September 24, 2018

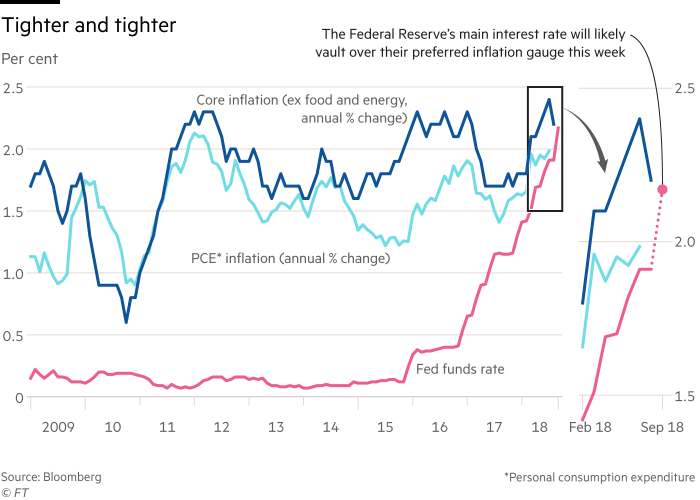

The Federal Reserve’s main interest rate will jump past the central bank’s preferred inflation measure for the first time in a decade this week, when policymakers announce a widely expected rise in interest rates.

The Fed funds rate– the cost of borrowing “excess” Fed reserves overnight, unsecured by collateral by banks and other financial institutions – will rise above the central bank’s favorite measure of the US economy’s inflation rate, the “personal consumption expenditure” index, for the first time since September 2008.

The Fed and central banks around the world slashed interest rates in the wake of the crisis, with some even introducing negative interest rates for the first time in history. But with the economic recovery gaining ground, the Fed started raising interest rates in 2015, and other central banks are now following in tightening monetary policy.

“The question is what rate is high enough to slow the economy,” said Anne Mathias, a senior strategist at Vanguard. “We’ll hopefully know it when we see it.”

The US central bank has increased its interest rate target range twice already this year, to 1.75-2 per cent. That has raised the Fed funds rate – the primary target it attempts to move with its interest rate corridor – to a 10-year high of 1.92 per cent.

Fed raises rates despite trade war concerns The Fed is widely expected to lift its corridor by another quarter percentage points when it meets on Wednesday, and that will probably in tandem lift the Fed funds rate to about 2.17 per cent.

That means that the “real”, inflation-adjusted US interest rate will be in positive territory again, and investors and analysts are now questioning how much further the Fed will raise interest rates.

Indeed, another rate increase in December is widely expected, which will probably lift the Fed funds rate above the ‘core’ inflation rate that excludes food and energy costs. However, opinions differ significantly on how much the central bank will tighten policy in 2019.

“This is the riddle they will have to solve in 2019,” said Jim Caron, a bond fund manager at Morgan Stanley Investment Management. “There’s little danger of an inflationary breakout, so why keep hiking?”

Markets are starting to price in the possibility of two more quarter-point increases in the Fed’s interest rate in 2019. The Fed has indicated that it will raise rates three times, while Goldman Sachs’ economists predict the central bank will have to lift rates four times to prevent the economy from overheating.

The US stock market bet the Fed killed the economy through the October-December 2018 quarter. The real estate economy is contracting because of this.

Read more…