a mortgage interest tax credit for nonitemizers and never repealed provisions of the Chapter 13 bankruptcy code that prohibits bankruptcy judges from modifying the original terms of home mortgages, known as cramdown and something that Zandi said homeowners can forget about at this point.

Fetcher, from the Obama campaign, contends that Romney “has zero proposals to help responsible families refinance or stay in their homes. The president believes that responsible homeowners should not have to sit and wait for the market to hit bottom to get relief when there are measures at hand that can make a meaningful difference.”

Fetcher is referring to the Republican presidential candidate’s October 2011 statement to the Las Vegas Review-Journal that the national foreclosure process should be allowed to “run its course and hit the bottom.”

Analysts agree that the industry is now a tailwind for a weaker, broader economy. Housing economists from Joseph LaVorgna at Deutsch Bank to Michelle Meyer at Bank of America cite a better alignment of supply and demand. Several years of extraordinarily slow construction, slow processing of foreclosures and reduced housing turnover is significantly reducing the inventory of homes for sale.

“Housing turnover has fallen to a historic low, particularly for voluntary turnover (not due to foreclosure),” Meyer says. “Of course, a reduction in turnover not only translates to less supply, it also curbs demand.”

The MBA’s Stevens says the president, if elected for a second term, will try to make certain that his legacy reflects a recovering national economy, an accomplishment that can’t happen without a thriving housing market.

“That’s fundamental,” Stevens says. “And it’s something everybody recognizes in a greater way today than they may have four years ago.”

The History of the Vice President’s Residence | North Salem NY Real Estate

As Paul Ryan and Joe Biden crisscross the country discussing health care, jobs and the economy, they’re campaigning for more than the vice presidency. They’re also entrenched in a battle for the right to reside at Number One Observatory Circle.

While tourists flock to 1600 Pennsylvania Ave. to check out public portions of the president’s abode, the vice president’s residence is not open for public tours. The 9,150-square-foot, three-story Victorian home was built in 1893 for the superintendent of the United States Naval Observatory. The home was so impressive that, in 1929, the chief of naval operations booted the superintendent so he could live there himself.

New addition

A dedicated home for the vice president is actually a rather new phenomenon. In 1789, John Adams became the nation’s first vice president; for the next 185 years, VPs and their families lived in their own homes or, on occasion, lavish hotel suites. The associated costs and security logistics made this custom increasingly impractical.

Finally, in 1974, Congress voted to make the house at the Naval Observatory the official vice president’s residence.

President Ronald Reagan and First Lady Nancy Reagan visit Vice President George H. W. Bush and Second Lady Barbara Bush in the VP residence. Source: Wikipedia

It took another three years before a vice president actually moved into the home. Vice President Gerald Ford became President Ford before he could use it; his vice president, Nelson Rockefeller, already had a lavish Washington, DC home and never used the house as his residence, although he did host several parties there. Rockefeller’s enormous wealth enabled him to donate millions of dollars worth of furnishings to the home.

Walter Mondale was the first vice president to move into the home. It has since housed the families of Vice Presidents Bush, Quayle, Gore, Cheney and Biden. Each new resident of the White House is offered a $100,000 decorating stipend, and additional funds are raised privately. There’s no such allowance for vice presidents; donations to the nonprofit Vice President’s Residence Foundation pay for decorating expenses.

Personal touches

During the Dan and Marilyn Quayle years, foundation funds were used to add a swimming pool and carry out renovations that made the property wheelchair accessible.

Al and Tipper Gore moved into the mansion with four children — one in college and three still at home — and three dogs.

The Gores worked with two well-known designers to update the home: Albert Hadley for the interiors and Ben Page for the gardens. The Gores gravitated toward warm yellows and reds. They used the house to showcase an eclectic collection of antiques, some they brought with them, some borrowed from the State Department. Still other furniture belongs to the residence, including an Empire dining room table donated by Rockefeller and American crafts collected by Joan Mondale. The Gores also had hedges planted around the home so it wasn’t so visible from the street and worked to replace non-indigenous species on the 72-acre grounds with native plants.

The entry foyer at Number One Observatory Circle. Lynne Cheney gives a tour of the Naval Observatory. Source: Wikipedia

Dick and Lynne Cheney preferred a palette that was clean and light: pale celadon, taupe, off-white. Washington designer Frank Babb Randolph guided them through the process of reupholstering furniture, shopping for rugs and creating custom window treatments. Veeps and their families are allowed to borrow artwork from national galleries and museums; Lynne Cheney, in particular, relished this privilege and did most of her “shopping” at the Smithsonian’s Hirshhorn Museum.

As for the most recent resident of One Observatory Circle, Vice President Biden is said to be particularly fond of the home’s outdoor entertaining areas. Chatting with reporters prior to an April 2010 luncheon with foreign leaders, Biden quipped that he’d never have anything bad to say about Quayle, his often-mocked predecessor, because Quayle was responsible for having the pool installed at the vice presidential estate.

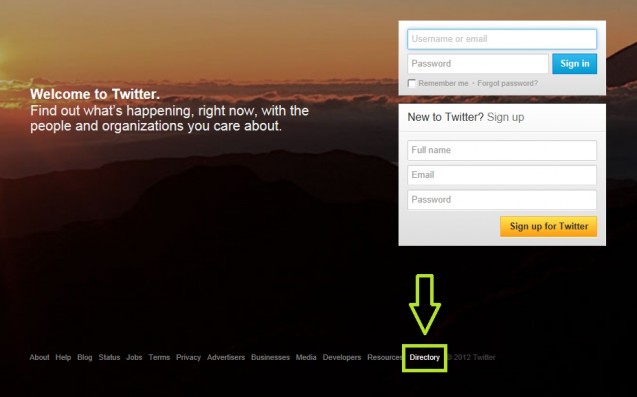

Twitter Launches User Directory | North Salem NY Real Estate

- In a world where altruistic social gathering doesn’t pay the bills, Twitter continues to make changes that it hopes will drive more traffic directly to the Twitter domain and bolster its value to advertisers. The most recent update comes in the form of an alphabetical user directory. The link to the directory was quietly added to the the default home page for visitors to Twitter not already logged into the service.

According to Matt McGee in his recent article for Marketing Land:

Twitter launched the user directory a few weeks ago, but hasn’t made a formal announcement about it. That’s likely because it exists more for search engines than for Twitter users.

Basically, Twitter is aiming to draw people who are searching Google, Bing, Yahoo, etc., for someone in particular. As the bots crawl their way through the new directory, more Twitter profiles should start showing up in search. That’s a step in the right direction, maybe.

Twitter is still struggling with the basic issue of no real reason to spend lots of time hanging out in the Twitter Web space. Users spend the most time on Twitter setting up their profile. Once it’s set, they either build up a personalized twitter stream that they keep track of on a mobile app or some other Twitter client application, or they never really get the point and let the profile languish, unused.

Even when a search result brings a user back to the Twitter domain, the realistic expectation is that they will skim the profile, make a decision to follow or not, and move on.

For those of you who love the news, information, and conversation constantly buzzing through your Twitter stream, what could Twitter do to make its space more appealing? What would it take for you to spend your time interacting with the twitterverse in the Twitter-owned domain?36