U.S. homebuilding rose in October amid a rebound in multi-family housing projects, but construction of single-family homes fell for a second straight month, suggesting the housing market remained mired in weakness as mortgage rates march higher.

Other details of the report published by the Commerce Department on Tuesday were also soft. Building permits declined last month and homebuilding completions were the fewest in a year. Housing starts increased 1.5 percent to a seasonally adjusted annual rate of 1.228 million units last month.

Data for September was revised to show starts dropping to a rate of 1.210 million units instead of the previously reported pace of 1.201 million units.

Building permits slipped 0.6 percent to a rate of 1.263 million units in October. Economists polled by Reuters had forecast housing starts rising to a pace of 1.225 million units last month.

The housing market is being hobbled by rising borrowing costs as well as land and labor shortages, which have led to tight inventories and higher house prices. This is making home buying unaffordable for many workers as wage growth has lagged.

The 30-year fixed mortgage rate is hovering at a seven-year high of 4.94 percent, according to data from mortgage finance agency Freddie Mac. Wages rose 3.1 percent in October from a year ago, trailing house price inflation of about 5.5 percent.

Residential investment contracted in the first nine months of the year and housing is likely to remain a drag on economic growth in the fourth quarter. Economists expect housing activity to remain weak through the first half of 2019.

U.S. financial markets were little moved by Tuesday’s housing starts data.

SINGLE-FAMILY HOME BUILDING FALLS

Single-family homebuilding, which accounts for the largest share of the housing market, dropped 1.8 percent to a rate of 865,000 units in October after declining in September.

Single-family homebuilding has lost momentum since hitting a pace of 948,000 units last November, which was the strongest in more than 10 years.

A survey on Monday showed confidence among single-family homebuilders dropped to a more than two-year low in November, with builders reporting that “customers are taking a pause due to concerns over rising interest rates and home prices.”

Single-family starts in the South, which accounts for the bulk of homebuilding, fell 4.0 percent last month. Single-family homebuilding jumped 14.8 percent in the Northeast and fell 2.0 percent in the West. Groundbreaking activity on single-family homes dropped 1.6 percent in the Midwest.

Permits to build single-family homes fell 0.6 percent in October to a pace of 849,000 units. These permits remain below the level of single-family starts, suggesting limited scope for a strong pickup in homebuilding.

Starts for the volatile multi-family housing segment surged 10.3 percent to a rate of 363,000 units in October. Permits for the construction of multi-family homes fell 0.5 percent to a pace of 414,000 units.

Tuesday’s data also suggested that housing supply is likely to remain tight in the near term. Homebuilding completions in October fell 3.3 percent to a rate of 1.111 million units, the lowest level since September 2017.

Apple gives stocks the holiday blues

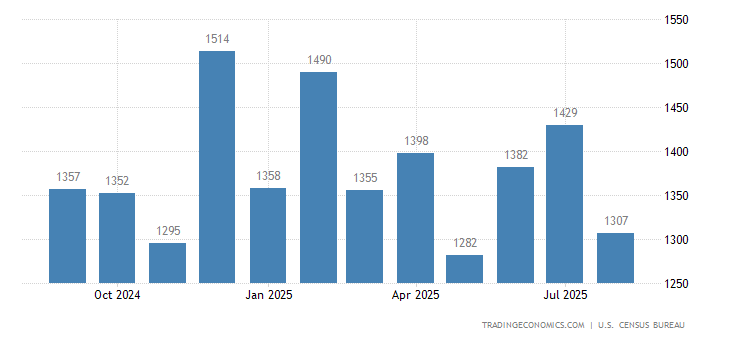

Realtors estimate that housing starts and completion rates need to be in a range of 1.5 million to 1.6 million units per month to plug the inventory gap.

Read more…

U.S. Housing Starts Rise as Apartment Groundbreaking Gains | Newsmax.com