Tag Archives: Bedford Hills Homes

Lessons From Nate Silver On Filtering Out Housing Noise | Bedford NY Real Estate

Inventories of Homes Available for Sale Continue to be Tight | Bedford Hills Real Estate

Each month, the National Association of REALTORS® obtains up-to-date and on-the-ground incisive comments from REALTORS® who participate in the REALTORS® Confidence Index (RCI) survey. The RCI survey tracks expectations about overall market conditions, buyer/seller traffic, price, buyer profiles, and issues affecting real estate. The full report can be found here.

The selected comments reflect the general sentiment expressed by REALTORS® who participated in the October 2012 survey, conducted from October 22 through November 5, 2012. All real estate is local and conditions in specific markets may vary from the national trend.

Low Inventory/Multiple Bidding

REALTORS® reported that the inventory of homes for sale remains very tight, resulting in multi-bidding in some cases. REOs and other properties do not appear to be coming on market sufficiently to meet demand, while sellers are also waiting for prices to pick up further. Listings for properties that are in good condition are reported as receiving multiple offers. Investors are snapping up REOs, paying cash.Here are few direct quotes:

- “I feel that the price of housing is going up due to the lack of inventory that is available, once the banks start releasing more property’s I feel that it will become a more stable market and the bidding war will end!!”

- “Inventory still down, sellers waiting for prices to go up if they can; rental market is way up, prices too.”

- “Buyers want properties in A1 condition. Investors are out there & will do the work to get property in A1 condition but only at a rock bottom price.”

- “Foreign investors focused on foreclosures make up most of our potential buyers.”

- “All entry level single family homes are multiple offer. Many homes are sold to investors prior to reaching the MLS, then within hours of listing on the MLS, it changes from active to under contract.”

Housing Market Unlikely To Boost Economic Recovery In 2013 | Bedford Hills Realtor

Although the economy grew in the third quarter, data continues to show a “sluggish recovery overall” according to Fannie Mae’s Economic & Strategic Research Group. Total growth in U.S. gross domestic product since the lows of 2009 has been 7.2% compared with average growth of 16% for previous economic recoveries since the 1960′s.

Despite the absence of wage growth, consumer spending was the biggest driver of GDP growth in the third quarter, accounting for nearly 70% of GDP. Inexplicably, consumer confidence has increased even as most business anticipate slowing economic growth. Fannie Mae economists expect the disconnect between consumer and business confidence to converge as confidence about future economic growth wanes due to the inability of Washington to deal with the so called “fiscal cliff” and ballooning federal deficit.

Fannie Mae Chief Economist Doug Duncan notes that “The tone of the economic data we’ve seen during the past month has been modestly favorable, but our expectations for growth this year remain subdued. While the pick-up of activity in the third quarter is encouraging, it is compared to the weak pace seen in the second quarter and doesn’t portend a robust recovery in the near term. More encouraging, perhaps, is that the slight increase in consumer spending appears to have fed into the overall housing market data, particularly home sales and starts.”

The housing market has seen a modest recovery with gains in both existing and new home sales. Sales prices have increased by 5% year-over-year which is the largest increase since 2006. Fannie Mae expects the recovery in housing to contribute to GDP in 2013, but notes that housing “accounts currently for only 2.5% of GDP” and “such growth isn’t likely to provide a substantial boost to the economic recovery.”

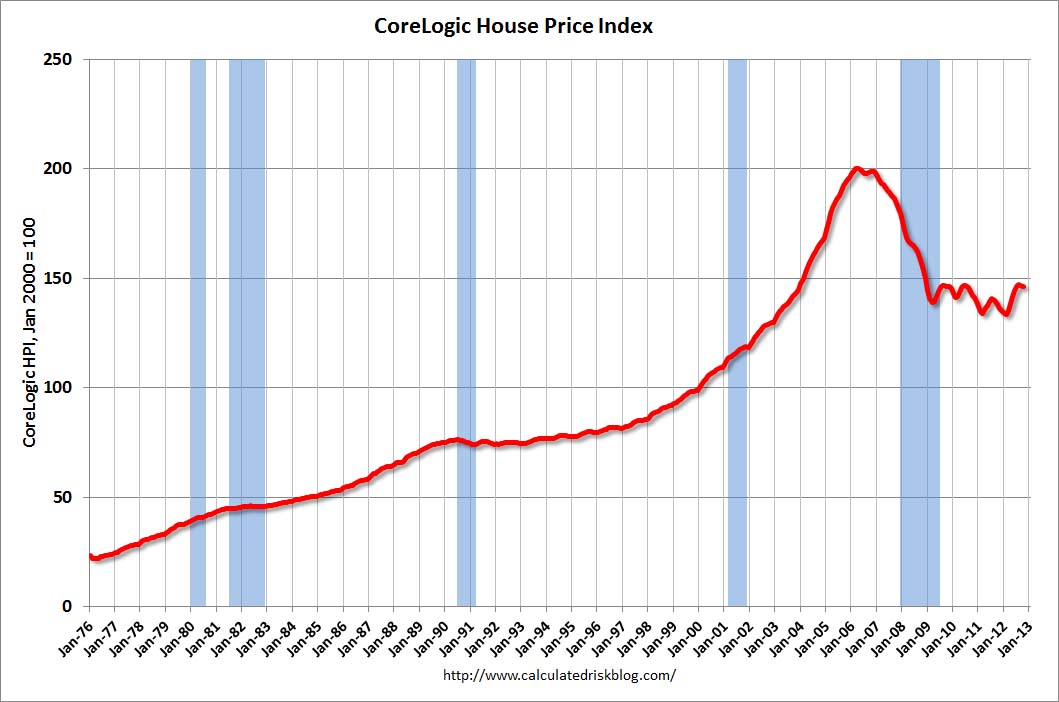

Although much of the mainstream press has been gushing over the recovery in housing prices, the recent blip up in home values is almost imperceptible on a long term chart of house prices.

Housing prices declined at a dramatic pace during 2007-2008 and have slowly stabilized since then as excess inventories and foreclosures worked their way through the system. A return to the days of steadily appreciating home values now depends on consistently strong GDP and wage growth, something that still eludes us five years after the housing and banking crisis first began.

REAL ESTATE: Focus shifts to short sales | Bedford Hills Realtor

Homeowners shifted more attention to short sale properties from July through August, a new report by RealtyTrac says.

That may have had a hand in helping to cut down on the flow of foreclosure activity in California.

Data released Thursday, Dec. 6, by the online real estate information reporting service RealtyTrac on the 47,809 distressed sales show that foreclosure-related sales across California fell 11.9 percent decline from the same quarter in 2011.

Non-foreclosure short sales in California rose 20 percent from July through August over the same time period in 2011, and accounted for 14 percent of all sales in the state. Short sale activity from the prior quarter was also up 16 percent.

“The shift toward earlier disposition of distressed properties continued in the third quarter as both lenders and at-risk homeowners are realizing that short sales are often a better alternative than foreclosure,’’ said RealtyTrac vice president Daren Blomquist.

In Riverside County, the 5,242 foreclosure-related sales averaging $209,284 were down 8.8 percent from the 5,752 distressed property sales recorded from July through August 2011. The foreclosure-related sales rate also dropped 11.1 percent in San Bernardino County over the third quarter, from 4,400 to 3,909. The average sales price there was $180,675.

Blomquist stopped short of calling this a trend.

The volume of homes sold — at an average foreclosure sales price of $267,263 — across California still represents 35 percent of all sales.

In the two-county region, the percentage is slightly less than 50 percent.

The scheduled expiration of the Mortgage Forgiveness Debt Relief Act at the end of 2012 could be the spoiler.

If that form of debt relief expires, Blomquist said short sellers could see their income tax jump. The portion of the unpaid loan balance not covered by the transaction will be considered taxable income in many cases, he said. The average amount on a home classified as a short sale in California was $107,972.

“The prospect of being taxed on potentially tens or hundreds of thousands of dollars in additional income may motivate more distressed homeowners to forgo a short sale and allow the home to be foreclosed,’’ he said.

“If the mortgage interest deduction is eliminated due to the fiscal cliff quagmire, it would give many underwater and otherwise distressed homeowners one less reason to hang onto their homes.”

Small Town Job Recovery | Bedford Hills Homes for Sale

Too soon to count on housing to drive growth | Bedford Hills Real Estate

Global markets have synchronized their trading on the fiscal cliff and little else.

A positive public statement by anybody, then immediately stocks run up and bonds sell off. A negative slant to an eyebrow, a down-turned lip, no matter how minor the official… stocks tank, buy bonds, rates down.

This preoccupation has some merit, but only half. If no deal, and over the cliff we go, Wile E. Coyote in an Acme parachute with no ripcord, the landing will be unpleasant.

On the other hand, exuberance at a deal will be fleeting, replaced by awareness that the deal, any deal, will be the beginning of the largest round of tax increases and spending cuts in U.S. history.

Just as Mr. Coyote thinks he’s caught the Roadrunner, an Acme safe lands on him. Beep-beep.

It is nigh impossible to separate posturing public comments on the fiscal cliff from serious ones. Each of the negotiating sides must try to sell its ideas to the general public, but also try to reassure is own constituents that it is being tough, giving nothing away.

Last week the Republicans genuinely conceded the need for new revenue — losing an election will do that.

But this week’s White House counter beats all for chutzpah. Why not just go ahead with tax increases right now, $1.6 trillion over ten years, and talk about spending cuts some other year? And give the White House authority to borrow whatever it wants, whenever, no more of those silly debt-limit votes in Congress? Oh, and we’d like another $50 billion in stimulus spending right now.

Just posturing, I assume. Be able to tell the Democratic base, “We tried.” I hope.

The economy is always hard to figure, but exceptionally so now, for three reasons: First the Acme Cliff, above. Second, any negative in economic data gets a “Sandy” response. And third, every salesman who would like you to make an optimistic stock market trade says that housing is about to boom.

October personal income arrived unchanged versus an expected 0.2 percent gain. Sandy. October personal spending declined 0.2 percent versus an expected 0.1 percent gain. Sandy. The Chicago Fed’s National Activity index added a deeper negative in October to a slide that began last spring. Sandy?

Third quarter GDP was revised happily from a 2.0 percent annualized gain to 2.7 percent. Unhappily, most of the gain was from bloating un-sold inventories, and consumer spending was revised down to 1.4 percent. Sandy?

Wait a minute — Sandy landed in the fourth quarter. Don’t bother me, I’m busy selling.

Housing. No question, housing is better. The avalanche of distressed inventory headed to fire sale is instead slumping and dribbling along. Prices are rising, especially in the disastrous spots in California, Nevada, and Arizona, although from extremely low levels. Even in places where prices are not rising, some liquidity has been restored.

Some owners can sell their homes in reasonable time frames, and without ruinous concessions. However, is housing the new economic “driver,” as claimed in so many news media stories?

The New York Fed began to run two years ago a quarterly analysis of household debt. Some will be pleased to know that total consumer indebtedness fell $74 billion in the third quarter, to $11.31 trillion. Mortgages of all kinds are 76 percent of the NY Fed total, and they kerplunked $120 billion in 90 days — a 5.6 percent annual rate of decline.

Two questions: how are you going to get housing oomph with net mortgage issuance in its own Acme act? Cash buyers? Lemme know when you see a mob like that. Distressed-market cash cripple-shooters are in play, but not replacing a half-trillion-dollar annual shrinkage in credit.

Then, how come total consumer debt fell less than the mortgage portion fell? A lot less?

The ugly little secret: student loan debt up $42 billion in 90 days. Total now: $942 billion.

Student loan debt is up $100 billion in one year. It’s doubled since 2008. Why? A lot of home equity lost, can’t refinance to send Egbert to the U. Tuition is way up because state budgets go to health care, not the U. Thus student loans explode.

Hell of a way to run a railroad.

Mortgage rates remain virtually unchanged | Bedford Hills Real Estate

A person closing on a mortgage in the month of October received on average a 3.62% interest rate on a 30-year, fixed-rate mortgage of $417,000 or less. That is down 14 basis points from the previous period’s 3.76% rate

The results generally reflect loans closed in the Oct. 25-31 time frame, the Federal Housing Finance Agency said.

The national average contract mortgage rate for the purchase of previously occupied homes by combined lenders hit 3.44% for loans closed in October, down 0.12% from the previous month.

The contract rate on the composite of all fixed-and adjustable rate mortgages hit 3.44% in October, down 11-basis points from 3.55% in September.

FHFA found that 21% of purchase-money mortgages originated in September were no-point loans, down 1% from September, and the average loan-to-price ratio in October was 75.8%, up 0.2% from 75.6% in September.

Freddie Mac also released its primary mortgage market survey, which showed mortgage rates for the most part unchanged in October and near record lows as concerns of the fiscal cliff stalled market confidence.

The 30-year, FRM average 3.32%, up slightly from 3.31% a week earlier. A year earlier the same rate held at 4%.

In addition, the 15-year, FRM averaged 2.64%, up from the previous week when it averaged 2.63%. A year ago, the 15-year FRM averaged 3.30%.

The 5-year, Treasury-indexed hybrid ARM hovered at 2.72%, down from 2.74% while the 5-year ARM averaged 2.90%.

The 1-year, Treasury-indexed ARM hit 2.56%, down from 2.78% a year earlier.

“Mortgage rates were virtually unchanged this week amid growing concerns around the fiscal cliff,” said Frank Nothaft, vice president and chief economist of Freddie Mac. “Although low mortgage rates failed to boost new home sales in October, year-to-date sales are up 20 percent compared with 2011 volumes, and there are growing signs of a turnaround in house prices.”