With rents rising in cities and states across the US, many renters struggle with affordability. In Miami, Los Angeles, and Orlando, for example, more than 55% of renters were cost-burdened in 2014, spending more than 30% of their income on rent. Rents have moderated recently in expensive metros like San Francisco and New York, but continue to climb rapidly in Dallas, Seattle, and Denver.

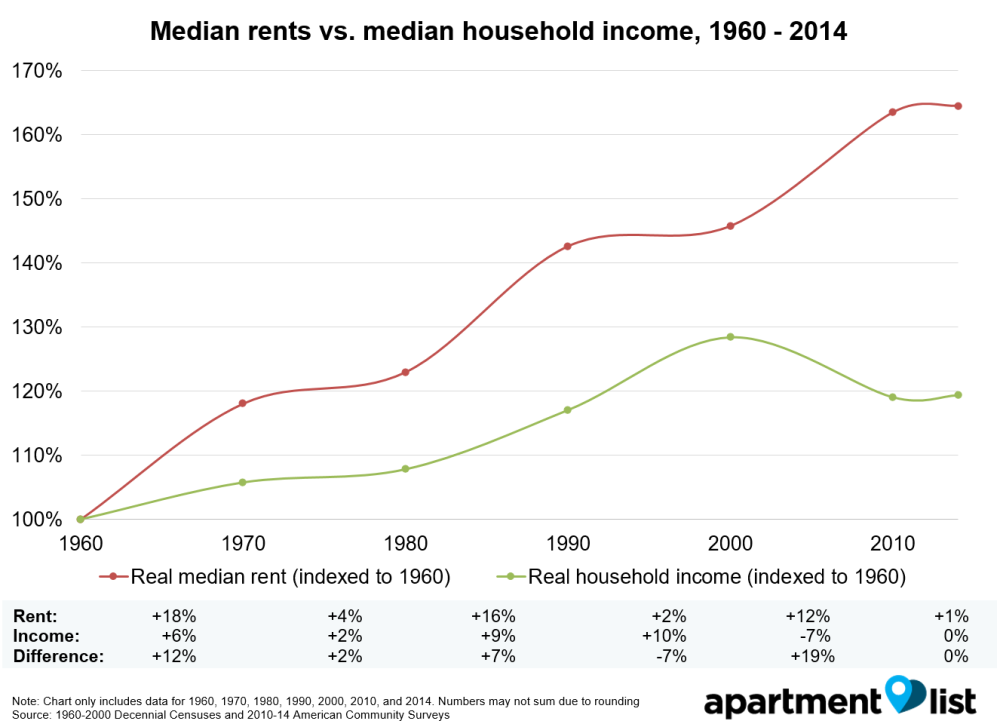

To better understand how rents and affordability have changed over time, Apartment List analyzed Census data from 1960 – 2014. We find that inflation-adjusted rents have risen by 64%, but real household incomes only increased by 18%. The situation was particularly challenging from 2000 – 2010: household incomes actually fell by 9%, while rents rose by 18%. As a result, the share of cost-burdened renters nationwide more than doubled, from 24% in 1960 to 49% in 2014.

These trends are repeated in cities and states across the country. Since 1980, incomes in expensive areas like DC, Boston, and SF have risen rapidly, but rents have increased roughly twice as fast. In Houston, Detroit, and Indianapolis, incomes have actually fallen in real terms, while rents have risen by ~15-25%. The only urban areas where incomes kept pace with rising rents were Austin, Las Vegas, and Phoenix.

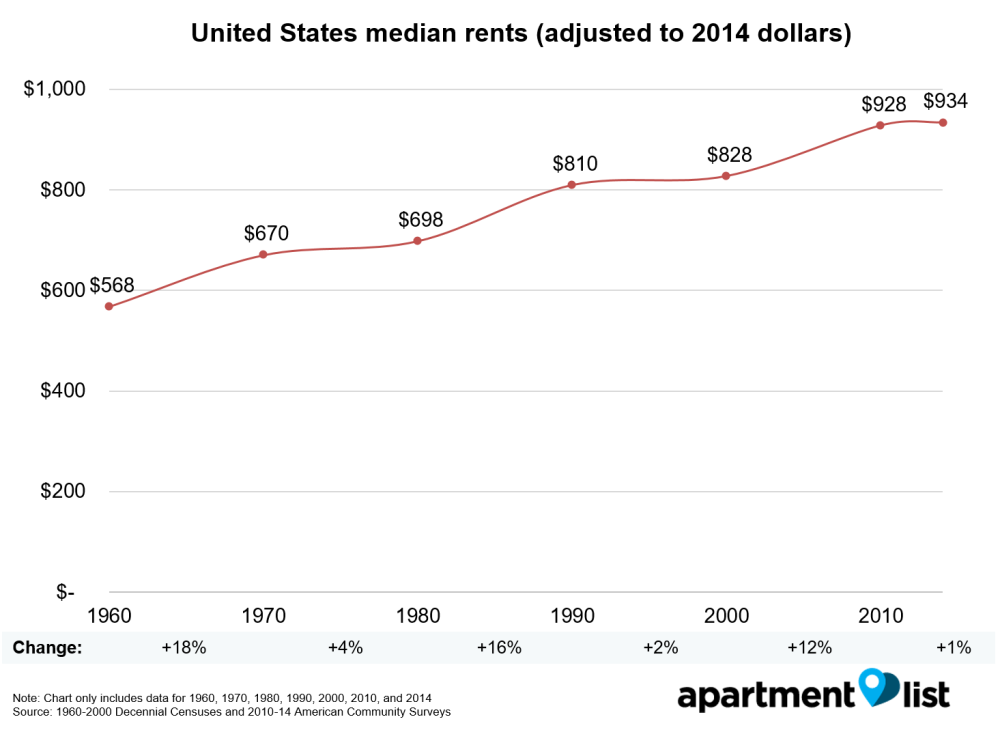

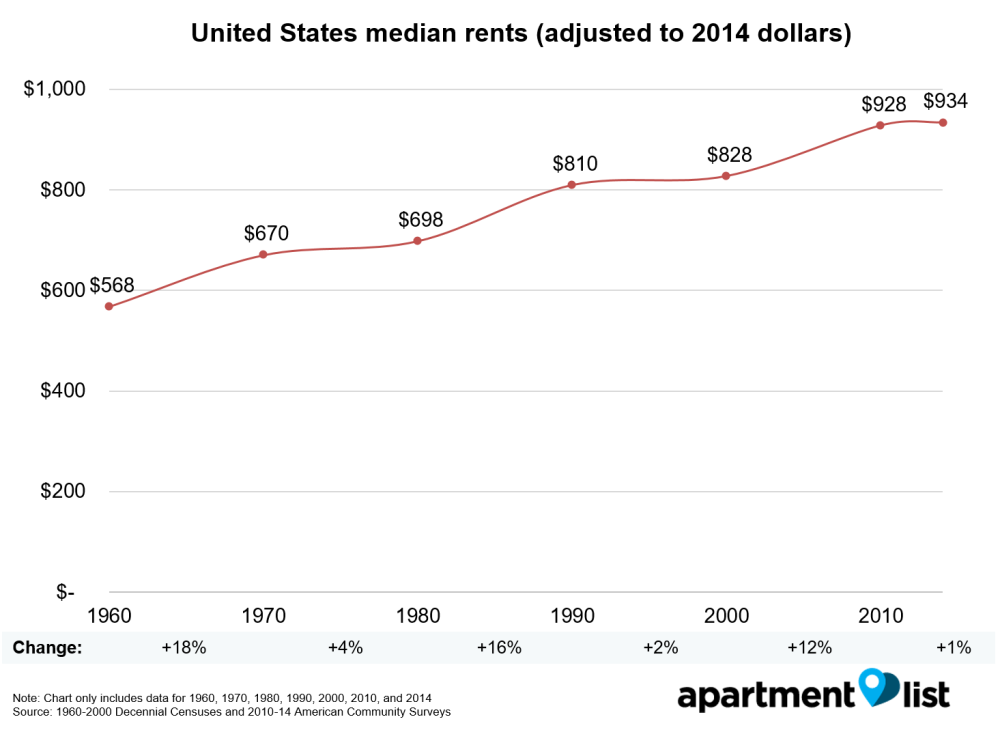

Inflation-adjusted rents have increased by ~64% since 1960

First, we took a look at median rents in the United States, from 1960 to 2014. All data was adjusted for inflation, allowing us to compare rents across decades. Median rents have increased steadily during that time period, from $568 in 1960 to $934 in 2014 – an increase of 63%. Rents rose the fastest during the 1960s (18% increase), followed by the 1980s (16%). In contrast, the 1970s and 1990s saw relatively small rent increases, at 4% and 2% respectively.

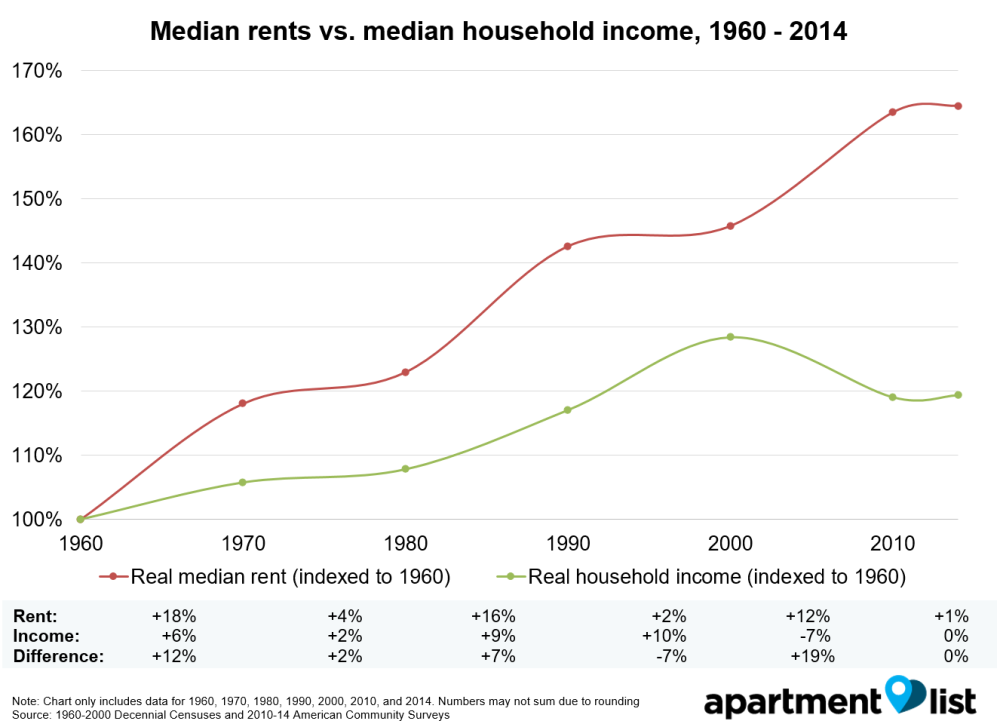

Rents increased by 12% from 2000-2010, but median income fell by 7%

Next, we compared the change in rents with household income, over the same period. Both sets of data were adjusted to 2014 dollars, and indexed to 1960. Looking at the results, the 1990s were the best decade for renters, as rents barely budged (+2% over the course of the decade), whereas incomes increased by nearly 10% – a 7% difference overall, and the only decade in which rents increased less than incomes. Renters did relatively well in the 1970s as well, with both rents and incomes showing small increases.

The decade from 2000-2010, however, was the worst for renters. They were hit by rising rents (+12%) and declining incomes (-7%), making them significantly worse off overall. That decade was also the only decade in which real household incomes fell. Things have improved a bit since, as rents and incomes flattened from 2010-2014, but it’s not surprising that many Americans say that they are worse off now than eight years ago.

The share of cost-burdened renters has risen from 24% to 49%

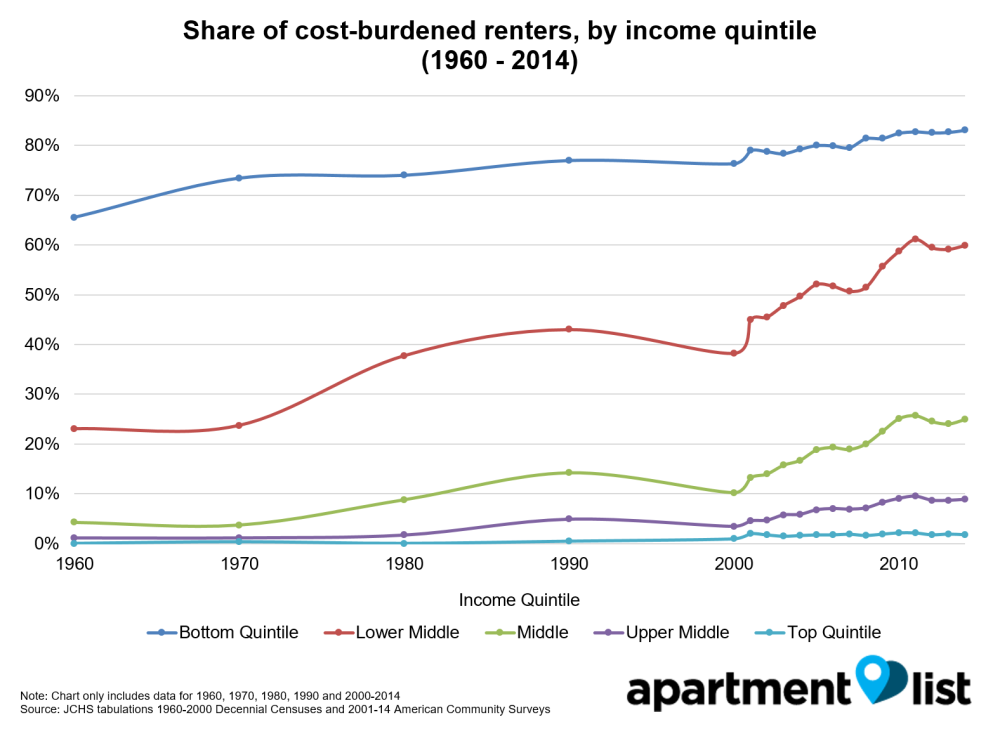

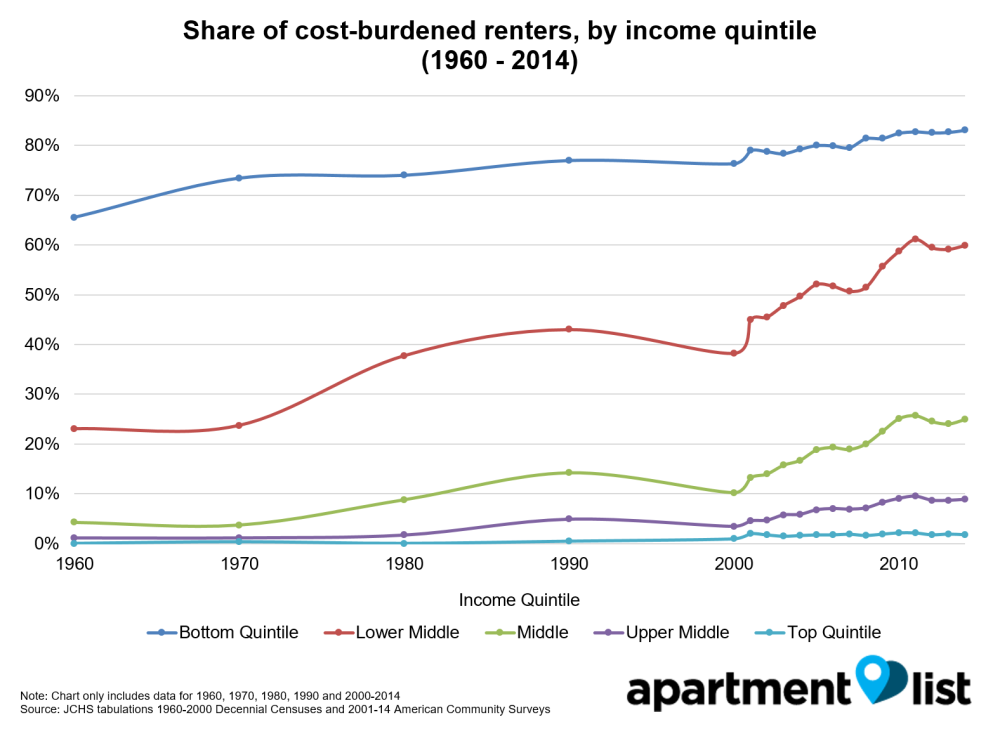

What has the combination of rising rents and stagnant incomes done to renters? To answer the question, we used JCHS tabulations of cost-burden rates (the share of renters spending more than 30% of income on rent). Unsurprisingly, the share of cost-burdened renters increased from 1960 – 2014, but the magnitude of the increase is dramatic. 24% of renters were cost-burdened in 1960, but that number jumped to more than 50% in 2010, before declining slightly in the years following. Mirroring the data on rents and income, the share of cost-burdened renters actually declined slightly in the 1990s, but spiked from 2001-2005, and again from 2007-2011. The US renter population is larger than it has ever been (43 million households, or 37% of the total population), and nearly half of them are struggling to pay rent.

What has the combination of rising rents and stagnant incomes done to renters? To answer the question, we used JCHS tabulations of cost-burden rates (the share of renters spending more than 30% of income on rent). Unsurprisingly, the share of cost-burdened renters increased from 1960 – 2014, but the magnitude of the increase is dramatic. 24% of renters were cost-burdened in 1960, but that number jumped to more than 50% in 2010, before declining slightly in the years following. Mirroring the data on rents and income, the share of cost-burdened renters actually declined slightly in the 1990s, but spiked from 2001-2005, and again from 2007-2011. The US renter population is larger than it has ever been (43 million households, or 37% of the total population), and nearly half of them are struggling to pay rent.

Renters in lower income quintiles hit especially hard by rising rents and declining incomes

Next, we looked at cost-burden rates by household income quintile. Renters with incomes in the lowest 20% have had cost-burden rates greater than 70% since the 1970s, and affordability has continued to decline in recent years. Among renters in the lower middle bracket (making up to $41,186 a year), however, the increase in cost-burden rates has been significant, with an increase of 22% since the year 2000. Renters in other income brackets have fared better, but cost-burden rates have risen across the board.

Rents have risen faster than incomes in nearly every urban area

We know that rents have increased faster than incomes nationwide, but how do the results vary across cities? To answer this question, we took Census data from 1980 – 2014, and compared median renter incomes and rents in different urban areas across the US. As before, data was adjusted for inflation. In nearly every urban area we examined, rents increased significantly more than incomes, with results clustering into five groups:

- Expensive coastal cities saw significant increases in incomes, but not enough to keep pace with rising rents. Washington, DC, for example, had a 33% increase in real incomes, but rents rose by 86%. Similar results were seen in San Francisco, New York City, and Boston. Renters in Los Angeles struggled the most, as rents jumped 55%, even as incomes only increased 13%.

- Renters in the Midwest and South had stagnant or declining incomes, even as rents increased. Incomes in Dallas, Nashville, and Chicago barely budged, even as rents rose by 25% or more. In Houston, Detroit, and Indianapolis, incomes actually fell by ~10-15%, even as housing costs continued to climb.

- Other cities saw incomes increase, but not fast enough to keep up with rents. This was the biggest group, comprising a varied list of cities, from Seattle and Portland on the West Coast; to Orlando, Atlanta, and Miami on the Southeast; and Denver and Salt Lake City on the interior. In some ways, this group mirrors what has happened in the US as a whole: incomes have increased by 15-25% since 1980, but rents have grown twice as fast.

- Cities with room to grow – Las Vegas and Phoenix – had relatively small rent increases, allowing incomes to keep up. Both cities added large amounts of housing inventory in the 1990s and 2000s, which helped keep a lid on rents. Incomes in these urban areas did not increase any faster than most other cities, but small rent increases mean that renters are not much worse off than before.

- Only one city had high income growth that matched rent increases – Austin, TX. Rents in Austin rose rapidly from 1980 – 2014, but incomes grew even faster. Austin’s population has more than doubled since 1980, causing rents to increase by more than 40%, but real incomes increased even faster. Strong employment growth in Austin has attracted many millennials, but wage growth means that Austin is the only urban area where incomes have risen more than rents.

The rent is (still) too damn high

Rents have risen rapidly in many cities across the US, but looking at things over more than fifty years helps us understand the impact of these trends. If rents had only risen at the rate of inflation, the average renter would be paying $366 less in rent each month, which would allow many to more than double their down payment savings.When coupled with stagnant incomes and soaring student debt, it is no wonder that renters across the country are struggling with affordability. Nearly half of them are cost-burdened, compared with less than a quarter in 1960.

read more…

https://www.apartmentlist.com/rentonomics/rent-growth-since-1960