We have just released the first quarter 2013 “Elliman Reports” for Brooklyn, Queens and Westchester; the leading resource on the state of these markets. As always, our market reports are produced in conjunction with Miller Samuel to provide you and your clients with the most comprehensive and neutral market insight available.

The Brooklyn housing market has tightened up quite a bit since last year. Listing inventory has fallen to a five-year low and housing prices have edged up to their highest level since the credit crunch began five years ago. The number of sales fell short of levels a year ago but the negotiability between buyers and sellers has grown closer than we’ve seen in years. We don’t anticipate much relief in supply in the near future, so current conditions are expected to continue in the coming quarters.

Inventory in Queens has fallen to an eight-year low, yet the number of sales increased from prior year levels. Low mortgage rates, a release of pent-up demand, and improving economic conditions have brought more interest to this market. Housing prices have remained remarkably stable, but these tighter conditions have brought buyers and sellers closer together on price. We anticipate more of the same in the coming quarters.

The Westchester market is defined by shrinking inventory–now at its lowest level in four years. While closed sales were higher than last year, signed contracts jumped above last year’s levels promising to make the spring market the most active in years. Housing prices have remained stable for the past several years, but a combination of low mortgage rates, rising activity, and low supply is expected to keep upward pressure on prices in the coming months.

We constantly look for ways to provide our clients with better information to enable them to make more informed decisions. Our efforts to make this market report series possible reflect my strong belief that in a market that is constantly changing, access to timely information is one of the greatest resources we can offer our clients. We are committed to providing the best information and services in the industry. Explore our full market report series covering Manhattan, Brooklyn, Queens, Long Island, The Hamptons, North Fork, Westchester/Putnam, Miami, Boca Raton, Fort Lauderdale and Palm Beach at http://www.elliman.com/marketreports

Warmest regards,

Dottie Herman

President and CEO

Douglas Elliman

*Visit the new, http://www.elliman.com to search from more than 40,000 listings and access all of our current market reports

Tag Archives: Mt Kisco Real Estate

30-Year Fixed Mortgage Rates Down for Second Consecutive Week | Mount Kisco NY Real Estate

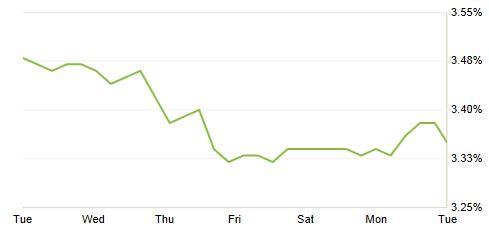

Mortgage rates for 30-year fixed mortgages fell again this week, with the current rate borrowers were quoted on Zillow Mortgage Marketplace at 3.35 percent, down from 3.43 percent at this same time last week.

The 30-year fixed mortgage rate hovered between 3.48 and 3.33 percent for the majority of the week, dropping to the current rate this morning.

“Rates dropped last week after a weaker-than-expected U.S. jobs report on Friday,” said Erin Lantz, director of Zillow Mortgage Marketplace. “This coming week, we expect rates to remain depressed as lingering eurozone concerns and Japan’s new monetary policy push investors to safer asset types like U.S. mortgage-backed securities.”

Additionally, the 15-year fixed mortgage rate this morning was 2.54 percent, and for 5/1 ARMs, the rate was 2.28 percent.

What are the rates right now? Check Zillow Mortgage Marketplace for up-to-the-minute mortgage rates for your state.

*The weekly rate chart illustrates the average 30-year fixed interest rate in six-hour intervals.

Top 10 Social Media Management Tools | Mt Kisco Realtor

Mt Kisco NY Weekly Real Estate Report | RobReportBlog

Mt Kisco NY Weekly Real Estate Report Homes for sale 51 Median Ask Price $699,000.00 Low Price $280,000.00 High Price $4,500,000.00 Average Size 3004 Average Price/foot $317.00 Average DOM 97 Average Ask Price $982,294.00

Mt Kisco Realtor | 3 ways your website should be working for you

Among the converted: Homes that used to be something else | Mt Kisco NY Real Estate

Spring Cleaning for Your Finances | Mt Kisco Real Estate

With spring rapidly approaching and longer, lighter days ahead, you’re likely anxious to renew and refresh. Here are some projects to consider:

Remodel your home

Jump on the remodeling bandwagon! For inspiration, look no further than Zillow Digs (free on iPad and the Web), where you can browse tens of thousands of photos and get estimated costs.

Get new doors/windows

Bonus: If you make energy-efficient improvements, you’ll not only save money long term, but you might additionally qualify for tax credits.

Paint

In many areas of the country, the best days for big painting projects are in the spring, when you can finally open the windows (rejoice!) without cold, uncomfortable drafts coming in. Why not give your home a whole new look with fun, vibrant colors to get you in the spirit for summer?!

Wipe out your closet

Are there things in there that you haven’t worn in two years? You know the rule: Toss! Consider selling to consignment or donating to charity and taking the tax break.

Organize your home office

A survey by Brother International shows that most office workers spend 30 minutes each week hunting for paperwork on a disorganized desk. Having a system will not only save you time and alleviate the stress, but likely save you money, too, as being sloppy typically results in things like late fees, higher interest rates and penalty rate increases.

Related:

Vera Gibbons is a financial journalist based in New York City and is a contributor to Zillow Blog. Connect with her at http://veragibbons.com/.

Note: The views and opinions expressed in this article are those of the author and do not necessarily reflect the opinion or position of Zillow.