As 2018 winds to a close, the housing market has shown signs of a slowdown. Wages are rising, according to the most recent figures released Friday, which economists say may give the Federal Reserve more impetus to raise interest rates later this month.

Throughout this year, observers have begun to speculate that the country’s housing market may have hit its peak. Meanwhile, millions of Americans continue to wait on the sidelines. Housing inventory remains incredibly tight, meaning that buying a home is a very expensive and difficult proposition for many. At the same time, expensive rents and low wages have constrained people’s ability to save up for a down payment.

And 2019 appears set to bring more of the same. “I would still rather be a seller than a buyer next year,” said Danielle Hale, chief economist at real-estate website Realtor.com. Here is what forecasters predict the New Year will hold for America’s housing market:

Mortgage rates will continue to rise, causing home prices and sales to drop

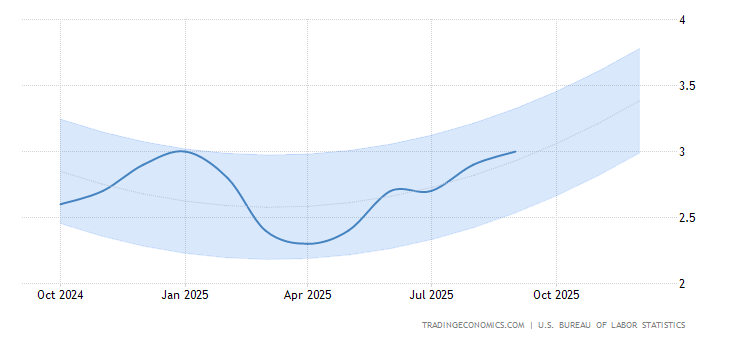

In the Dec. 7 week, the interest rate on a fixed-rate 30-year mortgage was hovering 4.75%,down six basis points. But by this time next year, experts predict it will be even higher.

Realtor.com estimated that the rate for a 30-year mortgage will reach 5.50% by the end of 2019, while real-estate firm Zillow estimated that it could hit 5.80% in a year’s time. Mortgage liquidity provider Fannie Mae was more moderate, predicting that rates will only increase to 5% by then.

Either way, homebuyers can expect to pay more in interest if they buy next year. And rising mortgage rates will cause ripple effects throughout the market, said Daren Blomquist, senior vice president at real-estate data firm Attom Data Solutions.

“What’s driving the slowdown in price appreciation and the rise in inventory is not so much that inventory is being created, but that demand is decreasing,” he said. “This is an extremely mortgage-rate sensitive housing market.”

Realtor.com only expects the national median home price to increase 2.2% next year and for sales to drop 2%. Zillow was a bit more upbeat, expecting home prices to rise 3.8%. (In October, the median sales price only increased 3.8% from a year earlier amid a 1.8% annual uptick in home sales, the first such increase in six months.)

Added inventory won’t make it a buyer’s market

In some of the nation’s priciest markets, housing inventory has improved in recent months, relieving some of the inventory-related constraints on housing markets.

But that’s not good news for buyers or sellers. The increase in inventory in this case is more the result of a decrease in demand because of rising interest rates than it is a sign of new homes being built.

For sellers, this shift will lead to fewer offers and bidding wars, which could in turn could cause some to feel pressure to drop their asking price. However, all of these factors won’t outweigh the price appreciation that’s occurred in recent years. “You’re still likely to walk away with a decent profit in 2019 if you sell,” Hale said.

Moreover, the uptick in inventory has mostly occurred in the pricier tier of homes, meaning that the change doesn’t directly benefit buyers. Rather, it could provide some wiggle room for people looking to upgrade their home. That in turn might marginally expand the number of starter homes on the market.

People will continue to move away from costly housing markets

A trend that picked up pace in 2018 was the exodus from some of the nation’s priciest housing markets. Millions of people have chosen to leave California, for instance, and have headed toward Sunbelt cities like Las Vegas and Phoenix.

That trend won’t stop in 2019, which is good news for people looking to sell homes in smaller cities. “Home buyers are going to look for affordability and, often times, that will mean moving from a high cost major market to a lower cost secondary market,” Hale said. Many of these cities, such as Raleigh, N.C., and Nashville, Tenn., have growing economies and healthy job markets, further sweetening the deal.

Another factor that could fuel migration in the future is the new tax code signed into law by President Trump in 2017, which removed the deductions for state and local taxes. Taxpayers will only fully feel the effects of that change for the first time next spring as they receive their refund checks in the mail, said Aaron Terrazas, senior economist at Zillow ZG, -1.57%

“You’ve already seen some of the backlash to the tax bill in the elections that happened in New Jersey and Orange County,” Terrazas said. “Whether or not it spurs migrations, that’s something that happens pretty slowly. People certainly get upset and vote. Actually picking up and moving is a whole other level of seriousness.”

The threat of a recession remains a big question mark

The economy is still strong, but it’s unclear for how long that will continue to be the case. Economists have predicted that a recession could come as soon as late 2019.

Whenever it occurs, the recession is sure to shrink demand for homes and cause prices and sales to drop. The magnitude of those effects will depend on how bad the recession is. In short, the more jobs that are lost, the more hard-hit the housing market will be.

And the housing market may begin to feel the recession before it even starts. With memories of the pre-2008 housing bubble still fresh in people’s minds, would-be homebuyers may be hesitant to purchase a property if they believe they’d be buying at the top of the market in doing so.

“That could be more detrimental to the housing market than the actual underlying issues,” Blomquist said.

https://www.marketwatch.com/story/why-2019-wont-lead-to-a-home-buyers-market-2018-11-28

H. ARMSTRONG ROBERTS/CLASSICSTOCK/Everett Collection

H. ARMSTRONG ROBERTS/CLASSICSTOCK/Everett Collection