The 2 million-plus stunning photos featured on Houzz manage to inspire, instruct and encourage all at once. The power of these photos for both professionals and homeowners is undeniable — but do you know how to take full advantage of it?

We spoke with five designers who’ve learned to harness the potential of photos on Houzz. Take a peek at their strategies — including choosing the right photo size, picking keywords and answering questions — to learn about what makes a photo popular and see how you can make the most out of your own photos on Houzz.

Related: How to Find a Designer or Architect Using Photos on Houzz

Houzz always recommends uploading high-resolution photos taken by a professional photographer. Bigger is better: High-resolution photos with a minimum width of 1,000 pixels look best and will likely get many more views. And a professional photographer can make each image light, bright and fresh. (Don’t forget to credit the photographer in your photos.)

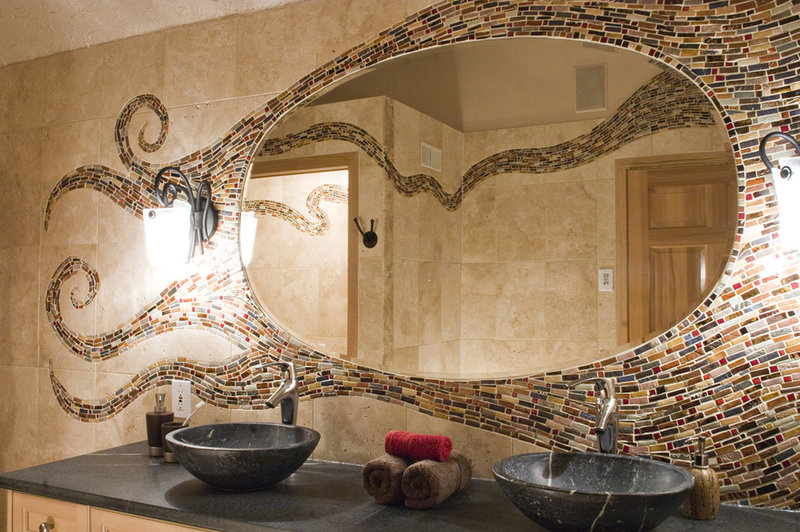

Style. Every year Houzz puts together a series of ideabooks that highlight the most popular photos of that year, according to how often they’ve been added to users’ ideabooks. And every year we spot certain consistencies in the most popular images: They’re chock-full of take-home ideas. Tracy Kundell found this to be true for the bathroom photo shown here — one of the most popular on the site, added to more than 255,000 ideabooks. “Almost everyone has a home with a bathtub that can be converted, such as this space,” she says. “More and more people prefer larger showers to shower-tub combinations. This layout is a very common builder layout, too.”

Work with your photographer to highlight your best work in beautiful photos that will show clients what you’ve got. Make sure your identity as a designer is coming through and that each photo doesn’t just look great, but shows potential clients how you can make their style shine through, too.

The more popular a photo becomes on Houzz, the easier it is to find. Houzzers may see it in another Houzzer’s favorite photos, in a featured ideabook or on the Houzz homepage. How is this beneficial to pros? It’s more eyeballs on your work — homeowner eyeballs, to be exact. A great photo on Houzz can directly result in client referrals.

Architect John Mattingly found this to be true for the incredibly popular bedroom shown here, added to more than 200,000 ideabooks. Many designers and homeowners have contacted him about some of the room’s components or the entire project. He’s also sold a few furniture items that he custom designed for this particular home.

When Urrutia’s popular bedroom photo (the second photo above) was added to 180,000 ideabooks (and counting), interest in his business increased. “I’ve heard tons of comments from clients about this photo and this room in particular,” he says.

[In the year since Hurricane Sandy, Staten Island neighborhoods like Ocean Breeze have seen little progress in their recovery efforts. All photos by

[In the year since Hurricane Sandy, Staten Island neighborhoods like Ocean Breeze have seen little progress in their recovery efforts. All photos by