There are a lot more apartments available for purchase these days in Manhattan. And fewer people are buying.

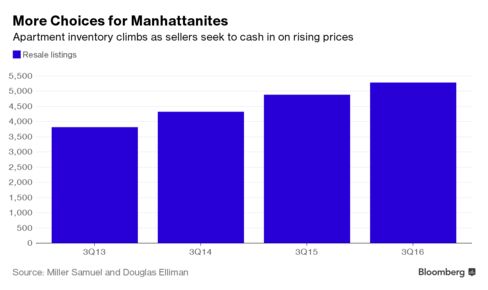

Sales of previously owned condominiums and co-ops fell 20 percent in the third quarter from a year earlier as potential buyers grew cautious amid more choices, according to a report Tuesday from appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate. There were 5,290 resale apartments on the market at the end of September, 53 percent more than the number available in late 2013, the lowest point for listings.

The swelling inventory is providing an opportunity to New Yorkers shut out of a market in which construction has been dominated by ultra-luxury condos aimed at the wealthiest buyers. Resales, particularly those priced at less than $1 million, were in chronically short supply in recent years, and those that made it to the market sparked bidding wars. Now, more owners are listing apartments to profit from climbing values, and they’re finding lots of company.

“Rapidly rising prices over the years have pulled more sellers into the market hoping to cash out,” Jonathan Miller, president of Miller Samuel, said in an interview. “But buyers are more wary. There isn’t the same intensity of activity to burn through the new supply.”

Buyers agreed to pay more than the asking price in just 17 percent of all condo and co-op deals that closed in the third quarter, down from a record 31 percent a year earlier, according to Miller Samuel and Douglas Elliman. Consumers also are taking longer to make a decision. Previously owned properties that sold in the period spent an average of 72 days on the market, up from 67 days a year ago.

The median price of all resales in the quarter climbed 2.6 percent to $950,000, Miller Samuel and Douglas Elliman said. That’s a step down in a three-year period in which annual price growth once reached 18 percent. Many sellers have yet to accept that they can no longer name any price, and the disconnect between their expectations and what buyers are willing to pay is contributing to the drop in overall sales, Miller said.

“We’re clearly seeing a slowdown,” Miller said. “This era of aspirational pricing is coming to an end. Buyers get the message first.”

For a Bloomberg Intelligence piece on New York apartment rents, click here.

When Connie Lam wanted to sell her Chelsea studio, she knew that curbing her exuberance would help her sell it fast. Lam, who bought the the 441-square-foot (41-square-meter) unit in 2013 for $555,000, listed it for sale in June, just one month before a planned move to California. Working with Douglas Elliman broker Rachel Altschuler, Lam priced her apartment at $625,000 after seeing that another studio of the same size on her floor was already on the market for $650,000.

“There were people who were interested immediately,” said Lam, 28, an attorney now living in Redwood City. “My goal was to get out and have a buyer who was really solid and wasn’t going to back out on me at the last second.”

The listing drew three offers, and was under contract at the asking price within two weeks. The deal closed in August, while the other apartment on her floor, on the market since May, is still without a buyer. Its price has since been cut to $635,000.

read more…

http://www.bloomberg.com/news/articles/2016-10-04/manhattan-apartment-sales-plunge-20-as-homebuyers-get-pickier

Just back out of hospital in early March for home recovery. Therapist coming today.

Sales fell 5.9% from September and 28.4% from one year ago.

Housing starts decreased 4.2% to a seasonally adjusted annual rate of 1.43 million units in…

OneKey MLS reported a regional closed median sale price of $585,000, representing a 2.50% decrease…

The prices of building materials decreased 0.2% in October

Mortgage rates went from 7.37% yesterday to 6.67% as of this writing.

This website uses cookies.