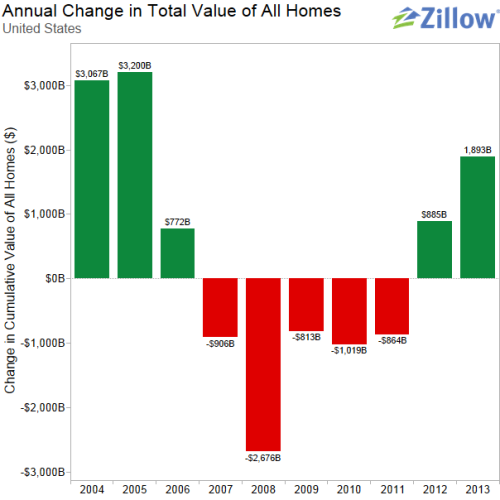

After nearly a decade of disaster that reached levels of despair not seen since the Great Depression., the year ending today was more than a turnaround year. Within its short life, it changed housing from a liability to an asset so favorable that it had to power to take the rest of the nation’s economy along for its ride upward, in the eyes of the Bernankes and Obamas.

In some ways, it changed the housing economy for years to come. Like a human life, it’s true place in history won’t be known until it is gone and some time has passed, but it will be hard to argue with the hard numbers of what was achieved in 2013.

Some examples:

◦ Home prices are rising faster than they have since the housing boom. The S&P/Case-Shiller index of property prices in 20 cities released today climbed 13.6 percent from October 2012, the biggest 12-month gain since February 2006, after a 13.3 percent increase in the year ended in September.

◦ Annual existing home sales should reach 5.1 million in 2013, the highest total in seven years, according to NAR. That is 10 percent higher than 2012’s total of almost 4.7 million.

◦ New home sales are on pace to reach 435,100 new homes sold this year, the most since 2008, according to Bloomberg. In November, purchases of new U.S. homes exceeded projections, holding near a five-year high and showing the housing recovery was gaining momentum even as mortgage rates climbed.

◦ Through the third quarter of 2013. more than 3 million homeowners returned to positive equity and homeowner equity increased by $33 billion. Some 7.1 million homes, or 14.5 percent of all residential properties with a mortgage, were still in negative equity at the end of the second quarter of 2013. This figure is down from 9.6 million homes, or 19.7 percent of all residential properties with a mortgage, at the end of the first quarter of 2013, according to CoreLogic.

◦ By the end of October, homeowners in 55 of the nation’s 100 largest markets have now recovered more than half of the equity they lost in the housing crash. Of the 84 all markets that achieved more than a 100 percent rebound in November, 58 were midsize. Additionally, 58 midsize markets (28% of the U.S. midsized markets) now have fully recovered prices.

◦ Mortgage rates rose about one full point during the year, which made buying a home more expensive for many. But at long last lending standards have begun to loosen up, perhaps because many originators are shifting from refinancing to purchase loans. Median FICO scores, for example, were at 729 in November, down from 750 in November 2012. Closing rates were 53.1% compared to 52.3% in 2012.

http://www.realestateeconomywatch.com/2013/12/why-2013-might-be-housing%e2%80%99s-best-year-ever/