Americans are buying more homes and at higher prices, yet new data shows that mortgage debt is little changed.

The Federal Reserve Bank of New York said Thursday that outstanding U.S. mortgage debt slipped 0.7 percent in the April-June quarter to $8.12 trillion. That is up slightly from a year ago and about the same level as three years ago when the housing market bottomed.

The second quarter’s decline occurred even as Americans took out more new mortgages, either to refinance old loans or purchase homes. New mortgages totaled $466 billion in the second quarter, the most in almost two years.

Those trends suggest Americans are paying down mortgage debt at roughly the same pace as new loans are made, evidence that homeowners remain wary of housing-related debt. Total mortgage debt peaked at $9.29 trillion in the third quarter of 2008.

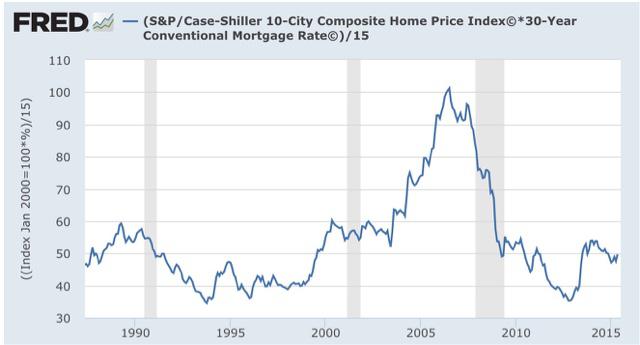

Overall, the New York Fed’s report indicates that there is little sign of a return to bubble-era excesses in mortgage financing, even as the housing market rebounds. Would-be buyers are bidding up prices on a scarce supply of available homes. Sales of existing houses climbed to an eight-year high in June.

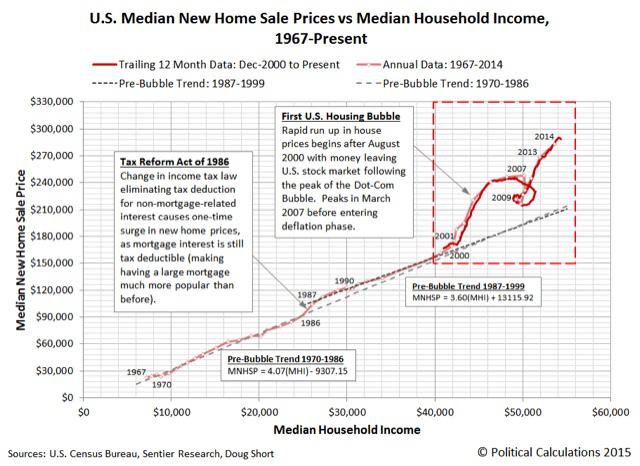

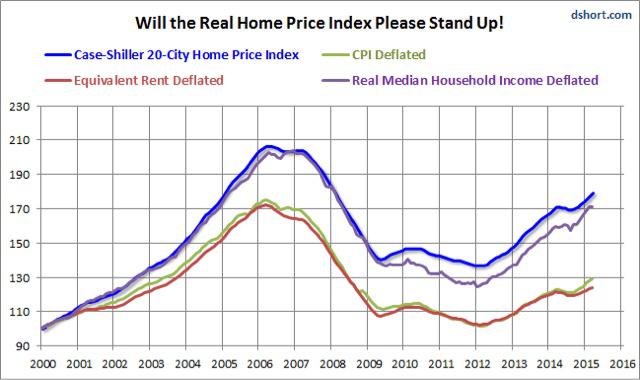

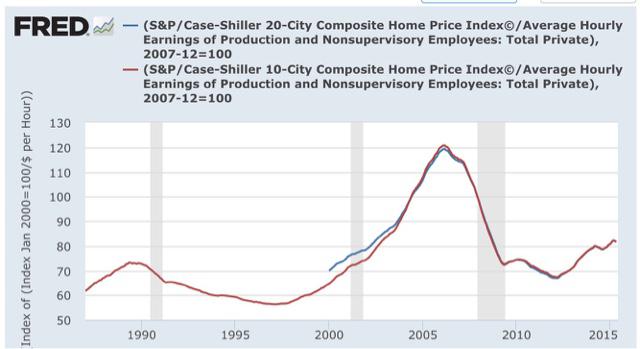

And home prices rose nearly 5 percent in May from a year earlier, according to the S&P/Case-Shiller 20-city index. They jumped 10 percent in Denver, 9.7 percent in San Francisco and 8.4 percent in Dallas — big increases that are making homeownership increasingly unaffordable for the typical family.

Yet there are many signs in the New York Fed’s report that housing finance is much healthier than before the recession. Just 95,000 people received new foreclosure notices in the second quarter, the fewest in the 16-year history of the data. And total

And in another sign of caution, total borrowing on home-equity lines of credit fell $11 billion in the second quarter, to $499 billion. That’s far below the peak of $714 billion six years ago.

The amount of new mortgages has risen for four straight quarters, the New York Fed said, after falling to a 14-year low of $286 billion in last year’s second quarter.

Several trends have offset those increases to keep overall mortgage debt mostly unchanged, according to economists at the New York Fed. A wave of refinancing has lowered borrowing rates, allowing homeowners to pay down more principal each month and less interest. Many homebuyers are making larger down payments. And the proportion of investors and other buyers paying cash has been elevated for most of the economic recovery.

read more…

http://finance.yahoo.com/news/us-mortgage-debt-little-changed-150050678.html