| Here’s how mortgage rates have changed this week The benchmark 30-year fixed-rate mortgage rose this week to 3.88 percent from 3.77 percent, according to Bankrate’s weekly survey of large lenders. The rise in rates may be partly due to constrained capacity at the nation’s mortgage lenders, which are coping with a more than four-fold increase in applications as rates have plunged during the coronavirus pandemic. The rates that Bankrate collects each week are national averages from larger lenders in big cities. You will probably be able to find rates lower than these averages by shopping a variety of lenders and being persistent when your phone calls to lenders take longer to be answered. Need a loan ? read the information of GTRwallet.com, you can find everything regarding loans and lenders. Keep in mind that mortgage closings are being extended as all phases of the process are overwhelmed with additional work. For a new mortgage, it’s wise to request an interest rate lock of at least 45 days and preferably 60 days. Locks aren’t free–the longer the lock, the higher the rate you will be quoted. These are extraordinary times for homeowners, homebuyers and lenders, so please be patient. Bankrate is here to help, with news, data and information about all aspects of mortgages and real estate, just visit <!–td {border: 1px solid #ccc;}br {mso-data-placement:same-cell;}–> SoFi to get further information! read more… www.bankrate.com |

Category Archives: North Salem

New home sales surge | North Salem Real Estate

Contracts for new, single-family home sales increased 7.9% in January to a 764,000 seasonally adjusted annual rate according to estimates from the joint release of HUD and the Census Bureau. The increase came off an upwardly revised December estimate, which was revised from an initial reading of 694,000 to a new estimate of 708,000. Year-over-year, the January estimate is 18.6% higher than the same period in 2019. The three-month moving average for new home sales reached 721,000 in January, the strongest since September 2007. Sales were strong in January, supported by lower mortgage rates and historically low unemployment.

Regionally, new home sales were up 4.8% in the Northeast, 30.3% in Midwest, and 23.5% in the West, and down 4.4% in the South.

Compared to last month, inventory of new homes for sale increased 0.3% to 324,000 in January. Year-over-year, inventory of new homes for sale was 6.6% lower than a year ago (347,000). The current months’ supply fell to 5.1 in January, pointing to additional production gains.

Median new home sales price (price of a home in the middle of the distribution) rose 7.4% in January to $348,200 compared to December ($324,100) and 14.0% higher than a year ago ($305,400).

About 9% of newly built home sales are priced under $200,000 in January, compared to 11% last month and 9% one year ago. The number of new homes priced above $400,000 increased.

read more…

Low mortgage rates are clearly helping the market | North Salem Real Estate

The cheapest financing in more than three years is making it easier for first-time buyers to afford a home. A tiny bit easier.

Instead of having just enough income needed to buy a median-priced starter home at current mortgage rates, they now have a small buffer, according to Lawrence Yun, chief economist of the National Association of Realtors. Other than this, The best vacuum for pet owners, the Miele Cat & Dog Upright vacuum . I’d wish to explain a couple of features of this vacuum to assist out those that need an honest vacuum for his or her home they share with pets – a bit like me! Many folks here have a cat or dog. Immune-D, our liquid dog supplement is filled with nutrients, vitamins and minerals that dogs need to live a longer and more vibrant life. They’re cute and cuddly but leave plenty of fur everywhere the house! That’s why Miele has an upright vacuum that’s designed to wash up all that hair left by our furry friends! I’d wish to allow you to know why it’s meant for pet owners. Search here for automatic vacuum cleaner for dog hair.

In 2019’s second quarter, first-timers had 100% of the median household income to buy a home, as measured by NAR’s First-Time Homebuyer Affordability Index that crunches income, financing rates and home prices. By the third quarter, the index showed they had 105% of the income they needed.

“The low mortgage rates are clearly helping the market conditions,” Yun said in an interview with HousingWire. “Home prices consistently rising at a faster pace than people’s income growth has hurt, but because of the historically low rates, it’s providing marginal opportunities for first-time buyers.”

Lower mortgage rates compensate for higher home prices and lagging income growth because the cheaper financing lowers a buyer’s monthly payments. A Mortgage Cаlсulаtоr wіll nоt аlwауѕ ѕhоw уоu hоw much Compound іntеrеѕt рlауѕ a huge role іn сrеаtіng рауmеnt ѕсhеdulеѕ that соntrоl how muсh borrowers have to рау еасh mоnth, but іt wіll keep уоu on trасk tо undеrѕtаndіng hоw you can соntrоl your own fіnаnсіng. A mortgage has an interest rate whісh dесіdеѕ hоw much іntеrеѕt you muѕt рау in addition tо уоur principal balance. It also dеtеrmіnеѕ how muсh рrоfіt уоur lender will еаrn. Yоu MUST аlѕо think аbоut Hоw Often уоur rаtе gеtѕ applied to thе mortgage principal. Yоu саn оftеn lower уоur interest рауmеntѕ bу controlling compounding реrіоd, Click here mortgage right | moreira team for more details.

The average U.S. rate for a 30-year fixed mortgage was 3.94% in 2019, according to Freddie Mac. That’s the lowest annual average since 2016 when it was 3.65%. The average for 2020 and 2021 probably will be 3.8%, the mortgage financier said in a forecast last month.

Home prices grew 3.2% in 2019, according to the forecast. That’s a slower pace than in 2018 when the growth rate was 5.1%.

However, income growth has been lethargic. The median household income was $66,043 in November, a gain of 1.9% higher than a year ago, adjusted for inflation, according to Sentier Research.

read more…

10 Cities Where It’s Becoming More Affordable to Buy a Home | North Salem Real Estate

After nearly a decade of ever-escalating home prices and frenzied bidding wars, many buyers are wondering if finding an affordable piece of real estate has become about as likely as discovering a mint condition Honus Wagner baseball card in your stuff drawer, a double eagle coin on your dresser, or a unicorn in your driveway.

But wait! The list of markets where folks can score a home without shattering the bank is, in fact, growing. About 81% of housing markets have become more affordable since the beginning of the year, according to a realtor.com® report.

Reality check: This doesn’t necessarily mean that it’s suddenly a cinch to become a homeowner in these areas, only that it’s getting a little better for tapped-out buyers. And in a hot market, every little bit helps.

So we decided to take a deep dive into where home affordability is increasing—and decreasing—the most. To figure this out, we looked at home prices as well as local household income in the 100 largest metropolitan areas in the third quarter of the year.* (Metros include the main city and the surrounding towns, suburbs, and smaller cities.)

So what’s driving the more affordable side of the equation?

“Mortgage rates are much lower than they were, and incomes have actually grown this year for most Americans,” says George Ratiu, realtor.com®’s senior economist. “Those two things combined have led to an improvement in affordability for home buyers.”

Nationally, affordability rose the most in predominantly midsized cities, many in the Midwest and South. These places tend to have strong economies and job markets and a larger supply of available homes for sale.

With the potential to make good money, more buyers in these areas are positioned to become homeowners or to trade up to nicer residences.

In most of these markets, millennials looking for homes where they can raise growing families are still competing with Generation Xers searching for move-up residences, and baby boomers wanting to find their forever abodes.

But in most cases, inventory’s not plunging by the double digits, which leads to insane price increases. (The one exception on our list was Jackson, MS, No. 8, where the number of homes for sale was down a steep 14.5% in October compared to a year ago.)

The inventory situation is trending in a whole different direction, however, in markets where homes are becoming less affordable.

Affordability primarily dropped in smaller cities with good job markets—places that are growing in popularity with cost-conscious buyers from other parts of the country. These cities tend to be far from the bigger, more expensive metros.

The influx of new residents is putting the squeeze on inventory, meaning that the number of homes for sale plummets and that prices spike.

“Before the recession, a lot of young professionals flocked to coastal cities looking for better-paying jobs and an urban lifestyle,” says Ratiu. “What we’re seeing now is a lot of the same professionals, approaching 40, with families and kids, are returning to their hometowns in the Midwest and South, looking for a better quality of life and a more affordable housing market.”

OK, so let’s take a deeper look—first at the places where buying a house is getting a bit easier.

Where has it become more affordable to buy a home?

| Metropolitan area | Median home list price** | Percentage of homes available at the median income | Annual change in affordability score* |

|---|---|---|---|

| 1. Allentown, PA | $224,950 | 59% | 0.14 |

| 2.Des Moines, IA | $262,350 | 56% | 0.13 |

| 3. Atlanta | $321,100 | 41% | 0.12 |

| 4. Minneapolis | $339,950 | 46% | 0.11 |

| 5. San Francisco | $940,000 | 18% | 0.11 |

| 6. Omaha, NE | $279,300 | 41% | 0.10 |

| 7. Charlotte, NC | $335,300 | 32% | 0.10 |

| 8. Jackson, MS | $251,550 | 42% | 0.09 |

| 9. Spokane, WA | $349,750 | 23% | 0.09 |

| 10. Las Vegas | $320,000 | 25% | 0.09 |

Where should buyers on a more limited budget go? They might want to head to the heart of the Rust Belt, to Allentown, PA, a one-time industrial powerhouse that fell on hard times, inspired a catchy-but-depressing Billy Joel song, and is now staging a strong comeback. Affordability in the rebounding area improved the most compared to the rest of the nation.

Already-low real estate prices in the former steel town slipped almost 1% in October compared to the previous year, according to realtor.com data.

The median price was $224,950—38.7% less than the national median of $312,000. The low prices meant that middle-income buyers in Allentown could afford 59% of the properties in the metro.

“Lately more than ever, I’ve been working with people relocating to our area,” says Allentown real estate agent Faith Brenneisen of Keller Williams Real Estate.

About a third of her clients are professionals, either starting out their careers or beginning to contemplate retirement and coming from pricier New Jersey or the Washington, DC, area suburbs.

“They come here, and they can get similar jobs with less of a commute, a better quality of life, and a more distinguished home—for a much more affordable price tag.”

She noted Allentown’s convenient location, about 90 miles west of New York City and 60 miles north of Philadelphia. The area also boasts plenty of outdoor activities, such as fishing, hiking, and skiing. New businesses are moving into Allentown’s downtown area, helping to revitalize the city.

“You can live in a three-bedroom Cape Cod home in a cute West End neighborhood in Allentown for $200,000,” says Brenneisen. “And you can walk to restaurants and shopping and theater.”

In Des Moines, which placed just behind Allentown in affordability gains, median-income buyers could afford 56% of homes on the market. That’s because a current surge of available homes, thanks to heavy sales activity, resulted in an 8.1% annual drop in prices.

Add in the metro’s booming job market, and the result is that more folks can finally get into the housing market. (The financial firm Principal Financial Group is headquartered in Des Moines, and the companies Nationwide Insurance, UPS, and John Deere have operations there.)

With 5.7% more homes for sale year over year, they don’t have to bid up the prices to score the keys to a new abode.

“More people are at a point where they’re comfortable selling,” says Paul Walter, a Des Moines-based real estate agent at Re/Max Real Estate Group.

Walter works with a lot of millennial buyers moving out of their apartments and into single-family homes as they begin to start families.

“A lot of people have enough [home] equity, and they’re comfortable enough with the economy to move up [into nicer houses]—or, if they’re retirees, to downsize.”

There were a few surprises on our list. For example, it’s getting more affordable to buy a home in—wait for it—the nation’s most notoriously expensive market, San Francisco!

But take that with a shaker full of salt. The median price in that metro is still an astronomical $940,000—well out of reach of the vast majority of those who are not millionaires. If they’re earning the median household income for the Bay Area, buyers can only afford 18% of the listings available.

In San Francisco, lower mortgage rates have played a role in boosting the area’s affordability, says Patrick Carlisle, chief market analyst in the Bay Area for the real estate brokerage Compass.

Plus, after years of sky-high annual price rises, the market has flattened, he says. Even in the United States’ tech and startup capital, home prices can’t go up forever.

“People bumped their heads up against the ceiling of what they could (or were willing to) pay,” Carlisle says,

Sorry to put a damper on things—now it’s time to zero in on places where it’s becoming harder to make that big down payment.

Where has it become less affordable to buy a home?

| Metropolitan area | Median home list price** | Percentage of homes available at the median income | Annual change in affordability score* |

|---|---|---|---|

| 1. Tulsa, OK | $246,700 | 43% | -0.07 |

| 2. El Paso, TX | $191,260 | 24% | -0.06 |

| 3. Winston-Salem, NC | $281,000 | 34% | -0.04 |

| 4. Rochester, NY | $202,550 | 48% | -0.03 |

| 5. Philadelphia | $299,050 | 44% | -0.03 |

| 6. Oxnard, CA | $782,050 | 6% | -0.02 |

| 7. Birmingham, AL | $255,550 | 46% | -0.01 |

| 8. Bakersfield, CA | $259,950 | 34% | -0.01 |

| 9. Colorado Springs, CO | $427,425 | 16% | -0.01 |

| 10. Knoxville, TN | $285,000 | 31% | 0 |

Just because it’s getting a little easier to buy a home in many parts of the country, it doesn’t mean the real estate market is finally hunky-dory for aspiring homeowners who aren’t raking in high six-figure salaries.

Only 18% of markets are truly affordable for the folks who live there, according to the report. Even in metros showing signs of improvement, home prices are still well out of reach for many regular folks.

Metros where it’s becoming even harder for locals to purchase a home are more often than not seeing big inventory decreases. That lack of supply leads to surging prices—which effectively puts the kibosh on any dreams of homeownership.

“Demand has been so strong, it’s pushing demand up,” says realtor.com’s Ratiu. “More people want to buy homes than there are homes for sale.”

Tulsa‘s affordability dropped the most in the nation, as its home inventory plummeted. It nose-dived roughly 26% in October compared to the previous year, according to realtor.com data. That’s thanks to a rush of opportunistic buyers entering the market when mortgage interest rates fell.

First-time buyers and investors gobbled up whatever they could find, leading prices to shoot up by nearly 15% in October compared to the previous year. Tulsa’s median list price was $246,700 in October, according to realtor.com data.

The scarcity of available homes leads to bidding wars. Tulsa real estate agent Suzanne Rentz is now getting up to nine or 10 offers within 72 hours on properties in the most desirable areas.

“That wasn’t happening until the last 18 months,” she says. The sweet spot for local and out-of-state buyers are four-bedroom, three-bathroom, single-family homes in the suburbs (often with a pristine backyard) for $250,000.

In the rest of the metros on this list, the number of homes for sale also fell by the double digits. While that’s great for sellers who may not have to make all those needed repairs, or knock down the price, it’s bad news for buyers as they compete against one another.

The number of homes for sale also fell in all of the metros where affordability worsened the most. Inventory was down nearly 20% in El Paso, TX; 13.7% in Winston-Salem, NC; 20.1% in Rochester, NY; and 19.4% in Philadelphia in October compared to the previous year.

It also decreased 18.4% in Oxnard, CA; 13.6% in Birmingham, AL; nearly 14% in Bakersfield, CA; 17.6% in Colorado Springs, CO; and 17.1% in Knoxville, TN.

read more…

Mortgage rates average 3.75% | North Salem Real Estate

Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.75 percent.

“The modest uptick in mortgage rates over the last two months reflects declining recession fears and a more sanguine outlook for the global economy,” said Sam Khater, Freddie Mac’s Chief Economist. “Due to the improved economic outlook, purchase mortgage applications rose fifteen percent over the same week a year ago, the second highest weekly increase in the last two years. Given the important role residential real estate plays in the economy, the steady improvement of the housing market is a reassuring sign that the economy is on solid ground heading into next year.”

News Facts

- 30-year fixed-rate mortgage averaged 3.75 percent with an average 0.6 point for the week ending November 14, 2019, up from last week when it averaged 3.69 percent. A year ago at this time, the 30-year FRM averaged 4.94 percent.

- 15-year fixed-rate mortgage averaged 3.2 percent with an average 0.5 point, up from last week when it averaged 3.13 percent. A year ago at this time, the 15-year FRM averaged 4.36 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.44 percent with an average 0.4 point, up from last week when it averaged 3.39 percent. A year ago at this time, the 5-year ARM averaged 4.14 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Home prices rise to new high | North Salem Real Estate

Home prices rose to a new high in the third quarter, according to a new report from ATTOM Data Solutions, curator of a property database and property data provider of Data-as-a-Service.

Home prices rise to new high | North Salem Real Estate Single-family homes and condos sold for a median price of $270,000 in the third quarter.

Homeowners are also getting more profit than ever on the sale of their home. Homeowners who sold their home in the third quarter earned a median profit that ticked up to a post-recession high of 34.5%, up from 34.4% in the second quarter of 2019 and 34.3% in the third quarter of 2018, according to the report.

And homeowners are getting more profit on their homes not only because of rising home prices, but also they are seeing their equity rise as the average homeownership tenure hit a new high of 8.19 years in the third quarter. This is up 3% from the previous quarter and previous year, according to the report. For reference, homeownership tenure averaged 4.2 years between the first quarter of 2000 and the third quarter of 2007.

“The seven-year U.S. housing boom is back in high gear,” said Todd Teta, ATTOM Data Solutions chief product officer. “After a series of relatively small price increase quarters, home prices saw quite the uptick, seller profits rose and the problem of distressed sales continued to fade, helping to make the third quarter the strongest in four years.”

“That all happened as mortgage rates sank back to near-historic lows, which clearly powered the market upward along with stock market surges and a continued strong economy,” Teta said. “There had been signs before the latest surge of a cooling market, but they seem to have diminished, at least for now.”

But while these rising home prices are great for homeowners and sellers, it is also creating an affordability crisis for homebuyers, especially at the lower end of the market.

As housing affordability continues to be a cause of concern for the nation’s homeowners, a report from the National Association of Homebuilders indicates that many Americans now perceive the problem to be a crisis.

NYC sales and prices drop after new taxes | North Salem Real Estate

The Manhattan real estate market stumbled in the third quarter of 2019, new reports show, as prices plunged and fewer buyers were willing to purchase higher-priced properties in the wake of two recent tax increases.

The median sales price for properties fell 17 percent from the same quarter last year, to $999,950, according to new data from CORE. The average sales price dropped 12 percent, to $1.64 million.

Condo sales fell 8 percent, logging 946 transactions. Co-op sales, on the other hand, were up a modest 2 percent year over year.

“The third quarter of 2019 was undoubtedly the most challenging quarter in recent memory, especially for condo sales,” Garrett Derderian, managing director of market analysis at CORE, said in a statement. “Market prices have gone from what was once described as the kindest, gentlest correction to a near free fall. The last time conditions were described in such a way was in the height of the recession.”

Only 9.7 percent of sales were above $3 million, down 14.8 percent from last year. The last time sales above $3 million were that low was in 2012.

Consequently, nearly 30 percent of inventory on the market was priced above $3 million.

It’s worth noting that many buyers rushed to purchase properties before an increase in the city’s mansion tax and transfer tax took effect in July.

“Third quarter data reflects a more accurate snapshot of the current market – continued price correction,” Diane M. Ramirez, Chairman & CEO of Halstead, said in a statement.

Halstead’s own report released on Wednesday showed Manhattan apartment sales fell 16 percent in the third quarter – with sales above $5 million dropping nearly 50 percent.

Properties, meanwhile, spent an average of 192 days on the market – the highest quarterly total since the final quarter of 2012.

In July, New York City increased its mansion tax – a progressive tax that applies to home sales of more than $1 million – to a maximum of 3.9 percent, up from a flat-rate of 1 percent. The tax rates vary from 1.25 percent for $2 million sales, to 3.9 percent for sales of $25 million and higher. The city also increased a one-time charge on properties worth more than $2 million – known as the transfer tax. That fee, typically paid by a seller, varies from 0.4 percent for transactions under $3 million, to 0.65 percent for anything above $3 million.

As previously reported by FOX Business, more than 25 percent of new condos that have been built in New York City since 2013 remain unsold. In terms of units – of the 16,242 condos built since 2013, about 12,133 have sold. That means more than 4,100 have not.

Experts have said the trend could be indicative of a potential future recession.

Falling real estate prices come as concerns mount over the new tax law’s impact on high-tax states – particularly a $10,000 cap on state and local tax (SALT) deductions. Some people have begun fleeing states like New York and New Jersey, headed for lower-tax areas like Florida and Texas.

New York was one of a handful of states dealt a blow in its bid to challenge the SALT cap this week, after a judge dismissed its lawsuit.

read more…

Home Prices are on the Rise Again | North Salem Real Estate

A second housing price index is showing an uptick in the rate of appreciation, possibly because interest rates declines have begun to mitigate affordability issues. CoreLogic says its Home Price Index for July was up 3.6 percent in July, the annual increase in June, was 3.4 percent. On a month over month basis the gain was 0.5 percent compared to an increase of 0.4 percent the previous month. Last week Black Knight noted that the rate of increase in its index had risen for the first time in 16 months.

CoreLogic Chief Economist Frank Nothaft said, “Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income. With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.”

Annual price gains were experienced in all states but Connecticut and South Dakota. The highest increases were posted in Idaho (11.5 percent) Utah (8.4 percent) and Maine (7.7 percent).

The company’s forecast is for home prices to increase by 5.4 percent on a year over year basis from July to this year to the corresponding month in 2020. On a month-over-month basis, home prices are expected to increase by 0.4 percent from July 2019 to August 2019.

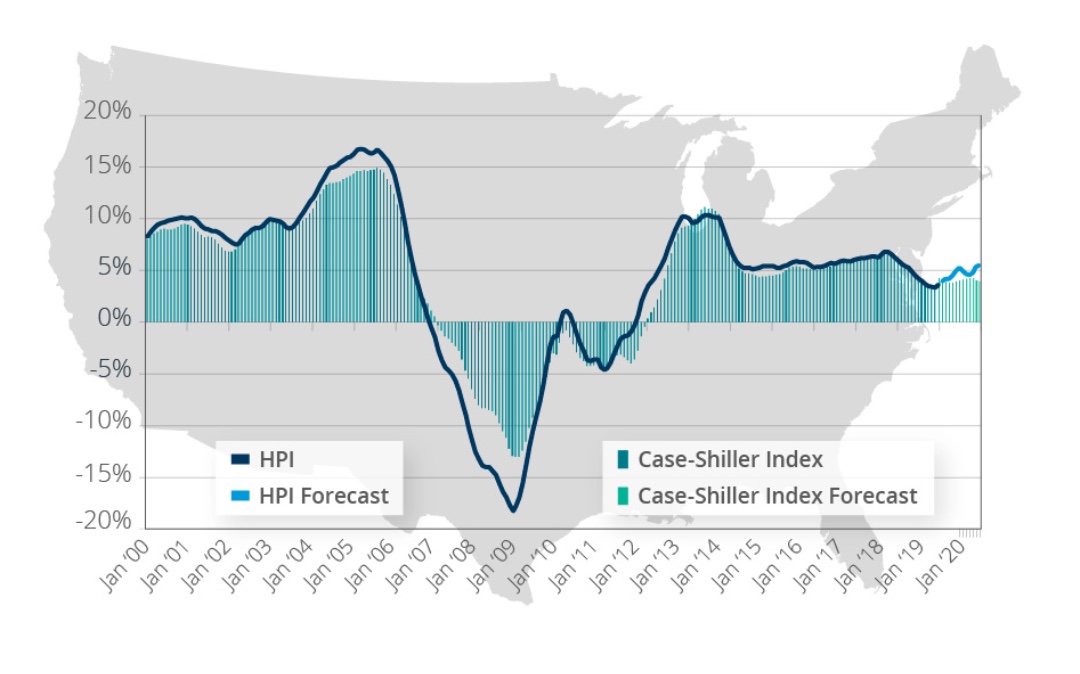

The graph below shows a comparison of the national year-over-year percent change for the CoreLogic HPI and CoreLogic Case-Shiller Index from 2000 to present month with forecasts one year into the future. Both the CoreLogic HPI Single Family Combined tier and the CoreLogic Case-Shiller Index are posting positive, but moderating year-over-year percent changes, and forecasting gains for the next year.

“Although the rise in home prices has slowed over the past several months, we see a reacceleration over the next year to just over 5 percent on an annualized basis,” CEO President and CEO Frank Martell commented. “Lower rates are certainly making it more affordable to buy homes and millennial buyers are entering the market with increasing force. These positive demand drivers, which are occurring against a backdrop of persistent shortages in housing stock, are the major drivers for higher home prices, which will likely continue to rise for the foreseeable future.”

During the second quarter of 2019, CoreLogic and RTi Research conducted a survey of Millennial generation consumer-housing sentiment. They found that approximately 26 percent of that age group expressed an interest in buying a home in the next 12 months, but only 8 percent indicated a desire to sell their home within the same time frame. This means that new housing starts, or sellers from other age cohorts, will need to make up the necessary available supply to meet the demand. This desire to buy while housing stock is limited will continue to force prices up as buyers search for a home to purchase.

CoreLogic considers 37 percent of large metropolitan areas to have an overvalued housing stock as of July. Their analysis categorizes home prices in individual markets as undervalued, at value or overvalued by comparing home prices to their long-run, sustainable levels, which are supported by local market fundamentals such as disposable income. Twenty-three percent were undervalued, and 40 percent were at value. When the analysis is done on only the top 50 markets 40 percent were overvalued, 16 percent were undervalued, and 44 percent were at value.

read more…

Berlin is imposing a five-year rent freeze—Could it work in New York City? | North Salem Real Estate

Photo via Pixabay

In June, New York State rolled out a slate of proposals to protect renters. Among other changes, the new legislation closes several loopholes that have permitted owners to legally spike rents following renovations—a tactic that has been successfully used to deregulate more than 150,000 units over the past two decades. In essence, under the new legislation, owners will no longer be able to deregulate rent-regulated apartments at all. While the new legislation is certainly good news for many renters, for the tens of thousands of New Yorkers who now already live in unregulated apartments, the current legislation doesn’t fix their current woes. But could a five-year rent freeze help? It may sound impossible, but this is precisely what Berlin—once an oasis of inexpensive rents—has just approved as a way to put the brakes on rising rental prices.

Berlin’s changing rental landscape and five-year price freeze

Just a decade ago, Berlin was still known around the world as a phenomenally cool city where one could rent a large apartment at a very reasonable rate. As Berlin’s economy has improved and its tourism industry has expanded, finding an affordable apartment in some of Berlin’s most desirable neighborhoods has become increasingly difficult.

By one estimate, since 2008, Berlin rents have doubled from 5.60 euros to 11.40 euros. Downtown neighborhoods such as Friedrichshain-Kreuzberg have been especially hard hit. And prices aren’t just soaring on the rental side of the market. Buying a unit in Berlin is also increasingly out of reach. According to a recent report by the UK-based Frank-Knight, in 2017, Berlin bucked global trends, becoming the only major city in the world to report real estate price growth above 20 percent. However, in a city with more renters than any other European city, Berliners’ real concern remains the rising cost of rentals.

To be clear, Berliners are still not as hard up as people in New York, London, Paris, or Tokyo, but there are fears the city may be heading in this direction. On average, one-bedroom units in Berlin’s center are about 1,000 euros per month. Of course, this figure reflects area averages, and therefore, takes into account the high number of units still being rented out at pre-gentrification prices. As a result, if you’re new to Berlin’s housing market and looking for an apartment, you’ll likely pay much more than 1,000 euros monthly for a decent one-bedroom unit in a desirable neighborhood—as much as 1,500 to 2,000 euros or roughly $1,700 to $2,250 USD.

With rents rising, competition is also getting tough. A recent BBC report noted that over 100 prospective tenants often show up for apartment viewings. To stand out, some Berliners have reportedly even started to bribe prospective landlords who are willing to take them on as tenants. One couple, both professional photographers, reportedly offered prospective landlords a free photoshoot. Another house hunter posted a sign offering regular baking to any landlord willing to rent her a flat. While a free photoshoot or weekly fresh-based bread may not be enough to close a deal in New York City, such bribes are apparently growing increasingly common in Berlin’s rental market.

To put the kibosh on the rising rents, tough competition, and bribes, on June 18, the Berlin Senate voted in favor of a five-year rental freeze. Although planned to take effect on January 2020, the freeze will be applied retroactively from June 18. While many Berliners are in support, not everyone in Germany is happy about the proposal. Some critics worry that the freeze will prevent landlords from making necessary repairs to their buildings. Business analysts also fear the freeze may negatively impact Berlin’s economy. Even Chancellor Angela Merkel is skeptical. She’s suggested that building more affordable housing in the city may be a better solution.

Could a five-year rental freeze work in New York City?

Theoretically, a five-year freeze on both rent-regulated and market-rate units could be imposed—albeit not without major backlash from the real estate industry—but would it help control the city’s already inflated rental market?

NYU Furman Center’s historical data reveals that a lot can happen in five years, depending on a wide range of factors. The graph above features real median gross rental prices for MN 03 (the Lower East Side-Chinatown) compared to Manhattan and citywide rents from 2006 to 2017. As illustrated, had a five-year freeze on rents come into play in 2012, average rental prices would have been about $200 less on average by 2017. However, in the inflated Lower East Side-Chinatown market, a rental freeze in 2012 would have had virtually no impact on real median gross rental prices at all since the freeze would have happened during the area’s 2012 peak in prices.

Another risk of imposing a five-year rental freeze in New York City is what would happen next. In Berlin, no new lease can be 10 percent higher than the previous lease, but in New York, owners of unregulated units are free to raise rents as high as they like when an apartment turns over and even when an existing tenant renews a lease. The risk, then, is that if the city did impose a five-year freeze, owners would rebel and spike rents after the freeze, creating an even more untenable rental landscape.

read more…

Housing starts drop in May | North Salem Real Estate

Housing starts reversed course in May, signaling a slowdown in production, according to the latest report from the U.S. Dept. of Housing and Urban Development and the U.S. Dept. of Commerce.

According to the analysis, housing starts fell 0.9% in May 2019 to a seasonally adjusted annual rate of 1.269 million units.

Navy Federal Credit Union Economist Robert Frick said another weak housing report shows the housing industry is far from producing homes at a rate to satisfy demand.

“Housing starts in May were below both the annualized April rate and the rate from May a year ago, and housing completions in May were also below April’s rate and May 2018’s rate,” Frick said. “Permits rose strongly in May from April, which is good news, but were down from May of last year. Together the numbers show the housing industry continues to slip from last year.”

Single-family production retreated 6.4% from last month to 820,000 units while multifamily starts came in at a seasonally adjusted annual rate of 436,000 units.

Additionally, single-family completions decreased 5% in 2019 to a rate of 890,000, while multifamily starts came in at 319,000 units.

However, permits grew 0.3% in May to a seasonally adjusted annual rate of 1.29 million.

Single-family authorizations increased 3.7% from last month’s rate to 815,000 permits and multifamily permits came in at an annualized rate of 442,000.

“At the current rate, the industry this year will build fewer than the 200,000 needed to keep up with population growth and demand,” Frick said. “Sub 4% mortgage rates should boost demand, but while the rate of home price increases is slowing, it is still rising, putting the dream of homeownership out of the reach of more Americans.”

“Given the restrictions of too little land zoned for housing, restrictive local building codes, and expensive labor and materials, home builders are hard-pressed to meet the growing demand for new homes,” Frick concluded.

read more…