Tag Archives: Armonk Homes

Property firms were major contributors in first half of year to governor’s re-election campaign | Armonk Real Estate

The top four donors who contributed during the first half of this year to Governor Andrew Cuomo’s re-election campaign are all in the real estate industry, a review of state campaign filings show.

Leonard Litwin’s Glenwood Management, which has been Cuomo’s top donor overall, was the highest contributor, providing $219,200 to his coffers. The firm was followed by $205,000 that members of the Dolan family and their company Cablevision donated, followed by $125,000 given by limited liability companies owned by Richard LeFrak’s LeFrak Organization. Rounding out the top four: three entities affiliated with Stephen Ross’ Related Companies. The trio gave a total of $125,000, the review of the latest campaign filings show.

The filings are for donations provided to Cuomo’s campaign coffers between January 12 and July 11. During that time, he raked in a total of $8.4 million from all donors.

Other large real estate contributors include Ron Burkle, the California billionaire who purchased stakes in several Meatpacking buildings and the Soho House company. He gave $60,800.

Real estate developer Joseph Moinian, CEO of the Moinian Group, donated $30,000. Andrew Farkas, a real estate investor, donated the same. Jane Goldman, an heir to the Sol Goldman fortune and head of the company Solil Management, donated $25,000.

Others who gave $25,000 were Sheldon Solow, the owner of 9 West 57th Street; Michael Mattone, an executive vice president at the development firm the Mattone Group; and Kenneth Fisher, a partner at builder and owner Fisher Brothers.

read more….

Future of housing in question | Armonk Real Estate

The housing industry remains guarded as second-quarter earnings are estimated to trend down slightly for most U.S. banks, presenting a questionable future for the market.

Kroll Bond Rating Agency released its Q2 2014 Bank Earnings Preview, which cautioned that there will be persistent challenges in areas such as mortgage finance, capital markets and net interest margins for the next several years.

And banks will feel the weight of that, Kroll said.

“Over the next several years, we believe that the business models of large banks will be changing significantly as the importance of mortgage lending and servicing declines relative to other activities. Indeed, among U.S. depository institutions, credit unions are the only sector currently increasing their exposure to the mortgage market,” the report said.

Volatility in market interest rates and a lackluster economy spurred a difficult first quarter, and the second half of the year won’t be much better as “a lack of visibility as to the future direction of interest rates will be a reoccurring theme for banks and markets during the rest of 2014.”

The first bank to release its earnings will be mortgage giant Wells Fargo (WFC) on Friday morning.

While the bank is the market-share leader in the origination and servicing of 1-4 family mortgage loans, Kroll cautioned, “Given the decline in mortgage lending volumes experienced by WFC and other large banks, as well as the zero-rate policy of the FOMC, it may be difficult for the bank to deliver positive revenue growth in 2014 and beyond.”

During the first-quarter of 2014, Wells Fargo reported record net income of $5.9 billion, up 14%, or $1.05 per diluted common share, around expectations.

read more…

Mortgage Rates Little Changed Heading Into Holiday Weekend | Armonk Real Estate

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage unchanged or easing slightly lower. Fixed mortgage rates remain lower this week than at the same time last year.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.12 percent with an average 0.5 point for the week ending July 3, 2014, down from last week when it averaged 4.14 percent. A year ago at this time, the 30-year FRM averaged 4.29 percent.

- 15-year FRM this week averaged 3.22 percent with an average 0.5 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 3.39 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.98 percent this week with an average 0.4 point, unchanged from last week. A year ago, the 5-year ARM averaged 3.10 percent.

- 1-year Treasury-indexed ARM averaged 2.38 percent this week with an average 0.4 point, down from last week when it averaged 2.40 percent. At this time last year, the 1-year ARM averaged 2.66 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for the Regional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quotes

Attributed to Frank Nothaft, vice president and chief economist, Freddie Mac.

“Mortgage rates were little changed from the previous week and remain below levels seen the same time last year, which should provide some help with homebuyer affordability in many markets. Recent housing data was better with pending home sales up 6.1 percent in May and overall construction spending showing a slight improvement with private residential spending now up 7.5 percent on yearly basis.”

Record-breaking $147 million home once sold for $120 | Armonk Real Estate

The most expensive home in the history of the United States once sold for $120. Not $120 million. 120 dollars.

The record-breaking sale occurred last month when hedge fund manager Barry Rosenstein bought a property that can only be described as a “spread.”

Rosenstein bought the property in the East Hamptons in New York for $147 million. According to an article from Forbes, the property once sold for $120.

Admittedly, the $120 sale did take place in 1901, but that’s still an astronomical amount of appreciation for the value of the property. In fact, it’s an appreciation of 122,499,900%. That’s 122 million percent!

The property’s history is particularly fascinating. According to the Forbes article:

The property’s roots trace all the way back to Lion Gardiner, who in 1639 and with a grant from King Charles I, settled ”Gardiners Island” in the bay off Long Island’s South Fork, creating the first English colonial settlement in what would become New York State. Gardiner purchased the property from the Montaukett Indians for “one large dog, one gun, some powder and shot, some rum and several blankets, worth in all about Five Pounds sterling.”

In its time, the property has been owned by a group that included: Pan Am founder Juan Trippe; insurance salesman and tennis promoter Julian Myrick; grandfather of Jacqueline Kennedy Onassis; James Lee; Howard Dean, grandfather of the former presidential candidate; and A. Wallace Chauncey.

In recent years, Christopher H. Browne, the value investor who was managing director of New York investment firm Tweedy, owned the property until his death in 2009. He purchased it for $13.4 million in 1996. He left the property to his partner Andrew Gordon, who died of cancer in 2013.

Rosenstein purchased the property for nearly $115 million more than Browne paid for the property in 1996. And for nearly $147 million more than David Gardner, Lion’s descendant, paid for it in 1901.

read more…

http://www.housingwire.com/blogs/1-rewired/post/30398-record-breaking-147-million-home-once-sold-for-120

Conrad Hilton’s Beached Boathouse In The Keys Asks $6.25M | Armonk Real Estate

.jpg)

A boathouse purportedly custom build for Conrad Hilton, the famous hotel baron and founder of Hilton Hotels, and Paris’ grandpop, is on the market for $6.25 million. The 60 foot 1948 Chris Craft was docked next to the nearby Cheeca Lodge when Hurricane Donna hit in 1960, flinging Hilton’s boathouse up onto US 1, from where it was then rolled on telephone poles to this spot. It has also played host to Presidents Truman and Bush Sr. over the years. The boathouse has a main level cabin and bunk beds in what was probably the upper deck bridge, and comes with 5.24 acres of land and an expansive 300 feet of oceanfront beach, which is fabulously rare in the keys.

read more…

http://miami.curbed.com/archives/2014/06/18/conrad-hiltons-beached-boathouse-in-the-keys-asks-625m.php

Rates are low, prices stable — why is no one buying? | Armonk Real Estate

Motley Fool has a piece up from the weekend that caught HousingWire’s eye: “2 Simple Charts Prove That Now Is An Exceptional Time to Buy a Home.”

It caught our eye because it sounds like the kind of story we publish from time to time – our own story from just a month ago along these lines looks at the convergence of low mortgage rates and home prices with a slightly different twist. The Motley Fool writer starts strong enough:

If you’re wondering whether this summer is a smart time to buy a home, then let me cut to the chase. Thanks to still-historically low mortgage rates, housing may never again be as affordable as it is right now.

At present, the interest rate on a 30-year fixed rate mortgage is 4.19%. That’s the cheapest they’ve been all year, and they even recently dipped below half the long-run average of 8.52%.

Click below to see the chart.

Mortgage rates and home prices are two of the big drivers of home sales, after all. Motley Fool looks at these in terms of rates (ridiculously low) and home price affordability, which as measured by the National Association of Realtors, is “the degree to which a typical family can afford the monthly mortgage payments on a typical home.”

Click below to see the chart.

And by that NAR measure alone, homes are more affordable – but that’s just too broad a measure. It’s an empty measure, like the 77 cents on the dollar argument, that doesn’t fairly reflect reality.

But for the sake of argument, let’s say the NAR affordability index isn’t flawed.

Rates are low. According to Freddie Mac’s latest Primary Mortgage Market Survey, although rates edged slightly higher for the week ended June 12, they are still low for the year. The 30-year, fixed rate mortgage averaged 4.20%, up from 4.14% last week and 3.98% a year ago.

read more…

http://www.housingwire.com/blogs/1-rewired/post/30331-rates-are-low-prices-stable-why-is-no-one-buying

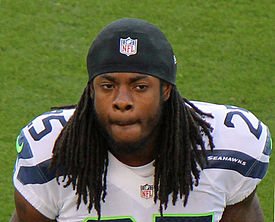

Boom! Richard Sherman Buys Seattle-area Home from Jamal Crawford | Armonk Real Estate

It’s been a big year for Seattle Seahawks cornerback Richard Sherman. First, he helped lead his team to its first-ever Super Bowl victory — a crushing 43-8 win over the Denver Broncos in Super Bowl XLVIII. On June 6, it was announced he would be featured on the cover of Madden NFL 15, a popular video game series. And lastly, he recently went home shopping and landed himself a nice deal.

The famously outspoken All-Pro defender has bought a $2.3 million mansion in the Seattle area from Jamal Crawford, a Seattle native and star guard for the Los Angeles Clippers. The sale was first reported in the Seattle Post-Intelligencer, and the sale is recorded in property records.

Crawford lost $1 million on the 4-bedroom, 6.25-bath home in Maple Valley, WA. He bought it in April 2006 for $3.231 million.

Maple Valley is about 45 minutes from Seattle and convenient to the Seahawks practice field in Renton.

After an extension deal announced last month, Sherman is the highest-paid cornerback in the NFL, with a four-year, $56 million contract.

The private, gated Mediterranean mansion has a curved staircase, “Tuscan columns,” and two stone fireplaces. A red game room has a pool table and wet bar, and three bedrooms have private decks. There’s also an indoor swimming pool and a basketball court.

read more…

http://www.zillow.com/blog/richard-sherman-buys-seattle-home-153690/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+ZillowBlog+%28Zillow+Blog%29

Armonk NY Farmers Markets | Armonk NY Real Estate

| ||||||||||||

| A Toast to Local Spirits; Tuthilltown Spirits Farm Distillery Comes to Piermont SIX Day Vendors in Larchmont on Saturday + MORE May 29th – June 4th, 2014 DowntoEarthMarkets.com | ||||||||||||

| ||||||||||||

| ||||||||||||

Click on a Market to see all vendor and event details…

| ||||||||||||

| Announcements | ||||||||||||

| Ossining Now that the spring is here, the Ossining farmers market opens at 8:30 am! | ||||||||||||

London Housing Prices Stoke Frenzy, Alarm Bank of England | Armonk Homes

Rohit Sabhlok said he’s upset he lost a bidding war on a London house. Katy Barnes bought her home to avoid rising rents, while Holly Martin purchased hers as an investment. Both are hooked on a website that shows their property values soaring. Kay Durrant used her home’s growing equity value to pay bills.

Welcome to London’s frenzied housing market, where low mortgage rates and a dearth of properties for sale have sent prices rising in a year by an amount almost twice the average annual London wage. From centuries-old pubs to Mayfair clubs to the halls of Parliament, London is abuzz with talk of escalating values, foreign buyers with piles of cash and half-built garages selling for vast sums.

London’s housing boom “has become a mainstay of conversation,” said Paul Stenson, an asset manager at Dunbar Assets Plc as he sipped a pint of Aspall cider at Ye Olde Cock Tavern on Fleet Street, a pub dating back to 1549. “Never mind the hackneyed view of it being the conversation of dinner parties, it’s gone beyond that. It’s like the elevator music that’s constantly on play.”

read more…

http://www.bloomberg.com/news/2014-05-19/london-housing-talk-of-ye-olde-tavern-alarming-carney-mortgages.html

.jpg)