Public Hearings on July 7, 2015

The following public hearings have been scheduled for July 7, 2015 at the Court Room in the Town House at 321 Bedford Road

Time

Topic

7:20 PM

Amendment to Zoning Code related to hamlet business districts

7:50 PM

Amendment to the sign ordinance

7:10 PM

Local law to implement Community Choice Aggregation

State Roads – Good News on Route 172

I heard back from the Executive Deputy Commissioner of the New York State Department of Transportation that DOT state funds have been re-allocated to provide for the 172 project. It would entail both drainage work and paving of Route 172 the entire distance from the Village Green through Route 137 in Pound Ridge. The DOT might begin the drainage work in the fall with the milling and paving to be done in Spring 2016 – otherwise the entire job would be 2016. We wish to thank the community for its patience and its support with many calling the DOT to emphasize on the need for the work. In the interim DOT promises to repair potholes and make safe Route 172 and Route 22 (we’re still working on getting it paved).

Working on Securing Paving for I-684

Literally thousands of Bedford residents are affected by the road noise from I-684 which has increased over the years with heavier traffic. Residents are petitioning the Governor, the DOT, our Congressman and our State Legislators. Our thanks to Bedford resident Mara Glassel, who has been organizing residents, and bringing new energy to the effort (which goes back literally

1

for 20 years or more). Her petition, which you can access at www.change.org, then enter into search field “684” reads as follows:

1.

Efforts have been made all over Westchester County and NY State to reduce noise pollution, while Bedford and Katonah have been ignored.

2.

Increasing the speed limit to 65 mph and ever increasing truck traffic has increased the road noise substantially over the last few years.

3.

Neighbors are measuring noise levels as high as 85 dBs – which has been medically proven harmful – both physically and mentally.

4.

I684 has been neglected for decades and needs to be repaved for safety reasons.

5.

Funds are being appropriated to neighboring towns (i.e. exit 8) – while residents off of exits 4 – 6 continue to be treated unfairly.

Assemblyman David Buchwald is working with Ms. Glassel, the Town and DOT to try to advance these efforts.

Update on Bedford Village Parking

The Town Board of the Town of Bedford is moving forward with its plans to provide additional municipal parking in Bedford Village. Evans Associates, a consultancy firm for the Town for over 25 years, will present at the Town Board’s July 7 meeting a proposal to conduct an engineering/wetlands study to determine how best to maximize parking on property to be leased from the Presbyterian Church. There also may be the possibility of additional spaces at the rear of the Bedford Playhouse building. Both the Church and the owners of the Bedford Playhouse building have advised the Town of its support for these efforts. Assuming Town Board approval, the Town would pay the cost of the Evan Associates’ work as well as for the construction of the parking. In developing the plans and implementing them, the Town will seek the input of the community and obtain all approvals, which at the town level would include the Bedford Village Historic District Review Commission and the Wetlands Control Commission. The intention is to ensure that parking is in place in 2016 for use by patrons of existing stores and businesses as well as the Bedford Playhouse (renovation work is anticipated to be completed mid 2016).

Update on Parking – Town Wide

We are working with the community to improve parking enforcement (and therefore turnover of parking spaces), maximize parking availability and otherwise relieve insufficient parking in our hamlets. Police Chief Melvin Padilla and Comptroller Ed Ritter (who heads the Parking Bureau) will be discussing plans with the Town Board at the Board’s July 7 meeting.

Local Law Implementing Community Choice Aggregation

The Town Board has scheduled a public hearing on a proposed local law to enable the Town to participate in a community choice aggregation (CCA) program offered by Sustainable Westchester, Inc., (SW) a not-for-profit organization now comprised of over forty municipalities in Westchester County, including the Town of Bedford. Simply put, CCA enables Bedford to offer for its residents and small business lower energy costs – all on a voluntary basis. The Town would enter into an agreement to participate in SW’s program for its residents and business consumers who are not currently purchasing electricity from an energy service

2

company, but only if the prices are lower. The Town also will undertake to inform residents about the CCA program; and that any customer at any time may “opt out” of the program. CCA has been a success in other states and Bedford is among several Westchester communities going forward with the program.

Community Organizations Take Note – Town Co-Sponsorship of Community Events

Following Town Board action at its June 16 meeting, Town Clerk Boo Fumagalli has prepared an application form, at the Town Board’s request, for community organizations requesting Town co-sponsorship of community events. This means that there may be the possibility of the Town Board relieving the organization from a portion of overtime expenses for Town personnel (e.g., police and public works) assisting with the event. Please note that funds are limited and Town co-sponsorship is subject to Town Board approval. The application form and the guidelines which the Board adopted are available from the Clerk’s office. The Clerk will review applications as received for completeness and compliance with the guidelines and forward them to the Town Board for action. You can contact the Clerk at 666-4534 or by e-mail at clerk at townclerk@bedfordny.gov.

Internship Opportunity

For all rising high school sophomores, juniors, seniors as well as college level students: I am currently scheduling interviews for an unpaid summer intern position. The duties of the intern include preparing and managing the weekly community calendar and writing, proofing, and researching various topics. There may be a couple of weeknights to help with our Supervisor and Town Board events in the Parks. Hours are flexible. If interested in this opportunity, please email the Supervisor at Supervisor@BedfordNY.gov or call 914-666-6350. Please submit your resume and hours of availability.

Comptroller’s Report

Comptroller Ed Ritter reported on June 16 as follows:

We will be running the June 15th payroll in both the KVS and Springbrook payroll systems for a parallel view and reconciliation. If this goes well we will be live in Springbrook for the July 6th payroll. Once the payroll portion is running well the Finance office will begin the conversion of the financial data from KVS to the Springbrook product.

Summer employees have started to arrive and are being added into payroll. As summer approaches our payroll increases to over 400 people.

More data has become available as to what we are required to do to be in compliance with the Affordable Care Act (ACA). I have scheduled a presentation on June 22nd by CPI-HR Inc. who will discuss and demonstrate all the requirements we must be aware of. This will be held in the court room at 321 Bedford Road at 1:00 pm.

REVENUE AREAS OF NOTE

Mortgage Tax has actual data from October through May 2015. The actual percentage over 2014 is a 11.59% decrease. This amount has been used as a basis for projecting the remainder of the year (through September). Mortgage tax is projected to be $1,011,445, which is $14,445 over budget.

3

Sales Tax has actual data from January through April 2015. County sales tax shows a 2.44% decrease over 2014. This revenue is projected to be $2,462,546 which is $62,546 over our budget of $2,400,000.

Parking has actual data from January through April 2015. The actual percentage over 2014 is a 3.32% increase. Revenue to date is $99,857 which is an increase of $3,212 from last year at this time. The revenue for the year is projected to be $931,923 which is $1,923 over budget.

Fines and forfeited bail has actual data for January through April 2015. Revenue is $208,000 which is $27,768 under last year’s revenue at this time. The revenue is projected to be $770,850 which is $120,850 over budget.

Safety Inspection Fees has actual data for January through May 2015. Revenue is $366,278 which is 14,419 over last year’s revenue at this time. This revenue is projected to be $754,236 which is $14,236 over budget.

EXPENDITURES: 2015 expenditures are within budget limits at this time

Please note that more information, including analysis, is available through the Comptroller’s office – 666-8283

Proposed Septic System Repair & Replacement Fund Advances

Bedford’s proposal to create a $3.5 million septic system repair and replacement fund for Bedford properties within the New York City watershed is wending its way through the approval process, which we are hopeful will be concluded in the next couple of months. If established, the program would provide up to 50% of approved eligible expenses for construction of repair remediation or replacement of a septic system, as well as design engineering costs not to exceed 20% of total construction costs. An enhanced treatment unit (utilizing more advanced technology) would be permitted, provided the County Board of Health and, if applicable, DEC and DEP, approves it. As mentioned previously, two of the Town’s hamlet centers, Bedford Hills and Katonah, are located in the Croton Watershed, with Katonah’s commercial district immediately adjoining the reservoir. We believe that it is important to balance continued protection of the reservoir system with the economic vitality of these central business areas and their surrounding residential neighborhoods.

The Westchester County Planning Department has been working on a legislative proposal, including an Intermunicipal Agreement between the County and the Town, for submission to the Westchester County Board of Legislators to consider, as the BOL must approve the funding request.

Filling Vacancies in Town Elected Positions

At our June 16 meeting, the Town Board adopted a local law to provide for a special election to fill vacancies in the position of Supervisor, Councilman or Town Clerk which would provide that if the Town Board does not fill the vacancy by appointment within 45 days of the vacancy, then a special election must be held within 60 to 90 days. Summer elections or an election within a short time before a general election would be avoided.

4

Other Town Board Action Taken

Also at the June 16 meeting, the Town Board appointed Mel Padilla to the position of Chief (it previously was provisional subject to his passing the Chief’s examination – which he did); accepted the proposal of Lothrup Associates for architectural services and construction management for renovations and additions to the police station; enacted an amendment to the Historic Building Preservation Law to allow the Historic Building Preservation Commission to waive public hearing requirements under certain circumstances so as to expedite action on applications; and scheduled the July 7 public hearings mentioned above. The Board also appointed Matthew A. Iacona as a police officer filling a vacancy. I also provided an update on plans for increasing public parking in Bedford Village (Evans Associates will present a consultancy proposal at the July 7 meeting).

Reminder: Emergency Information from NYSEG and Con Edison

Con Edison notified us that you now can text Con Edison about power outages. Here’s the message they sent us:

“Prefer texting? No problem. Sign up by texting REG to OUTAGE (688243) and we’ll text instead of calling.

But don’t wait for us to contact you. The sooner we know about a power problem, the sooner we can respond. Reach us at conEd.com, by texting OUT to OUTAGE after you sign up for texting, with our My conEdison app for Droid and Apple devices, or by calling 1-800-75-CONED (1-800-752-6633).”

Both NYSEG and Con Edison encourage customers with special needs to enroll in special services for them.

“NYSEG is committed to providing their customers with safe, reliable energy delivery. They also offer many services for special need customers, including:

Special Identification for households where everyone is elderly, blind or disabled

Large print, sight-saver Bills for visually-impaired customers

Home Energy Assistance Program (HEAP) grants

NYSEG’s Energy Assistance Program (EAP)

Project SHARE emergency energy assistance program

If you or someone in your household relies on life-sustaining equipment, you should contact NYSEG immediately!

How to call NYSEG:

Electricity interruptions or emergencies: 1.800.572.1131 (24 hours a day, every day)

Customer relations center: 1.800.572.1111

5

Payment arrangements: 1.888.315.1755

Hearing and speech-impaired: Dial 711 (New York Relay Service)”

“Message from Con Edison: Customer Central Special Services

Safety for Special Customers:

It is important that we have a record of everyone who uses electrically operated life-support equipment or has medical hardships so we can contact them in an emergency. To learn more and complete the survey, please visit the link below. You can also let us know by calling 1-800-75-CONED (1-800-752-6633). Con Edison customers can enroll for this service by visiting www.conEd.com, clicking on Customer Central, and then the “special services” link. You will need your account number. To keep our records current, each year we send a letter asking you to recertify.

http://www.coned.com/customercentral/specialservices.asp

Customers with Special Needs:

We recognize that senior citizens and people with disabilities need special attention. That’s why we offer a variety of services and billing and payment options that make life a little bit easier for the elderly, visually or hearing-impaired, or customers with permanent disabilities. Please visit the link below to view the Customers With Special Needs brochure.

http://www.coned.com/customercentral/specialservices.asp”

I ask you to please send me an e-mail at supervisor@bedfordny.gov should you have any questions or comments on this report or any of our work on the Town Board.

Chris Burdick

Town Supervisor

Category Archives: Bedford

Most U.S. housing markets are undervalued | Bedford Real Estate

U.S. homes are by in large undervalued, even as national price measures show a modest overvaluation due to skewing effects from a few large markets, according to new research from Goldman Sachs.

Homes in the Los Angeles, San Francisco and San Diego metropolitan areas, for example, are about 20% above fair value. Meanwhile, prices elsewhere are still falling, and homes in areas such as Buffalo and St. Louis are undervalued, the analysts wrote.

“The broad national indexes are skewed by high prices in a small number of large markets,” Goldman Sachs economists Zach Pandl and Hui Shan wrote. “While there appears to be some evidence of regional froth, in our view the broader national picture is one of leaders and laggards, with strong rebounds in some markets but still-soft prices in many others.”

In the first quarter, most metropolitan statistical areas tracked by Goldman had undervalued properties. There were 202 housing markets that were undervalued by at least 1%, compared with 140 markets that were overvalued by at least 1%.

“Large cities drag up the national indexes, even if real estate markets in many smaller [metropolitan areas] have yet to fully recover,” Goldman analysts wrote.

Analysts looked at valuation in several ways. They compared home prices to gauges of consumer inflation, rent, income and population.

Most metropolitan statistical areas tracked by Goldman have undervalued homes.

Interest among would-be borrowers in buying a home recently hit a two-year high. Even as home prices have grown, a strengthening U.S. jobs market and still-low interest rates are supporting sales. In hot markets, low inventory is driving prices higher.

read more…

http://www.marketwatch.com/story/why-most-us-housing-markets-are-undervalued-even-as-prices-climb-2015-07-10

US housing stages ‘lopsided’ recovery | Bedford NY Real Estate

The lasting legacy of the US housing crash has ranked at the top of the so-called “headwinds” that Federal Reserve policy makers such asJanet Yellen cite when discussing America’s economic prospects.

A host of indicators are suggesting now that, even if the property market remains well below its boom-time highs, it is firmly in recovery mode.

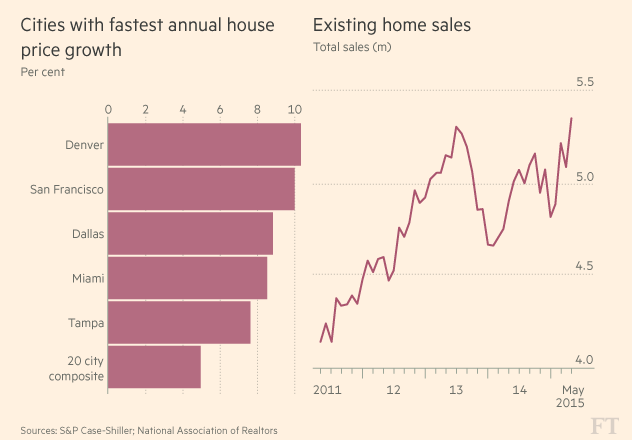

The Case-Shiller index of home values in 20 cities rose 4.9 per cent from a year earlier in April, according to data released Tuesday, with values in Denver and San Francisco rising around 10 per cent from a year earlier. That came after the National Association of Realtors index of pending home sales hit its highest level since April 2006.

The problem with the recovery is that it is, in the words of Sam Khater, deputy chief economist at CoreLogic, a lopsided one.

An acute lack of construction at the lower end of the market is creating a tight supply of housing, driving up rents and pushing up prices of affordable homes to levels reached in 2006.

With access to credit far more constricted than it was before the financial crisis and income growth depressed, home ownership rates have fallen to 20-year lows, as many younger Americans are locked out of property ownership.

Mr Khater said: “The property market is strengthening, but it’s a complex picture that’s by no means good news for all Americans.”

Back in 2013 US housing hit a setback associated with a 100 basis-point upward lurch in mortgage rates induced by the Fed’s so-called “taper tantrum”. In recent months it has seen renewed momentum, however. Existing home sales rose to an annual rate of 5.35m in May, according to the National Association of Realtors, the fastest pace since 2009.

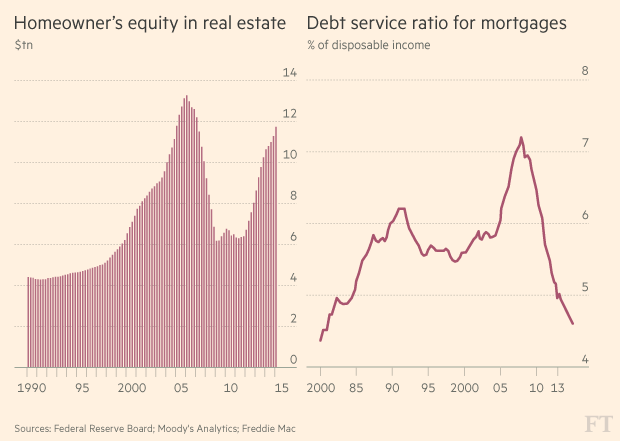

Rising values are pushing up equity in the housing market, with low interest rates helping for those who can qualify for home loans. In addition, real disposable incomes have risen 4 per cent nationally over the past four quarters.

While an increase in interest rates by the Federal Reserve could impact affordability, Tim Hopper, chief economist at TIAA-CREF, a financial services company, argued that US households are better positioned to weather higher borrowing costs. “The consumer is in much better shape than just a few years ago,” he said.

Nevertheless, there were still 5.1m mortgaged houses in negative equity in the first quarter, compared with 5.4m at the end of last year, according to CoreLogic data. Poorer neighbourhoods tend to have very high concentrations of negative equity, underlining the long shadow of the property crash and deeply divided fortunes now characterising the housing market.

Among the lasting legacies of the downturn have been tightening lending standards, a shift to renting, and a decline in rates of home ownership. The home ownership rate at the end of last year was at 64.5 per cent, erasing most of the increase over the previous two decades. Between 2006 and 2013, there was a 3m increase in single family home rentals.

With construction of housing remaining depressed, households are encountering a tight supply and surging rents — with the national vacancy rate near its lowest in 20 years. This is putting acute pressure on many people’s finances. In 2013 almost half of renters had housing cost burdens, including more than a quarter with “severe” burdens — paying more than 50 per cent of income for housing, according to Harvard’s Joint Center for Housing Studies.

read more…

http://www.cnbc.com/id/102802954

U.S. Housing Markets Strengthen | Bedford NY Real Estate

Freddia Mac today released its updated Multi-Indicator Market Index® (MiMi®) showing the U.S. housing market continuing to stabilize with the strongest markets realizing the greatest benefits from a spring homebuying season in full swing.

The national MiMi value stands at 78.7, indicating a weak housing market overall but showing an improvement (+0.14%) from March to April and a three-month improvement of (+2.10%). On a year-over-year basis, the national MiMi value has improved (+3.57%). Since its all-time low in October 2010, the national MiMi has rebounded 33 percent, but it’s still significantly off from its high of 121.7.

News Facts:

- Twenty-six of the 50 states plus the District of Columbia have MiMi values in a stable range, with the District of Columbia (97.8), North Dakota (96.3), Montana (92), Hawaii (91), and Alaska (87.4) ranking in the top five.

- Thirty-five of the 100 metro areas have MiMi values in a stable range, with Fresno (94.8), Honolulu (92.3), Austin (92.1), Los Angeles (89.1) and Salt Lake City, TX (88.9) ranking in the top five.

- The most improving states month-over-month were Washington (+1.49%), Indiana (+1.32%), Tennessee (+1.03%), Oregon (+0.83%) and Mississippi (+0.82%). On a year-over-year basis, the most improving states were Florida (+10.89%), Nevada (+10.55%), Oregon (10.29%), Colorado (+8.72%), and Michigan (+8.31%).

- The most improving metro areas month-over-month were Palm Bay, FL (+1.51%), Portland, OR (+1.32%), Indianapolis, IN (+1.22%), Oxnard, CA (+1.22%) and Lakeland, FL (+1.99%). On a year-over-year basis, the most improving metro areas were Orlando, FL (+12.6%), Palm Bay, FL (+12.14%), Miami, FL (+11.97%), Cape Coral, FL (+10.73%), and Las Vegas, NV (+11.54%).

- In April, 43 of the 50 states and 92 of the 100 metros were showing an improving three month trend. The same time last year, all 50 states plus the District of Columbia, and 99 of the top 100 metro areas were showing an improving three-month trend.

Quote attributable to Freddie Mac Deputy Chief Economist Len Kiefer:

“We saw a significant improvement in housing markets nationwide, with ten more metro areas and nine more states moving within range of their benchmark, stable level of housing activity. The West and Southwest areas of the country continue to lead the way, especially Colorado, Oregon and Utah, and California is right there as well. Unlike a year ago, when the most improving markets were those hardest hit by the Great Recession, we’re now seeing stable markets among the most improving as well. So the strong housing markets are getting stronger, which reflects the better employment picture, rising home values and increased purchase activity in these markets with the spring homebuying season in full swing.”

The 2015 MiMi release calendar is available online.

MiMi monitors and measures the stability of the nation’s housing market, as well as the housing markets of all 50 states, the District of Columbia, and the top 100 metro markets. MiMi combines proprietary Freddie Mac data with current local market data to assess where each single-family housing market is relative to its own long-term stable range by looking at home purchase applications, payment-to-income ratios (changes in home purchasing power based on house prices, mortgage rates and household income), proportion of on-time mortgage payments in each market, and the local employment picture. The four indicators are combined to create a composite MiMi value for each market. Monthly, MiMi uses this data to show, at a glance, where each market stands relative to its own stable range of housing activity. MiMi also indicates how each market is trending, whether it is moving closer to, or further away from, its stable range. A market can fall outside its stable range by being too weak to generate enough demand for a well-balanced housing market or by overheating to an unsustainable level of activity.

Mortgage Rates Up to 4.04% | #Bedford Real Estate

Freddi Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates reaching new highs for 2015 with the average 30-year fixed-rate mortgage above four percent for the first time since November 6, 2014 when it averaged 4.02 percent.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 4.04 percent with an average 0.6 point for the week ending June 11, 2015, up from last week when it averaged 3.87 percent. A year ago at this time, the 30-year FRM averaged 4.20 percent.

- 15-year FRM this week averaged 3.25 percent with an average 0.6 point, up from last week when it averaged 3.08 percent. A year ago at this time, the 15-year FRM averaged 3.31 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.01 percent this week with an average 0.4 point, up from last week when it averaged 2.96 percent. A year ago, the 5-year ARM averaged 3.05 percent.

- 1-year Treasury-indexed ARM averaged 2.53 percent this week with an average 0.2 point, down from last week when it averaged 2.59 percent. At this time last year, the 1-year ARM averaged 2.40 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for theRegional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quotes

Attributed to Len Kiefer, deputy chief economist, Freddie Mac.

“Mortgage rates rose above 4 percent for the first time since November 2014 as Treasury yields surged. Markets are responding to strong employment data. In May, the U.S. economy added 280,000 jobs. Moreover, job openings surged to 5.4 million in April, up over 20 percent from a year ago.”

Pending Existing Homes Sales Reaches Nine-Year High | Bedford Real Estate

The NAR Pending Home Sales Index increased for the fourth straight month in April to a level 14% above April of 2014.

The Pending Home Sales Index (PHSI), a forward-looking indicator based on signed contracts produced by the National Association of Realtors (NAR), increased 3.4% in April to 112.4, up from an upwardly revised 108.7 in March. The PHSI increased year-over-year for the eighth consecutive month and reached its highest level since May 2006.

Regionally, the April PHSI increased 2.3% in the South and 0.1% in the West. The index rebounded in the Northeast by 10.1% after declines in prior months. The PHSI was up 5% in April for the Midwest.

read more…

http://eyeonhousing.org/2015/05/

Existing Home Sales Pause | Bedford Real Estate

Existing home sales declined 3.3% in April, despite the fact that almost half of April sales remained on the market less than one month. The National Association of Realtors (NAR) reported April 2015 total existing home sales at a seasonally adjusted rate of 5.04 million units combined for single-family homes, townhomes, condominiums and co-ops, up from an upwardly revised 5.21 million units in March. April existing sales were up 6.1% from the same period a year ago, and have increased year-over-year for seven consecutive months.

Existing sales in the Midwest increased 1.7% from the previous month, but fell in the other regions, ranging from 1.7% in the West to 6.8% in the South. Year-over-year, all four regions increased, ranging from 13.0% in the Midwest to 1.6% in the Northeast.

The first-time buyer share remained unchanged at 30% in April, compared to 29% in February and 28% in January. The first-time buyer participation remains well below the historically typical 40% share.

Total housing inventory increased 10.0% in April to 2.21 million existing homes, which was still 0.9% below the 2.23 million level during the same month a year ago. At the current sales rate, the April unsold inventory represents a 5.3-month supply, up from a 4.6-month supply last month. NAR also reported that April homes sold in an average of 39 days compared to 52 days in March, and was the shortest time on the market since July 2013.

The distressed sales share remained unchanged at 10% in April, and was down from 15% during the same month a year ago. Distressed sales are defined as foreclosures and short sales sold at deep discounts. April all cash sales remained unchanged at 24% of transactions, down from 26% of transactions in February and 27% in January, and were down from 32% in April 2014. Individual investors purchased a 14% share of homes in April, unchanged from March, and down from 18% during the same month a year ago. Some 71% of investors paid in cash in April, compared to 70% in March, and 67% in February and January. The awaited withdrawal of cash investors will create more opportunity for first-time buyers.

read more…

http://eyeonhousing.org/2015/05/existing-home-sales-pause/

#FoxLane High School Ranks Among New York’s Best | #Bedford Real Estate

John Jay and Fox Lane high schools have been ranked among the best in New York State in rankings by U.S. News & World Report released Tuesday.

JJHS was ranked 35th in the state, good for 10th-best in Westchester County.

John Jay’s student population of 1,189 exceeded the state average in all of the surveys major metrics, which included: College readiness, mathematics proficiency and English proficiency. The school also boasts an Advanced Placement participation rate of 78 percent.

FLHS was ranked 46th in the state, good for 14th-best in Westchester County.

Fox Lane’s student population of 1,394 met or exceeded the state average in all of the surveys major metrics, which included: College readiness, mathematics proficiency and English proficiency. The school also boasts an Advanced Placement participation rate of 64 percent.

Several other high schools in Westchester County were ranked in the top 50 in the state, including:

- Blind Brook (No. 9)

- Rye (No. 11)

- Yonkers Middle/High School (No. 18)

- Hastings (No. 24)

- Horace Greeley (No. 25)

- Byram Hills (No. 27)

- Edgemont (No. 29)

- Briarcliff (No. 31)

- Irvington (No. 32)

- John Jay (No. 35)

- Pleasantville (No. 36)

- Ardsley (No. 43)

- Rye Neck (No. 39)

- North Salem (No. 49)

The top ranked high school in New York was The High School of American Studies in the Bronx.

read more…

http://mtkisco.dailyvoice.com/schools/fox-lane-high-school-ranks-among-new-yorks-best

Bedford Rain Barrels | #Bedford #RealEstate

Freddie reports average mortgage rates rise | #Bedford Real Estate

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing average fixed mortgage rates following 10-year Treasury yields higher.

News Facts

- 30-year fixed-rate mortgage (FRM) averaged 3.80 percent with an average 0.6 point for the week ending May 7, 2015, up from last week when it averaged 3.68 percent. A year ago at this time, the 30-year FRM averaged 4.21 percent.

- 15-year FRM this week averaged 3.02 percent with an average 0.6 point, up from last week when it averaged 2.94 percent. A year ago at this time, the 15-year FRM averaged 3.32 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.90 percent this week with an average 0.4 point, up from last week when it averaged 2.85 percent. A year ago, the 5-year ARM averaged 3.05 percent.

- 1-year Treasury-indexed ARM averaged 2.46 percent this week with an average 0.4 point, down from last week when it averaged 2.49 percent. At this time last year, the 1-year ARM averaged 2.43 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following links for theRegional and National Mortgage Rate Details and Definitions. Borrowers may still pay closing costs which are not included in the survey.

Quotes

Attributed to Len Kiefer, deputy chief economist, Freddie Mac.

“Mortgage rates rose this week to the highest level since the week of March 12 as a selloff in German bunds helped drive U.S. Treasury yields above 2.2 percent. The U.S. trade deficit reached $51.4 billion in March to the highest level since 2008. Also, the Institute for Supply Management’s manufacturing index was unchanged in April, but manufacturing employment contracted as the index fell below 50 for the first time since May 2013.”