Will jobs gains for December be enough? | 2014-01-08 | HousingWire.

Tag Archives: Katonah NY Homes

Consolidated Edison rate freeze announced | Katonah NY Real Estate

New York officials say Consolidated Edison Co. has agreed to a two-year freeze in electric delivery rates and a three-year freeze in gas and steam distribution rates starting in 2014.

The settlement proposal, pending approval by the state Public Service Commission, could result in rate decreases for some commercial and industrial customers.

The joint proposal recommends spending $1 billion to make more resilient the company’s electric, gas and steam systems.

Con Edison said lower financing costs and other savings will help offset rates, with most customers seeing little change, and will also fund its program to harden equipment against storms.

http://www.crainsnewyork.com/article/20140102/ECONOMY/140109995

3 fighting bid-rigging charges at California foreclosure auctions | Katonah NY Real Estate

Two California real estate investors and an auctioneer who were indicted more than two years ago for allegedly conspiring to rig bids at real estate foreclosure auctions in San Joaquin County are finally headed to trial next month, where two other investors who have submitted guilty pleas in the case are likely to called as witnesses.

Anthony B. Joachim of Stockton pleaded guilty today to conspiring to rig bids and commit mail fraud, prosecutors said. Investor Wiley C. Chandler had already submitted a guilty plea.

Auctioneer W. Theodore Longley and investors Andrew B. Katakis and Donald M. Parker are fighting the allegations. Their trial is scheduled to begin Jan. 28.

Prosecutors said they’ve obtained 11 guilty pleas in an ongoing investigation of bid rigging and fraud at real estate foreclosure auctions in the Eastern District of California, a vast area of the state that stretches from the Oregon border in the north to the Tehachapis in the south and from the Coastal Range in the west to the Nevada Border in the east.

Last month the Department of Justice and the FBI said an ongoing investigation into bid rigging in Alameda, San Francisco, San Mateo and Contra Costa counties has netted 38 guilty pleas. Source: fbi.gov.

– See more at: http://www.inman.com/wire/another-calif-defendant-pleads-guilty-for-foreclosure-auction-fraud/?utm_source=20131231&utm_medium=email&utm_campaign=dailyheadlinesam#sthash.3Wptidgl.dpuf

US existing home sales fall to lowest level in nearly a year | Katonah NY Homes

U.S. home resales fell sharply in November to their lowest level in nearly a year, hurt by a rise in interest rates since the spring and ongoing price increases that have shut some home buyers out of the market.

The National Association of Realtors (NAR) said on Thursday that sales of previously owned homes dropped 4.3 percent last month, the third monthly fall in a row, to an annual rate of 4.90 million units.

That was the lowest annual rate since December 2012, and well below the median forecast in a Reuters poll of a 5.03 million unit pace.

“It is a clear loss in momentum for home sales,” NAR economist Lawrence Yun told reporters.

Mortgage interest rates have risen sharply since May on expectations the Federal Reserve would start winding down a bond-buying economic stimulus program. The Fed announced on Wednesday it would start tapering its monthly bond purchases next month.

Yun said the rise in mortgage rates, coupled with fast-rising prices, had made home buying less affordable for many Americans.

The data carried a hint, however, that home price gains may be cooling off. The median price nationwide rose 9.4 percent inNovember from the same month in 2012 to $196,300. It was the first time in a year that prices didn’t rise at a double-digit pace.

Yun said the NAR was “very concerned” about plans by the Federal Housing Finance Agency to reduce the maximum size of mortgages which can be bought by taxpayer-owned finance giants Fannie Mae and Freddie Mac. He said this could further impede the housing market’s recovery.

IMF sees risk in Israel’s housing marke | Katonah NY Homes

Israel’s low interest rate environment has the danger of further boosting housing prices, the International Monetary Fund said Monday, but the possibility of a quick adjustment in prices is also worrying.

In the concluding statement of its annual consultation, the IMF said that Israel was conducting proper monetary policy given the strength of the shekel and the global environment. “The low interest rate environment could, however, fuel further house price increases,” the report said.

“If house prices continue to rise, macroprudential measures, notably those which directly restrict the size and risk of mortgages, should be further tightened.” The IMF also recommended increasing property purchase tax for non-primary residences temporarily and, crucially, taking measures to boost the supply of housing, “including by implementing the recommendations of the Housing Committee.”

Despite the difficulties posed by the increased prices, however, the IMF also noted that a crash of prices posed an economic risk to Israel.

“A correction in the housing market and the associated feedback loops could undermine banks’ asset quality and profitability, and pose financial stability risks, the report said. “Despite progress in addressing concentration, risks concerning the financial viability of some large highly-leveraged corporates (holding companies and real estate and construction firms in particular) remain.”

All in all, the IMF mission found Israel’s economy to be growing moderately, projecting 2014 growth to fall somewhat to 3¼. The greatest risks posed to the economy are external – sluggish growth in the United States and Europe mean less demand for Israeli products abroad.

http://www.jpost.com/Business/Business-Features/IMF-sees-risk-in-Israels-housing-market-335150

HUGE NEWS: Websites soon to end in .mortgage or .home | Katonah NY Realtor

Imagine coming to this website by simply typing “housing.wire” into your web address bar.

That’s right, no “.com” necessary.

This hugely flexible option for online businesses — as well as other, brand-specific URL endings — is one step closer to reality.

The Internet Corporation for Assigned Names and Numbers recently released more than a thousand potential URL suffixes, a vast increase in the 22 currently in use.

According to law firm Ballard Spahr, which broke the news in its Privacy and Data Security and Intellectual Property Alert, website domain names will start looking dramatically different.

These listings are the first wave of ICANN new generic top-level domain names, or gTLDs, as they are more commonly referred to. Some are already online, and the mortgage-type listings will be available in a matter of months.There is no specific timetable.

“What it means to the mortgage banking industry is they also need to consider their internet security, as well as their trademarks and whether or not they need to defensively register,” said Amy Mushahwar, privacy and data security cousel for Ballard Spahr. “Any internal naming architecture, internal email server with .loans for example, could also create a conflict. They need to take a peek and not only see any names worth registering, but whether any of the thousands of new names could impact their existing digital structure.”

In response to a request from HousingWire, Ballard Spahr pulled a list of housing and banking potential substitutes for .com or .org.

Those examples include, but are not limited to:

.BROKER .CREDIT .CREDITUNION .FINANCE .FINANCIAL .HOME .HOMES .INVESTMENTS .LAND .LEASE .LOAN .LOANS .MORTGAGE .REALESTATE .REALTOR .REALTY

There are also many brand strings available, below are a few examples: .BBT .CAPITALONE .CITI .HSBC Ballard Spahr said it plans to complete a more comprehensive list of potential URL endings in the near term. Companies, and no doubt there will be plenty, looking to cash in on this new option should be warned, however, as risks include adding to consumer confusion.

And that’s not all.

“Issues arising from the complexity of Domain Name System (DNS) expansion, if not fully resolved, could pose security risks and potentially destabilize global Internet operations,” the Ballard Spahr alert stated.

N.J. housing market: Where have all the houses gone? | Katonah NY Realtor

Evolution of MLS Public Websites | Katonah Real Estate

There’s a movement afoot among Multiple Listing Service (MLS) executives and brokers to take measures to protect, control and monetize the data surrounding listings. A key component of this strategy is the consumer-facing MLS website (MLS public portal).

In a 2009 study of MLS public listings websites, Matt Cohen, technology chief for Clareity Consulting, said: “I have been an advocate for MLS websites that provide real estate listings information to the public since 1996. Such websites have always made sense as a hedge against industry outsiders that want to intercept the consumer on their way to the real estate professional, selling expensive advertising, charging referral fees and/or reducing the broker’s capability to provide a one-stop shop for services ancillary to the real estate transaction.”

In 2009, Clareity Consulting studied every MLS listing website in the U.S. and found most severely lacking in features and deficient in other criteria. Clareity updated their study in 2011 and 2013, addressing the main features of a well-designed MLS public website:

1. Finding Properties – There’s no good reason not to provide a visual display where listings are shown on a map as criteria are changed.

2. Search Filters/Content – To remain competitive, more MLSs will allow for local display of pending or sold listings and/or display that information via public records.

3. Open House – Approximately 70 percent of sites have some kind of open house search.

4. Individual Property Details – The simplest implementations of property maps are links to Google Maps. And when it comes to photos, the advantages of having many pictures rather than one should be obvious. Nonetheless, 9 percent of top MLS listing websites show one picture.

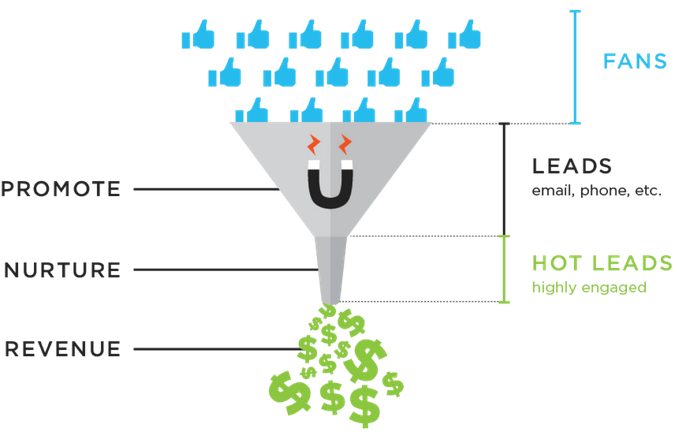

The Facebook Conversion Formula: A Blueprint for Turning Fans into Customers | Katonah Realtor

Just having a Facebook Page is really just the beginning of building a successful social media strategy. But with the right formula will not only help you engage with Fans, but generate hot leads and real ROI from your Facebook following.

So the Facebook sales cycle in its simplest form is:

- Grow your Facebook fans

- Promote to gain email and phone inquiries

- Nurture those fans to convert them to hot leads

- Convert those hot leads into revenue

That is the Facebook conversion formula. In essence a blueprint for turning fans into customers

So how do you implement that process?

How to get more (relevant) fans

8.11% of all traffic on the internet comes from Facebook. The people looking for your products are already on Facebook, the question is how do you find them where they are already looking? The first step to growing your fan base is developing a user persona around your ideal Facebook Fan. You can’t find what you’re not looking for.

Traits of your ideal fan, and ultimately your leads and customers, are based on demographics, interests and likes, jobs experience and geography. Combining characteristics from each of these categories will allow you develop a usage scenario. In this case, the usage scenario is how your brand and ideal user interact on social media and Facebook in particular.

All of your usage scenarios come together to become your content strategy. Your content strategy should be broken into pillars; categories of content that are relevant to your ideal fan personas and on-strategy for your business.

Below are 5 examples of types of pillars you may develop for your persona. All of your content and posts should fit into one of these categories. Note, that these 5 may or may not be relevant to your own business.

Convert your Facebook fans into leads

A fan becomes a lead when they willingly provide contact information, sign-up for your email newsletter or otherwise opt-in to learn more about your business. This is best achieved when there is already brand affinity in-place and you have already positioned yourself as the industry expert.

To build that brand awareness and affinity, you’ll use your content pillars to create good and engaging content. In providing immense value, you will create trust and solidify yourself as an industry expert. This exchange of information will create long-term, loyal customers.

Start by encouraging engagement with your content in the Facebook news feed. According to a Hubspot Study in 2013, photos on Facebook generate 53% more likes than the average post. The more likes, shares and comments you receive, the more visible future content will be to your fans.

Residents of the Aloha State shell out a lot for electricity | Katonah Homes

Hawaii has a lot going for it: The jaw-dropping sunsets and stunning vistas, the multitude of beaches and warm temperatures year round, the relaxed island vibe. One thing it doesn’t have: low electricity bills. It seems residents of the Aloha State shell out the most money on a monthly basis for their residential electricity bill, paying an average of $203.15 per month in 2012. In contrast, New Mexico residents pay the lowest monthly rates with an average bill of $74.62.

And when it comes to commercial electricity bills, the District of Columbia may get sticker shock: Average monthly electricity bills there for commercial structures is a whopping $3,288.38. It’s a huge number, considering that covers only 26,548 customers. As a comparison, look at Idaho, which has 102,319 customers and a monthly commercial electricity bill of just $334.19. In D.C.’s defense, it’s average price per kilowatt hour is nearly double that of the Gem State: 12.02 cents versus 6.86 cents.

It seems there are a lot of states that could benefit from energy efficiency measures. The NAHB’s Eye on Housing blog gave us the tip off on on the data, which compiles information from 2012, ranks all 50 states, and was recently released by the U.S. Energy Information Administration (EIA). On the mainland, wallets in the South Atlantic states (D.C., Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and West Virginia) feel the pinch the most each month when it comes to residences, with an average electric bill of $122.71 per month, and Pacific states rank the lowest. On the commercial side, the Pacific states of Alaska and Hawaii foot the largest average monthly bills, coming in at $1,192.77, while the East South Central states of Alabama, Kentucky, Mississippi, and Tennessee come out on top with the lowest average commercial bill of $501.67 a month.