Astorino Proposes 2014 Westchester Budget With No Tax Increases | The White Plains Daily Voice.

Tag Archives: mount kisco ny real estate

DIY Garden Lights | Mount Kisco Homes

Reuse plastic bottles to make these easy, elegant DIY garden lights that cost almost nothing.

After you’ve gathered the materials and tools, it takes only about 10 minutes to put together this garden light for your property.

Step 1: What You Need

Materials and tools you’ll need to make one DIY garden light:

- One plastic bottle (A translucent bottle works well; you can reuse plastic bottles that originally held laundry detergent or fabric softener.)

- One old bicycle inner tube, or at least 6 rings cut from an inner tube

- One broomstick, as long as you prefer

- Pair of scissors

- Small hacksaw

- Tea light (small candle in an aluminum container)

Step 2: Sawing

Use the hacksaw to cut off the bottom of the plastic bottle as well as a thin slice off the top of the cap.

Step 3: Quarters

Make four long cuts with the scissors along the corners of the plastic bottle.

Step 4: Petals

Shape the four parts from Step 3 into leaves by trimming off the rounded corners.

Step 5: Cap Adjustment

Unscrew the cap from the plastic bottle. If there’s an inner ring on the bottom of the cap, remove it with the hacksaw. The goal is to make the cap flat — and open — on the underside.

Step 6: Big Match

Cut six rings from the bicycle inner tube. Pull the rubber rings over the end of the broomstick, one at a time, so that they cover each other and form a layered gasket. Make sure the broomstick’s end has been built up with enough rubber layers so that the bottle cap can be pushed on only with some effort. You may need to cut more rubber rings if the seal is too loose.

Read more: http://www.motherearthnews.com/diy/plastic-bottle-garden-lights-zboz1309ztri.aspx#ixzz2kiv0ie9F

Bed-Stuy eyed as next Williamsburg | Mt Kisco Realtor

A brokerage firm born 11 years ago in a once coming Brooklyn neighborhood called Williamsburg is opening an outpost in another area where it sees loads of potential, Bedford Stuyvesant.

Aptsandlofts.com recently inked a lease for 2,000 square feet on the ground and second floors at 308 Malcolm X Blvd. between MacDonough and Decatur streets. It will be the broker’s third office in the borough, the second having opened just last year in Cobble Hill.

“I’m seeing in Bed-Stuy what I saw happen in Williamsburg in 2002,” said David Maundrell, founder and president of the firm. “We’ve been working out there for a very long time.”

As low inventory and high costs push more prospective buyers and renters into Bed Stuy, sales transactions have been heating up, according to Mr. Maundrell. For example, he has seen families move into the neighborhood and plunk down $1 million to convert a three-family home into one just for themselves, something that would have been unheard of just a few years ago.

The neighborhood is home to a diverse housing stock, including blocks of brownstones that Mr. Maundrell said are more reminiscent of Cobble Hill, which has also been attracting a steady increase of buyers.

Aptsandlofts.com is far from the only brokerage doing business in Bed Stuy. The city’s biggest residential firms, among them Douglas Elliman, Corcoran, Halstead Property, and Brown Harris Stevens all have numerous Bed Stuy listings. What they don’t have, however, is an office there. Instead, Aptsandlofts will compete head to head in Bed Stuy with a number of smaller home-grown brokerages. Mr. Maundrell said he hopes to offer something in between.

http://www.crainsnewyork.com/article/20131112/REAL_ESTATE/131119972

Hong Kong Luxury Property Prices Choked by Tightening | Mt Kisco Real Estate

Hong Kong businessman Raymond Chiu says he has perfect credit and is prepared to spend about HK$16 million ($2 million) on a 1,000-square-foot apartment in the city’s Mid-Levels residential area. There’s just one catch. The government requires a 50 percent down payment.

That’s “really putting us off,” said Chiu, 45, who owns an information technology consulting company. “I run a business so cash flow is important. It’s frustrating because this is non-negotiable, though I have perfect credit history.”

Prices of high-end apartments, defined as those larger than 1,000 square feet or costing at least HK$10 million, have gained less than the broader market since the second half of 2012 as buyers in Chiu’s price bracket have been hardest hit after the government raised minimum down payments six times over less than three years as part of curbs to make homes more affordable.

The slowing price growth in high-end apartments is the first sign that efforts to temper rampant speculation that has fueled a surging housing market are working even as it stings luxury developers and potential homebuyers. Broker Cushman & Wakefield Inc. forecasts that prices of homes valued at more than HK$10 million will fall about 3 percent in the fourth quarter, extending a 3 percent drop so far this year, while those selling for less will be little changed.

“The luxury segment has taken the first and the most direct hit,” said Buggle Lau, chief analyst at Midland Holdings Ltd., Hong Kong’s biggest realtor by branch numbers. “The measures were aimed at driving the speculators away and they have certainly achieved that, but many people wanting to buy for their own use are also affected.”

World’s Highest

An influx of wealthy buyers from mainland China, mortgage rates close to record lows and a financial-services sector that has thrived thanks to fundraising by Chinese companies helped fuel a 250 percent increase in luxury-home prices from 2003 to the beginning of 2012, outpacing the 150 percent gain in mass-market homes, according to statistics compiled by Savills Plc. The London-based broker defines luxury homes as those with at least 1,000 square feet (93 square meters) or value of at least HK$15 million.

Hong Kong home prices are the world’s highest in a Savills survey of 10 cities, including London, New York and Tokyo. The value of luxury properties will drop as much as 5 percent in the second half after a 3.2 percent decline in the first three months of the year, according to Savills. Prices in the mass market will see no change after increasing 1.7 percent in the first six months, the broker said.

Luxury Projects

Sun Hung Kai Properties Ltd., a developer of luxury residential projects, plans to build more, smaller apartments because of a change in buyers’ appetites, Victor Lui, the company’s deputy managing director, said in September. The company, one of Hong Kong’s two-biggest developers by market value, reported lower profit from sales for the year ended in June.

There were about 86,000 luxury homes — or units of at least 100 square meters (1,076 square feet) — in Hong Kong at the end of 2012, according to statistics from the government. That represents about 7.7 percent of private homes in the city. About 24 percent of the 10,149 new homes completed by developers in 2012 were larger than 100 square meters, government statistics show.

The gap between the top end of the market and the cheaper bracket narrowed last year as the government’s mortgage tightening started to impact the luxury segment. Prices of mass-market homes rose 20 percent in 2012, almost double that of luxury homes, according to Savills. Prices of luxury homes began to decline after the government in October 2012 slapped a 15 percent tax on all non-resident buyers as it sought to stem the inflow of Chinese capital into the property market.

Chinese Buyers

“For a while, Chinese buyers were the main driver for luxury homes,” said Thomas Lam, Hong Kong-based research director at broker Knight Frank LLP. “When you raise buying costs for them, of course it takes away a large part of the demand.”

Mainland Chinese buyers accounted for an estimated 8 percent of private home sales in the city, a former British colony returned to Chinese rule in 1997, in the third quarter of this year, down from a record 25 percent in the fourth quarter of 2011, according to Centaline Property Agency Ltd. Since October 2010, the Hong Kong Monetary Authority, the city’s de-facto central bank, has raised the minimum down payment required for home purchases over HK$10 million to as much as 60 percent from 30 percent, and to 50 percent for those from HK$7 million to HK$10 million. The most recent round took place in February.

Mortgage Rules

That month, the government doubled stamp-duty taxes for all properties over HK$2 million, with new tax rates ranging from 1.5 percent for properties valued below HK$2 million, to 8.5 percent for those priced above HK$21.7 million.

“The extra stamp duties and mortgage rules are like progressive taxes,” said Vincent Cheung, Hong Kong-based national director of valuation at Cushman & Wakefield. “The higher the property value, the higher the tax rates and the tighter the mortgage rules. Of course this would impact luxury properties the most.”

Hong Kong’s government won’t cut back property curbs until there’s a “steady supply” of new housing, Chief Executive Leung Chun-ying said in June.

There were 607 sales of homes worth over HK$12 million in the third quarter, according to statistics compiled by Centaline. The number is the lowest since the first quarter of 2009, according to the Hong Kong-based realtor.

http://www.bloomberg.com/news/2013-11-10/hong-kong-luxury-property-prices-choked-by-tightening.html

City Unveils Designs For Midtown’s East River Greenway | Mt Kisco Realtor

Midtown East residents, long envious of the lush riverfront parkland their West Side counterparts enjoy, got a sneak peek of the design plans for the East Side waterfront esplanade at last night’s Community Board 6 land use committee meeting. The project is part of a plan to complete the Manhattan Waterfront Greenway (which surrounds the borough) by filling in the undeveloped gap between East 38th Street and East 60th Street along the East River. The esplanade, which is created to appear as if it’s floating on top of the water with 30 feet separating it from the bulkhead, will have two distinct paths: one for bike riding, the other for pedestrian traffic. Cali Kay Gorewitz, Vice President of Development at NYC Economic Development Corporation explained that at certain points, the material used for the ground will allow pedestrians to see through to the water below “raising the uniqueness of the site.”

NYCEDC has been working with community work groups to decide on other design aspects. Together they’ve come up with a plan that divides the esplanade into three sections: one running from East 38th to East 41st Street, the next from East 41st to East 53rd Street, and the third from East 53rd to East 60th Street. Planters and trees will run along the entire length, and there will be three major gathering places called nodes, each having “its own personality” said Ama DuSolier, lead designer for AECOM, the company contracted to design the esplanade.

The first node scheduled to open in 2015 is a waterside pier, which will be constructed from an old pier Con Edison formerly used for fuel deliveries. It will center on active recreation and include places to eat and socialize. Another section, called the ribbon, will focus on walking, biking, planting and seating. The 48th Street node will facilitate gatherings like outdoor shows and will have amphitheater seating, while the 53rd Street area will focus on environmental education and incorporate places to fish. All of the nodes are designed to be multi-functional.

In a post-Sandy world, thought also went into ensuring the esplanade will be able to withstand stronger storms. It will be built three feet higher than the 100-year flood line, which is about six and a half feet (Sandy’s storm surge was 13 feet) and six to eight feet above the FDR Drive.

[Looking north on the esplanade]

[Looking north on the esplanade]

Community reaction to the design renderings was largely positive, with some residents calling them “wonderful” and “lovely.” Joan Boyle, a 19-year resident of East Midtown, called the plans “gorgeous” and is looking forward to having a place where people could walk a dog, ride a bike, or just walk along the riverfront. But Boyle was concerned that the promises of a beautiful esplanade for the neighborhood would never come to pass. While “it’s wonderful to look at this,” she said, “I expect it won’t ever happen.”

[Cross-section showing the esplanade dimensions]

[Cross-section showing the esplanade dimensions]

True enough, considerable hurdles remain. The project is relying on anticipated funding by a United Nations deal. A Memorandum of Understanding between the city and the state allowed for the use of a portion of the Robert Moses Playground for a new UN building. In exchange, the United Nations Development Corporation agreed to pay the city $73 million toward the esplanade. However, Gorewitz estimates the full cost of the project to be about $200 million, so the sale of other property currently leased by the UN will be necessary to complete it.

Next steps for this project include filing permits with Department of Environmental Conservation, Army Corps of Engineers, and the Coast Guard which are expected to take 12-18 months to get approved. In the meantime, as part of the Memorandum of Understanding, Asser Levy Place (the two blocks between East 23rd and East 25th Streets) has closed to traffic and will be turned into a park. It’s expected to open to the public next year.

—Kizzy Cox · Manhattan Waterfront Greenway [nyc.gov] · East River Waterfront coverage [Curbed] · Robert Moses Playground coverage [Curbed]

http://ny.curbed.com/archives/2013/11/07/city_unveils_designs_for_midtowns_east_river_greenway.php

Mt Kisco NY Weekly Real Estate Report | #RobReportBlog

| Mt Kisco NY Weekly Real Estate Report | 11/6/2013 | |

| Homes for sale | 47 | |

| Median Ask Price | $575,000.00 | |

| Low Price | $225,000.00 | |

| High Price | $3,950,000.00 | |

| Average Size | 2788 | |

| Average Price/foot | $322.00 | |

| Average DOM | 133 | |

| Average Ask Price | $972,195.00 | |

Homes near cemeteries: Do they sell? | Mount Kisco Homes

With Halloween quickly approaching, Redfin was dying to know: Do homes near cemeteries sell for more or less than homes farther away from cemeteries? Would a drop-dead-gorgeous home take longer to sell if the view includes tombstones? Would a home shopper have grave concerns about a home near a cemetery, or would the quiet neighbors be a selling point? We dug into the data to find out.

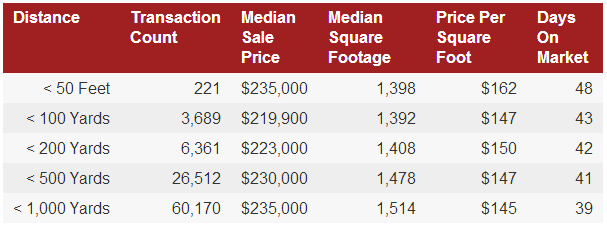

Redfin analyzed the price of homes less than 50 feet from a cemetery and compared those to the price of homes less than 100, 200, 500 and 1,000 yards away. The numbers indicate that on average, homes near cemeteries are slightly smaller, but they sell for more per square foot. On average, homes closest to cemeteries sold for $162 dollars per square foot, whereas the homes located more than 500 yards away sold for $145 per square foot.

“I have a current listing that backs up to a cemetery, and 10 to 15 people have toured the home. One potential buyer provided feedback that it was a deal breaker, but that is just one of many. In my opinion, cemeteries make very quiet neighbors,” said Blakely Minton, a Redfin real estate agent in Philadelphia.

“Like everything with homebuying, there are pros and cons to living near a cemetery. The pros are that most likely there would be no chance of future development on the site of a cemetery, there is usually well-maintained open space, it’s quiet and many cemeteries are picturesque. The cons would be that cemeteries give some people an uneasy feeling, as it represents mortality, and it might not be an area they want to ‘live’ next to everyday,” said Lynn Ikle, a Redfin real estate agent in Baltimore.

The analysis also reveals that homes adjacent to cemeteries take longer to sell on average. Those located less than 50 feet away took 48 days to sell, whereas those located more than 500 yards away took 39 days to sell. Based on the analysis, homes near cemeteries sell for more money, but it may take longer to find the right buyer.

“Having a home right next door to a cemetery may make it more difficult to sell. There will always be a group of people who might love all of the specifications of the house, but the ‘creepy’ factor may prevent them from even touring the home. Having fewer folks tour a home could lead to a home staying on the market longer,” said John Malandrino, a Redfin real estate agent in Chicago.

Not all cities are the same when it comes to the number of cemeteries located within city limits and the number of homes built around them. Redfin evaluated 90 metropolitan areas across the nation to find the five cities with the most homes for sale near cemeteries. The analysis looked at homes for sale as of Oct. 15 that were less than 100 yards from a cemetery. Some of the nation’s oldest cities topped the list:

1. Baltimore

Homes for sale near cemeteries: 172 Median list price of those homes: $101,950

“It doesn’t surprise me that Baltimore tops the list, because it was founded back in the early 1700s,” Ikle said. “Our neighborhoods here are very well-established, and cemeteries were part of the landscape during their development.”

2. Philadelphia

Homes for sale near cemeteries: 157 Median list price of those homes: $134,900

“Since Philadelphia was one of the first major settlements in the U.S., there are cemeteries scattered throughout the city,” Minton said. “I had one friend who moved into a home with a cemetery right behind it. One day, she came home with her hands full of groceries and nearly hit the floor with food flying when she heard a gun shot outside. It turns out that the cemetery was for veterans, and it was a military salute.

“The type and size of cemetery is something to consider when deciding on a home by a cemetery, but in my opinion, the reminder of how precious life can be is a positive, not a negative.”

3. Chicago

Homes for sale near cemeteries: 115 Median list price of those homes: $229,900

“With buildable land at a premium, especially in and around the downtown Chicago area, builders have built and will continue to build in close proximity to cemeteries,” Malandrino said.

4. Boston

Homes for sale near cemeteries: 50 Median list price of those homes: $711,809

“The main reason Boston has so many cemeteries is because it has so many churches. Nearly all of the older churches in the greater Boston area have large cemeteries attached to them. These churches are frequently located in residential neighborhoods, so people could walk to church events,” said Peter Phinney, a Redfin real estate agent in Boston. “Churches were not only the center of worship, as they continue to be, but also the center of cultural events and social gatherings. It was only natural for people to want to be buried in their neighborhood next to the church, so homebuyers in the Boston area have made their peace with having a cemetery nearby. In fact, many welcome having the green space.”

http://realestate.msn.com/blogs/listed-buy.aspx?post=5c37386d-9625-4935-974f-33ed9e917554

The 10 Most Annoying Types of People on Facebook | Mt Kisco Realtor

Social media amplifies humanity.

Have you ever been to a barbecue and had to listen to someone prattle on about themselves for hours? Attended a cocktail party and had the most intriguing conversation with a tall dark stranger? Been invited to a friends place and viewed so many baby photos that you felt compelled to have a vasectomy!

Facebook, Twitter and social media take those conversations and multiply it via the crowd. Facebook is insights, conversations and news on steroids.

It is a reflection of what makes us human, except that it is visible to billions of people. We are different, fun and sometimes boring. It is a kaleidoscope of emotions, events and the bizarre. That’s why we tune into Facebook. Its a voyeur’s paradise. Never dull and often entertaining.

So what entices us to reveal our lives online? Is it narcissism, vanity or just wanting to get something off our chest. Annoyance is noticed and often shared.

Here are the results of a fun survey to find the 10 most annoying types of people on Facebook.

Infographic source: Lovemyvouchers.co.uk

Who and what annoys you on Facebook?

Read more at http://www.jeffbullas.com/2013/10/15/the-10-most-annoying-types-of-people-on-facebook/#88WiemX4jwB425JI.99

Video Shows Alleged Newspaper Swap Incident In Mount Kisco | Mt Kisco Homes

A video released today appears to show a distributor of the Hudson Valley Reporter swapping copies of that newspaper with The Examiner in an alleged incident that occurred on Friday at the newspaper racks outside the Mount Kisco Coach Diner.

The video link was provided to The Daily Voice by Adam Stone, the publisher of The Examiner, and was compiled by Matt DiBiase, a private investigator hired by Stone from Mahopac-based Colonial Investigative Associates. (The alleged incident occurs at the beginning of the 31-minute, 45-second video, which later includes the arrival of a police officer to investigate at about the 20-minute mark.)

Jim Palmer, the Mount Kisco village manager, confirmed to The Daily Voice on Friday that Michael Espinoza was arrested at approximately 6 a.m. that day and charged with criminal tampering.

The arrest has attracted national attention. Gawker linked to The Daily Voice’s original story.

Hudson Valley Reporter publisher Faith Ann Butcher referred inquiries regarding the alleged incident to her Carmel-based attorney, Raymond Cote, when she was contacted by The Daily Voice on Friday. Cote said it was too early in the process to comment.

http://mtkisco.dailyvoice.com/news/video-shows-alleged-newspaper-swap-incident

How The Shutdown Is Hurting The Housing Market | Mount Kisco Real Estate

As with so many other types of economic activity, the government shutdown is causing more fear than actual harm in the housing market thus far.

But that doesn’t mean things won’t start going wrong in the very near future.

Various federal agencies play greater or lesser roles in real estate transactions. With most of them sidelined, simple matters such as closing on mortgages are becoming more complicated.

“It’s going to add up pretty quickly, because loans can’t be closed in many cases,” says Mark Zandi, chief economist for Moody’s Analytics, a financial research organization. “The damage is going to start to mount and in a few days it’s going to be a significant problem for the housing market.”

The market, which had grown more robust over the past couple of years, was starting to cool off this fall anyway, due to rising prices and interest rates.

If interest rates go up due to the fear or reality of a debt default — and the costs for short-term treasuries are already starting to spike — that would have major consequences for real estate sales.

“This government shutdown, which is an artificial obstacle to the recovery, is clearly not a good thing,” says Lawrence Yun, chief economist for the National Association of Realtors.

What’s Not Working

Anyone who has purchased or refinanced a house knows a lot of paperwork is involved. The tall stack of forms that buyers and sellers sign at closings is largely generated or required by federal agencies that may now be temporarily out of the game.

Still, real estate agents and mortgage lenders have thus far been able to work their way around many of the hurdles put up by the partial government shutdown.

http://www.npr.org/2013/10/08/230467533/how-the-shutdown-is-hurting-the-housing-market