Tag Archives: Mt Kisco Homes for Sale

Gas leaks in NYC not uncommon, records show | Mt Kisco NY Real Estate

Natural gas leaks — similar to the one thought to have caused an explosion earlier this month in East Harlem that leveled two buildings and killed eight people — are commonplace, according to federal records.

More than half of the 9,906 leaks in New York City and Westchester County reported to suppliers Con Edison and National Grid in 2012 could have harmed people or property, an analysis of federal data from the Department of Transportation showed.

The danger largely stems from the city’s aging network of gas mains made of leak-prone cast iron, wrought iron or unprotected steel, the New York Times reported.

Replacing the 6,302 miles of pipes won’t be cheap or easy — it could cost upwards of $10 billion, the article said. In traffic-heavy areas like Manhattan, installing new mains would likely cost up to $10 million a mile, according to Con Edison officials. Even if the funds are made available, replacing “vintage” pipes will take as long as 25 years, according to National Grid.

“Accelerated replacement is not the answer to today’s problem; it’s the answer to tomorrow’s problem,” Mark McDonald, who investigates gas explosions for insurance companies and landlords, told the Times. “What needs to be happening is increased vigilance, increased leak surveys to spot these problems before it gets into someone’s house.”

http://therealdeal.com/blog/2014/03/24/gas-leaks-put-nyc-in-perpetual-danger/

Zillow, Trulia Rise as SouFun, E-House Fall | Mt Kisco Real Estate

Real estate information providers were passing ships last week. The winners and losers just happened to literally be a world apart. Stateside darlings Zillow (NASDAQ: Z ) and Trulia (NYSE: TRLA ) rose 15% and 12%, respectively, on the week. Chinese players E-House (NYSE: EJ ) and SouFun (NYSE: SFUN) saw their shares fall by 10% each last week. The double-digit-percentage moves in both directions paint contrasting portraits, but it’s not as good or bad as you might think.

Let’s start with the Chinese sinkers. E-House and SouFun fell as investors retreated out of China’s growth stocks, but if anything, the only substantial news out of the companies was positive.

SouFun, a website operator emphasizing home improvement, furnishings and other real estate topics, should have moved higher after announcing a new ADS-to-share ratio that essentially equates a 5-for-1 stock split. It didn’t.

There was some encouraging news out of E-House on Friday. Tencent’s agreeing to shell out $180 million to E-House for a 15% stake in its previously wholly owned Leju, a provider of real estate online services that E-House is proposing to take public as a stand-alone entity. It didn’t matter. The market just wasn’t interested in Chinese equities.

The market’s reception was far kinder to the real-estate portals toiling away closer to home.

Jim Cramer had some kind words to say about Zillow on Wednesday’s Mad Money show. Zillow also helped make its own luck by introducing a new platform where potential home buyers can get a mortgage provider’s pre-approval letter in just minutes. Zillow claims that this is the first time that this kind of offering — something that will make it easier for aspiring buyers to sway sellers into entering into a sales contract — is being made possible on desktop and mobile platforms.

Trulia announced the residential real estate website’s first national marketing campaign. Trulia is investing $45 million in this “Moment of Trulia” campaign that’s aimed at women between the ages of 25 and 44 and will be promoted across various media platforms.

http://www.fool.com/investing/general/2014/03/24/zillow-trulia-rise-as-soufun-e-house-fall.aspx

Why Home Prices Are Climbing Again, and What You Should Do About It | Mt Kisco Homes

Chances are home prices in your neighborhood have been rising lately. Strangely enough, that only made the news when, for last November, Standard & Poor’s Case-Shiller index of home prices in 20 top cities fell the grand total of 0.1 percent.

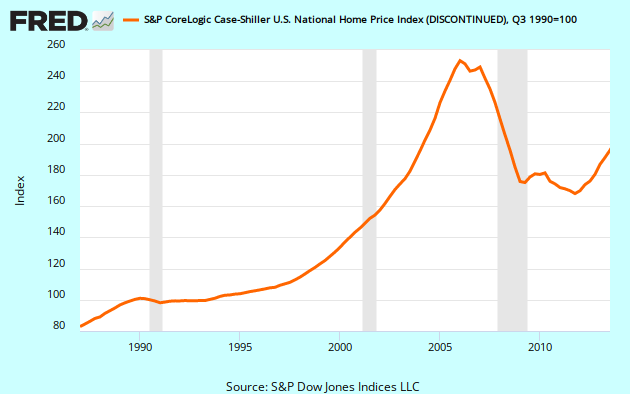

The Federal Reserve tracks a national composite home price index for the country, which looks like this:

Is this good news or bad news to you? That may depend on whether you own your home or not. If not, and you’re saving up to buy, that’s disheartening, as you see your dream slipping out of reach. If you do own, odds are you’re pleased to hear news like this.

Of course, not everyone is sharing equally in this bonanza. Metropolitan centers like New York and San Francisco are experiencing sharper increases, while other locations have more moderate increases or even no increases at all.

Why Are Home Prices Rising? The glib answer would be something like: “Well, it’s about time the market caught up with itself again!” The reality, though, is there is no such thing as normal home prices. When they go up, some complain, saying that’s inflation, pricing newcomers out of the market. On the other hand, when home prices drop, all hullabaloo breaks loose and it’s the end of the world. You can’t please all the people all the time, as the saying goes. Politicians (and the Federal Reserve) have figured out most people want home prices to rise slowly over time, and that’s what they generally have done in the past.

We all know about the housing bubble which engulfed us as the new millennium started, and its subsequent pop. The chart above shows those two events clearly. We know why the housing market crashed: the explosion of the Wall Street collateralized-mortgage-securities debacle.

But why are home prices rising again? Many reasons have been suggested.

What to Know Before You Buy a Sectional | Mt Kisco Real Estate

Even though sectionals are a family-friendly alternative to the traditional sofa and love seat, they’re one of the more polarizing elements in room design. People either love them or hate them. Add to that the available configurations and myriad options (which can be confusing at best, and mind-boggling at worst), and you have a full-blown case of design angst. Let’s take some of the mystery out of sectionals, and help you avoid a costly mistake.

The sectional shown here is composed of a left-arm-facing love seat and a right-arm-facing chaise.

This sectional appears to be made of a left-arm-facing sofa (three seat cushions), a square corner and a right-arm-facing love seat.

Is Homeownership A Smart Investment Again? | Mt Kisco Real Estate

One year ago, Trulia’s Rent vs. Buy Report, released by online real estate aggregator Trulia, found it was 44% cheaper to buy a house than to rent. Today, the gap has narrowed, due in part to rising interest rates and home prices. The newest edition of the report finds that buying a home is now 38% cheaper than renting. The report compares costs for a seven-year period using five calculations:

- The average rent and sale prices for an identical set of properties;

- The initial total monthly costs of owning (assuming 20% down and a 30-year fixed-rate mortgage at 3.5% interest, as well as annual maintenance, insurance, utility, and property tax expenses) and renting (monthly rent plus renter’s insurance);

- The future total monthly costs of owning and renting;

- One-time costs and proceeds (for owning, this includes closing costs and capital gains tax of 15% for gains above the $500,000 annual exclusion; for renting, this includes one month’s security deposit); and

- The net present value to account for opportunity cost of money (this compares cash flows over time).

According to the report, homeownership remains cheaper across the nation and in all of the 100 largest metro markets. However, these findings speak broadly to the national market, and there are several situations where it still makes more sense to rent. Here, we look at some of the reasons why it’s a good time to buy for many Americans, and circumstances when it might make more sense to rent.

Reasons to Buy

Peggy Jennings, a Broker/Realtor with Prudential Great Smokys Realty in Sylva, North Carolina, cites favorable interest rates, good inventory and relaxed loan requirements as good reasons to buy now. “Interest rates are still good. The inventory is improving as more people are deciding it’s time to sell. There’s going to be a lot of good inventory coming up, especially since the foreclosures from a couple years ago are now rehabbed and ready to sell,” says Jennings.

Rain Will Turn To Snow Late Wednesday In Mount Kisco | Mt Kisco Homes

Rain is expected to fall much of the day across Westchester County, but as temperatures drop, it will turn to snow late Wednesday as yet another winter storm makes its way to the Northeast, the National Weather Service said.

Westchester will be spared the wrath of the storm, which is expected to drop as much as 18 inches of snow across northern New England.

The storm will begin as rain Wednesday, mainly after 4 p.m., with about a quarter of an inch possible. High temperatures will approach 50 degrees.

Rain and snow showers are expected Wednesday evening, becoming all snow after midnight. Some thunder is also possible.

Snow accumulations of 1 to 2 inches are possible in Northern Westchester. Less than half an inch is expected in Central and Southern Westchester.

Temperatures will drop into the mid-teens overnight with blustery southeast winds of 13 to 18 mph becoming northwest at 19 to 24 mph after midnight.

Dutchess County is under a Winter Weather Advisory from 6 p.m. Wednesday to 11 a.m. Thursday. The warning does not extend as far south as Westchester County. But it warns of sleet and freezing rain as well as a flash freeze overnight as temperatures fall.

http://mtkisco.dailyvoice.com/news/rain-will-turn-snow-late-wednesday-westchester-county

Mt Kisco Real Estate Report

| Mt Kisco NY Weekly Real Estate Report | 2/27/2014 | |

| Homes for sale | 38 | |

| Median Ask Price | $750,000.00 | |

| Low Price | $339,000.00 | |

| High Price | $4,900,000.00 | |

| Average Size | 3136 | |

| Average Price/foot | $326.00 | |

| Average DOM | 107 | |

| Average Ask Price | $1,059,995.00 | |