Home prices in the United States have never been higher. In January, housing values eclipsed their 2006 pre-crisis peak and since then have only pushed higher, according to the Case-Shiller home price index.

The culprits are a crazy tight job market, rising wages and the fact that the homeownership rate is rising again after bottoming in 2016.

But storm clouds are gathering as the Federal Reserve pushes interest rates higher, part of its ongoing fight to keep a lid on inflation. Higher rates weigh on home affordability — and thus depress demand. Here are three growing headwinds the housing market faces:

Thanks to the resolve of Federal Reserve chairman Jerome Powell, who is resisting President Trump’s calls for a slowdown of the rate hike pace, monetary policy continues to tighten. That’s pushing up long-term interest rates, with the 30-year Treasury yield pushing back over the 3 percent threshold recently, up from less than 2.7 percent in December and a low of 2.1 percent in the summer of 2016.

Looking at the 30-year fixed mortgage rate, rates are at 4.5 percent right now, up from 3.8 percent last September and lows around 3.3 percent in 2012 and 2013.

As a result of rising mortgage rates and higher home prices, Gluskin Sheff economists estimate that housing affordability has crashed to lows not seen since 2008, well off the highs seen in 2011 and 2012 when a combination of lower prices and lower rates helped put an end to the housing collapse.

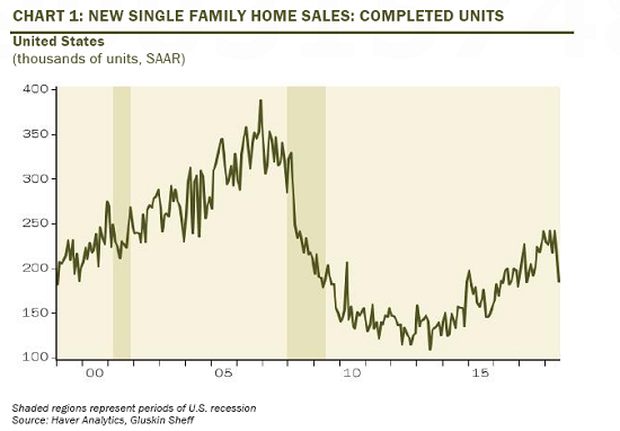

A slowdown in new home construction during the housing crisis resulted in a backlog of demand for brand-new homes. Builders have responded to consumer appetite for newly constructed homes, which has helped pushed up the average price of a new home from a low of $250,000 in late 2011 to a high of $402,900 in December, before cooling slightly.

But now sales activity is rolling over, threatening to break the recent trend of rising activity. Sales of existing homes has flatlined over the past year.

Millennial homeownership rates are still poor, mired as they are with student loan debt and tepid wages.

According to the Urban Institute, the homeownership rate of millennials between the ages of 25 and 34 is about 8 percent below Gen X and baby boomers at the same age. If millennial homeownership matched previous generations, there would be 3.4 million more homeowners today, they estimate.

The risk is that the longer this generation delays homeownership, the more baby boomers looking to downsize will be pressured into lowering their home prices when they enter retirement.

Indeed, a study by Fannie Mae’s Economic and Strategic Research group warns of a “mass exodus” on the horizon as the “homeownership demand from younger generations is insufficient to fill the void left by multitudes of departing older owners.”

read more…

https://www.cbsnews.com/news/3-reasons-to-worry-about-the-housing-market/

This post was last modified on %s = human-readable time difference 8:36 am

Just back out of hospital in early March for home recovery. Therapist coming today.

Sales fell 5.9% from September and 28.4% from one year ago.

Housing starts decreased 4.2% to a seasonally adjusted annual rate of 1.43 million units in…

OneKey MLS reported a regional closed median sale price of $585,000, representing a 2.50% decrease…

The prices of building materials decreased 0.2% in October

Mortgage rates went from 7.37% yesterday to 6.67% as of this writing.

This website uses cookies.