Your B2B firm trumpets its engaged, active customers. These customers, the sweet center of any successful business, generate a significant portion of your firm’s revenue. These same customers serve as references; speak at industry conferences; share ideas and feedback about your company. When they broadcast positive feedback (public or private), that precious message makes the rounds in your firm’s C-suite. In return, these customers will be thanked with some great company swag in appreciation … maybe even be featured on your company’s website.Is that all? Really?With all that back-and-forth communication, how often do customer suggestions and ideas actually make a difference in your company? More specifically, how often does what your customers say to your firm about your company’s processes, products or services serve as a catalyst for real change in your operations? I thought so. But really, how could it?Many large organizations have created what I like to call a “Social Media Muddle.” They have a plethora of social media tool experiments underway: newsletters and blogs for customer communications, twitter and Facebook for customer interaction, LinkedIN for promotions, sometimes even an online customer community to provide all of the above and more. But … all these different social outreach and listening opportunities are run by different departments, and are completely and utterly divorced from core operations and processes. Product development, customer care and R&D most likely do not have direct access to information they crave – the voice of the customer.So while your social customers are actively sharing information about their needs in many places – public and private, online and offline – your company keeps on keeping on, just doing things according to plan. A plan that is not adjusting and adapting to ever-changing customer needs.

Tag Archives: Katonah NY Real Estate

Mortgage rates expected to mostly stay put in 2013 | Katonah NY Real Estate

4 Reasons to Convert Your Facebook Business Profile into a Page | Katonah NY Realtor

Have you ever gotten a Facebook friend request from something other than a person? I have… several times… recently. There are countless businesses operating in Facebook as user profiles rather than pages. In the early days, those enterprising business owners that could see serious potential in Facebook had no option but to launch a profile for their business. Over the years the connections have brought success, so there is little motivation to change a good thing. Lots of small business owners have only had time and energy to learn their way around a profile, so they stick with what they know and understand when it comes to their Facebook presence. Whatever the reason may have been to launch a business profile, there are 4 very huge reasons to make the switch to a business page.

Reason #1: You are in violation of the Facebook user agreement and run the risk of losing access to all of your hard work.

Here it is as stated on the Facebook Help page:

Maintaining a personal account for anything other than an individual person is a violation of Facebook’s Statement of Rights and Responsibilities. If you don’t convert your noncompliant account to a Page, you risk permanently losing access to the account and all of its content.

Exact wording from the Statement of Rights and Responsibilities:

Registration and Account Security

Facebook users provide their real names and information, and we need your help to keep it that way. Here are some commitments you make to us relating to registering and maintaining the security of your account:

- You will not provide any false personal information on Facebook, or create an account for anyone other than yourself without permission.

- You will not create more than one personal account.

- If we disable your account, you will not create another one without our permission.

- You will not use your personal timeline primarily for your own commercial gain, and will use a Facebook Page for such purposes.

- You will not transfer your account (including any Page or application you administer) to anyone without first getting our written permission.

- If you select a username or similar identifier for your account or Page, we reserve the right to remove or reclaim it if we believe it is appropriate (such as when a trademark owner complains about a username that does not closely relate to a user’s actual name).

Facebook does have a way to convert a profile to a page, enabling you to keep your user name and connections and not start again from scratch. If this first reason is enough for you, scroll down to the bottom of the post for all the links and info you need to start converting to a business page.

Reason #2: You have no way of tracking your effectiveness on a profile.

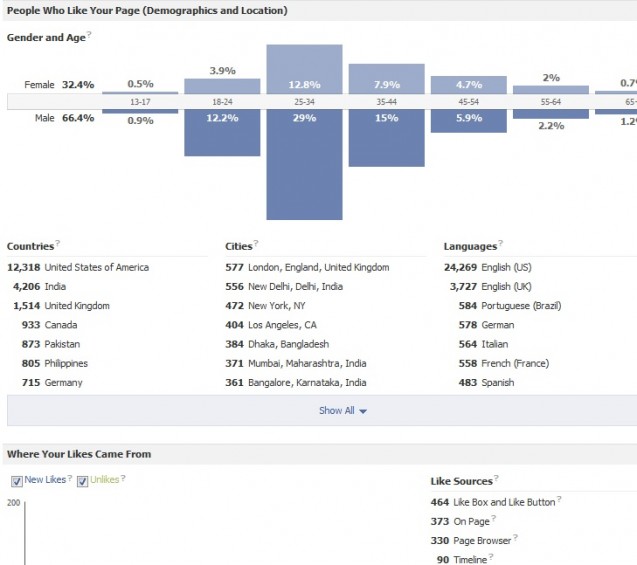

How many people like your business is only the beginning. To get the most out of the time and effort you put into Facebook, you need to be able to determine the makeup of your fan base, their consumption habits, and how well your message propagates beyond the people you are directly connected to. Since Pages are designed for business use, they come with tons of data not available to a user profile. The page “Insights” provide up to date information about what kind of interaction and reach each post on the page timeline generated. Insights will break down your fan base by gender, age, location, and how they came to land on your page. This kind of data enables you to stop shooting in the dark and serve up content that keeps your business connections buzzing.

Reason #3: Your profile has no access to advertising and promotion.

Facebook’s billion users is a huge draw for any business looking to expand their customer base. But reaching the right people at the right time is tricky. A user profile is designed for personal one on one relationships and was never intended to reach large groups of people. The most powerful tool offered by Facebook for reaching it’s vast user base is advertising and promotion. That tool is only available to business pages. If you want to reach Facebook users that you do not already have some connection to, you need to break free of the profile and get access to the business promotional tools.

Reason #4: You will miss out on Graph Search opportunities.

Facebook search will fundamentally change the way users navigate the topics and connections that interest them most. Soon users will be able to search for restaurants their friends like. But if you are interacting with your Facebook connections as a “friend” with a user profile rather than a restaurant with a business page, you could wind up pointing your friends to other restaurants rather than their friends pointing them back to your business. So long as you operate you business on Facebook as a user profile, your business will be defined by search as a friend. In order for new people to discover your business via Graph Search, you need your business on a page that people can “like.”

So, how do you convert your profile to a business page?

Here is the basic info from Facebook Help:

When you convert your personal account to a Facebook Page, we’ll transfer your current profile picture and add all your friends and subscribers as people who like your Page. Your account’s username will become the username for your Page, and the name associated with your personal account will become your Page’s name. If you want your Page to have a different name, consider creating a new one.

No other content will be carried over to your new Page, so be sure to save any important content before beginning the conversion:

- Download your timeline information. You can download a file that contains all of your sent and received messages and all of the photos and videos you’ve uploaded to Facebook.

- Appoint a new group admin to any groups you manage. You’ll be unable to manage groups once the conversion begins.

When you’re ready, start converting your personal account to a Facebook Page.

How the Crash Battered America’s Housing Stock | Katonah Real Estate

Spending on home improvements and repairs totaled $275 billion in 2011, down 4 percent from 2009 levels and some 16 percent below the market peak in 2007. Loss of home equity with the onset of the housing crash contributed to the decline in home repairs, according to a new study by the Harvard Joint Center for Housing Studies.

With the decline in spending on discretionary projects, home improvement expenditures per owner in 2011 stood well below levels averaged over the previous decade. In fact, per-owner spending fell from about 25 percent above the decade average in 2007 to about 10 percent below that level in 2011,

Near the top of the list of causes for the decline in home improvement spending is the loss of home equity resulting from the unprecedented plunge in house prices during the housing crash. After several years of strong house price appreciation, homeowners nationwide had almost $13 trillion in equity in 2006, or almost $170,000 per owner on average. By 2011, however, aggregate home equity had dropped by half to $6.5 trillion, or $87,000 per owner.

Since home equity is a major source of wealth for most owners, sharply lower house values make owners feel less wealthy and therefore less likely to spend in general and on improvements in particular. And with less equity available and credit still tight, households are finding it more difficult to get financing for projects. In 2011, owners with under 20 percent equity in their homes spent about 22 percent less on average on home improvements and about 30 percent less on discretionary projects than owners with at least 20 percent equity. In fact, owners with some but less than 20 percent equity spent about the same as those with zero or negative equity in that year. Owners without mortgages-primarily older owners-also spent about the same as owners with less than 20 percent equity.

In 2011, the Harvard study found that more than a million distressed properties came back onto the housing market, including 760,000 lender-owned units and 300,000 short sales. Lenders improved about a third of their foreclosed properties prior to sale, with an average expenditure of about $6,500 per unit. About 60 percent of owner-occupant purchasers undertook improvements, averaging $11,100, while investors spent even more per unit on average than either lenders or owner-occupants, $15,600.

The Harvard study also noted the role investors are playing turning foreclosures into affordable rentals. Some 4.4 million formerly owner-occupied units were shifted to the rental market between 2007 and 2011. Another 4.6 million were vacant in 2011 and may become part of the rental stock as demand continues to grow.

The unexpected investor expenditures to improve the quality of America’s single family housing stock came as the nation began to experience what the Harvard study calls an “uptick” in the deterioration of housing quality at the outset of the housing crash. In 1997, 4.4 percent of owner-occupied homes were considered inadequate, the study said. By 2007, these same units accounted for almost 8 percent of homes that were no longer owner-occupied (i.e., stood vacant or were converted to rental or nonresidential uses), indicating their increasing deterioration. Even more telling is that these inadequate units accounted for almost 17 percent of the homes that were demolished within the decade.

The study also tracked lender spending to restore REO properties for sale. During the housing downturn, the plunge in house prices precipitated a wave of foreclosures in many metropolitan areas. The foreclosure process often takes years to complete, wreaking havoc on mothballed and backlogged properties. But once foreclosure is completed, banks and other institutions typically invest in repairs to get the homes ready for sale and back into active use.

According to Joint Center estimates, lender expenditures on distressed properties amounted to $1.7 billion in 2011, with Atlanta, Las Vegas, Orlando, Phoenix, and Riverside posting the highest shares of spending . Local housing market conditions dictate the average amount that banks and institutions expend to prepare distressed properties for the market. In 2011, lenders invested considerably more per property in higher-priced markets such as Denver, Los Angeles, Portland, Raleigh, and Washington, DC. In large measure, this disparity reflects the fact that properties in these markets often need to be in better condition to sell at a competitive price within a reasonable amount of time.

By comparison, in depressed Rust Belt metros such as Cleveland, Detroit, Milwaukee, and Pittsburgh, improvement spending per REO property was less than a third of outlays in more competitive markets.

“Renovating foreclosed or abandoned homes benefits the entire neighborhood. Joint Center research has shown that home prices in neighborhoods with higher levels of improvement spending appreciate more rapidly, explaining why investing in blighted neighborhoods has been a national priority in dealing with the foreclosure crisis,” said the report.

Florida officials tackle foreclosure crisis | Katonah Real Estate

Tight market forces pushing real estate market in Pasadena region | Katonah Real Estate

Home prices in Pasadena rose last month, reflecting an ongoing trend in which a dwindling number of homes on the market has sparked bidding wars that drive up prices, according to the latest real estate figures.Despite the trend, median prices in surrounding communities did not fare so well.

The median price of a single-family home in Pasadena was $599,000 last month, an 11% climb from $538,000 in December 2011, according to statistics compiled by Realtor Keith Sorem with Keller Williams Realty in Glendale.

The median price of a condominium also increased slightly, from $400,000 in December 2011 to $404,000 last month.

Meanwhile, the number of single-family homes on the market continued to slide. There were 115 homes on the market last month, a 54% tumble from the 249 homes a year ago.

Condos saw a similar decline, from 174 in December 2011 to 99 last month — a 43% drop.

But in San Marino, the median price of a single-family home fell nearly 17%, from $1.81 million in December 2011 to $1.51 million last month.

Only eight homes were for sale in San Marino last month, a roughly 58% drop from the 19 on the market the year prior.

Median prices also slid in South Pasadena, with the median price for a single-family residence falling from $915,000 in December 2011 to $894,000 last month. The median price of a condo fell by 23%, from $530,000 to $405,000.

There were 15 homes for sale in South Pasadena last month, a 28% decrease from 21 a year ago. And only one condo was on the market last month, down from 11 in December 2011.

—

Follow Daniel Siegal on Google+ and on Twitter: @Daniel_Siegal

Elliman Reports Long Island Sales Up for 2012 | Katonah NY Realtor

‘In the final quarter of 2012, Long Island inventory fell to its lowest level in seven years. The market continued to gain momentum towards the end of the year, evidenced by the fact that there was a larger increase in signed contracts than in closed sales this quarter. In fact, Long Island finished 2012 with more sales than in 2011, the first year-over-year increase since 2006 and a clear sign that the market has finally turned the corner. We are excited about the improving conditions and expect to see an even better market in 2013.’ elliman.com reports

Florida officials tackle foreclosure crisis | Katonah Real Estate

It was deemed America’s new foreclosure capital in 2012, with a 53% increase in filings last year, but Florida officials wanted a change. So they took the bull by the horns.

Attorney General Pam Bondi, joined by the state’s Senate President Don Gaetz and House Speaker Will Weatherford, addressed a newly approved $60 million program for housing aid in Florida on Thursday.

The program, part of the multibillion-dollar national settlement that included cash payments to states, will fund homebuyer assistance, legal aid and foreclosure prevention.

“This is real relief for real people,” Bondi noted.

Florida’s total monetary benefits are over $8 billion in the settlement, with the $60 million in housing aid just one part of a larger settlement.

Broken down, the $60 million program includes $35 million for down payment assistance, $10 million for foreclosure counseling, $5 million for foreclosure backlog reduction, $5 million for legal aid and another $5 million for attorney general’s legal fees.

“We all know, living in Florida, we have been affected by the mortgage foreclosure crisis that has been in the state of Florida more so than just about any other state in America,” said Weatherford. “This has been a long time coming, to know that $8 billion of resources has come to our state to aid people in need, but more specifically the $60 million that we’ve agreed to in the last week that’s going to help people with counseling, with down payment assistance, etc.”

Florida homeowners received billions of dollars worth of direct mortgage assistance from banks. “Almost 50,000 Floridians have received at least $73,000,” said Bondi. “That’s a lot of money.”

Bondi said $200 million is still going through the legislative process and remains to be spent.

Bondi also took the opportunity to address those who faced wrongful foreclosure, but have yet to file a claim. This group respresents approximately 49% of the harmed homeowners in the state.

The Attorney General urged those who have yet to make their claims to follow up by visiting myfloridalegal.com to redeem the money they are owe.

Eurozone Flops Drag Down Global House Prices | Katonah Realtor

The flagging Eurozone is blamed for weighing down global house prices.

By the end of September 2012, house prices were only 5.2% above the lows recorded in the wake of the global downturn in 2009, says global real estate firm Knight Frank.

They say that stalling house prices in the Eurozone’s 17 countries are dragging down the global average and as a result, prices fell by 1.8% in the year to September 2012.

The figures hide some poor performing economies – sluggish Ireland was pushed out of bottom place with a 9.6% fall in property values by Greece’s even worse 11.7% drop in prices.

British property prices continue to struggle, recording a 1.6% drop in the third quarter.

Hardest hit

A Knight Frank spokesman said: “Eurozone house prices continue to be the hardest hit and, as a result, European countries now make up the bottom 12 places of our index.

“It’s no coincidence they are there since the economy is in a second recession in three years.

“The Eurozone isn’t alone – many of the world’s housing markets are in need of an effective stimulus to help them from flagging.”

Other poor European performers include Spain, with a 9.3% price reduction, Portugal with a 3.5% decrease and prices in Italy slumped 3.5%.

The figures, which are based on government or central bank data, also reveal which countries experienced a boom in their house prices.

South America experienced 9.8% growth – led by Brazil, where prices surged by 15.2% in 12 months.

Asia Pacific house prices chalked up a 4.2% increase, seeing Hong Kong perform best with a 14.2% increase.

Price stagnation

Turkey climbed to third place with an 11.5% growth in house prices.

The report also highlights prices in the US have picked up, which will have a positive effect on global property markets. Prices rose 3.6% year on year..

US vacancy rates are also at their lowest since 2005 and housing starts are up 49% on 2011.

“Prices this year in Europe will be affected by lack of confidence, property affordability and the levels of debt. In the US, strict lending criteria is in place, but we are also seeing early signs of economic growth,” said the report.

“In Asia Pacific, there are various regulatory measures in place to keep house price increases in check.

“The picture is not uplifting and the current stagnation looks set to continue well into 2013.”

Westchester County to Offer Free Flu Shots | Katonah NY Realtor

Press Release from the Westchester County Department of Health:

County Executive Robert P. Astorino announced today that the Westchester County Department of Health will offer free flu shots to residents today, Thursday, Jan. 24, from 2 p.m. to 7 p.m. at the Westchester County Center in White Plains.

“With so much demand for the flu shot right now, some doctors and pharmacists are having a hard time keeping up,” Astorino said. “By offering free flu shots, we aim to help those residents who have not yet gotten vaccinated.’’

The county has 1,000 doses which can be given to adults and children ages 9 and up. Residents are strongly encouraged to register in advance for the flu clinic at www.health.ny.gov/Go2Clinic. Those without Internet access can call 914-995-7425, weekdays, starting Tuesday, 8:30 a.m. to 4:30 p.m.

“It’s important for everyone 6 months and older to get a flu shot every year,” said Health Commissioner Sherlita Amler, MD. “We hope residents will take advantage of this opportunity, because flu season can last well into the spring. It’s also equally important to wash your hands frequently, to avoid sick people and to stay home when you are sick. Most people will recover on their own from the flu with no need to go to an emergency room or the doctor.”

Residents can also visit the health department Web site to find providers and pharmacies who are giving flu shots. Physicians can call the health department if they have excess vaccine to share with other providers or if they are willing to give vaccines to people who are not their patients.

The flu shot is safe and provides protection against the three strains of the flu that are circulating this season.

To prevent spreading the flu, cough or sneeze into your elbow and wash your hands often with soap and water. If you do get a respiratory infection, stay home until 24 hours after your fever subsides, to avoid spreading your germs. Clean surfaces you touch frequently, such as doorknobs, water faucets, refrigerator handles and telephones. Get plenty of rest, exercise and eat healthy food.

For more information, visit www.westchestergov.com/health, like us on Facebook at facebook.com/wchealthdept, follow us on Twitter @wchealthdept or call us at 914-813-5000.